Dividend stocks are the multi-purpose tool of the markets. They offer investors a two-pronged path towards profitable returns, including a measure of defense against tough market conditions along with a steady source of passive income. It’s an attractive combination.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The best dividend stocks will give an inflation-beating income based on the dividend alone, backing it up with a long-term history of reliable payments. It’s a win-win situation for investors: when the stock goes up, you’ll make money, but when it goes down, you can still make money.

The Street’s analysts are not shy about recommending high-yield dividend payers, and we’ve found two among their recent calls with dividend yields reaching up to 10%. That’s a solid return right there, but these equities also feature ‘Strong Buy’ ratings from the analysts – so let’s dip into the data from TipRanks and find out just what makes them such compelling portfolio additions.

Sunoco LP (SUN)

First up is Sunoco, one of America’s great brand names. The company has a long history in the energy industry, mainly as a producer and provider of motor fuels. Sunoco’s product lines include multiple formulations of gasoline, diesel fuels, and jet fuels, all offered in both branded and unbranded labels. The company manages a distribution network comprised of gas stations, convenience stores, independent dealers, and commercial distributors, with more than 10,000 locations across 40 states.

Sunoco’s fuel retail operations are backed up by the usual ‘value added’ products in the gas stations and convenience stores, including snacks and beverages, and the company also provides fuel dispenser equipment for gas stations and fleet customers.

In an important nod to the expanding ‘green’ economy, Sunoco has been developing reclamation solutions for transmix fuels – that is, gasoline, diesel, and jet fuels that mixed in the transport pipeline, rendering them unusable. The company collects these mixed fuels for processing into usable products, reducing both fuel waste and damage from environmental pollution.

With all that said, Sunoco’s latest quarterly update was something of a mixed bag. The company reported $5.75 billion at the top line in 2Q23, a total that was down 26% year-over-year, although the figure beat expectations by $28 million. The bottom line, while profitable, was not as upbeat; the 78-cent EPS figure came in 47 cents per share under the forecast.

For dividend investors, a key metric to note is the distributable cash flow, which was reported at $175 million for Q2, a favorable comparison to the $159 million from the prior-year second quarter. This supported a Q2 dividend declaration of 84.2 cents per common share, or $3.36 annualized. At the annualized rate and current share valuations, the dividend is yielding 7.1%, more than double the average dividend found among S&P 500 companies, and almost double the 3.7% annualized inflation reported for August.

For Justin Jenkins, 5-star analyst from Raymond James, Sunoco is notable for its ability to remain profitable and to generate cash, both features that will support a continued high-yield dividend. He writes of the company, “We remain constructive on Sunoco given strong execution, confidence in the continuation of increased profitability, and the upside potential from medium-term business optimization and M&A opportunities. These efforts, along with capital/cost discipline, have allowed for considerable free cash flow generation, positioning the balance sheet with solid flexibility, which will be utilized to further grow the business (organically and inorganically). While the macro backdrop is still ‘throwing curve balls,’ we see a stable-to-positive volume trend in 2023 supported by elevated fuel margins. This is complemented by a healthy slate of attractive bolt-on acquisitions and organic projects that generate long-term value, while further M&A could add to upside.”

Jenkins goes on to rate SUN shares as Outperform (a Buy), with a $53 price target that indicates room for 12% upside in the next 12 months. (To watch Jenkins’ track record, click here.)

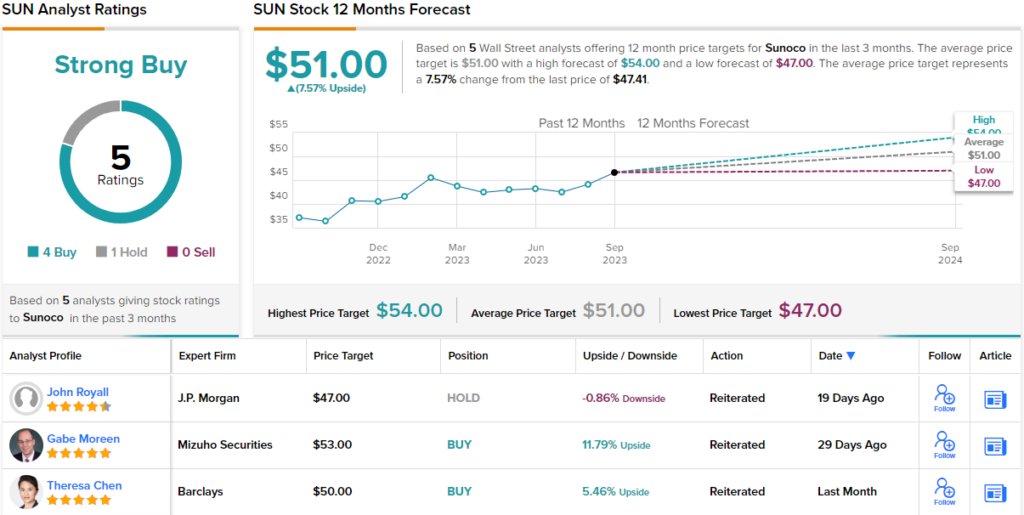

The 5 recent analyst reviews on SUN include 4 Buys against 1 Hold, for a Strong Buy consensus rating. Going by the $51 average price target, the stock has a one-year upside potential of 7.5%; add in the dividend, and the total return potential here approaches 15%. (See Sunoco’s stock forecast.)

Ares Capital Corporation (ARCC)

The next stock on our list is Ares Capital Corporation, a BDC, or business development company. These firms are specialty lenders, providing credit and financing services for small- and mid-market businesses that won’t necessarily qualify for services from the traditional commercial banks. ARCC’s combination of capital funding, credit services, and provision of financial instruments is essential for its client base, and fills a vital niche in the American small business landscape.

Since going public in 2004, ARCC has invested over $21 billion in 475 companies, and generated a shareholder return of 12%. The company boasts a market cap exceeding $10.7 billion, making it the largest publicly traded BDC in the US markets. The portfolio behind this performance is both diverse and well-balanced, with a healthy composition of assets. Of the total, 22% is in software and services, 11.3% is in healthcare services, and 8.7% is in commercial and professional services. Other sectors represented in the portfolio include power generation, insurance, and consumer durables. Just under 42% of the portfolio is in first lien senior secured loans, and another 18.1% is in second lien senior secured loans.

For investors, results are what matter most. Ares reported 2Q23 total investment income of $634 million, up from $479 million in 2Q22 – for a y/y gain of 32% and beating the forecast by $11 million. At the company’s bottom line, Ares posted earnings of 58 cents per share, 1 cent ahead of the estimates and well above the 46 cents per share from 2Q22. The company boasted $411 million in cash and liquid assets as of June 30, 35% better than it had at the end of 2022.

A profitable business and solid cash holdings support the company’s Q3 dividend, which was declared on July 25 for a September 29 payout. The dividend, of 48 cents per common share, annualizes to $1.92 and yields 10%. The company has a dividend history stretching back to 2004, with regular quarterly payments interspersed with variable special distributions.

KBW analyst Ryan Lynch notes Ares’s history of generating returns and surviving the ups and downs of credit cycles. He says of the stock, “ARCC has a great underwriting and credit quality track record, and has generated some of the best economic returns in the sector, and has a best-in-class credit platform. ARCC has one of the longest track records and has operated through multiple credit cycles with very good results. ARCC’s dominant platform and broad, long-standing relationship with sponsors will help ARCC continue to capture a significant market share of the growing direct lending market. ARCC has the best liability structure which is low-cost, diverse, long-dated, and flexible with multiple investment grade ratings which have funded and will continue to help fund their portfolio growth.”

Looking forward, Lynch gives ARCC an Outperform (Buy) rating, linked with a $21 price target. This suggests an 8.5% upside potential on the one-year time horizon. (To watch Lynch’s track record, click here.)

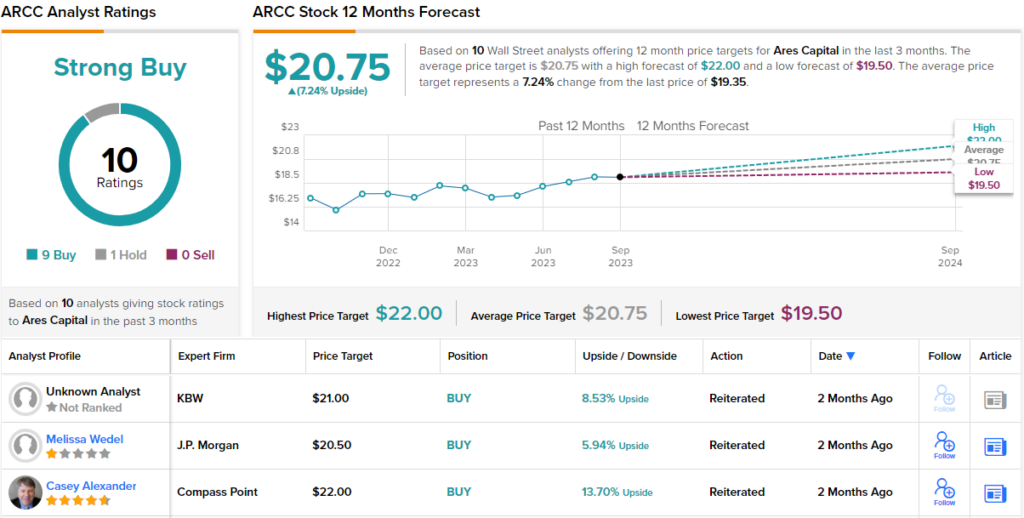

The Strong Buy consensus rating on ARCC is based on 10 analyst reviews, including 9 Buys and 1 Hold. The shares are currently trading for $19.33 and their average price target, at $20.75, implies a 12-month gain of 7%. With the dividend in the mix, investors can realize a 17% return on ARCC. (See Ares Capital’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.