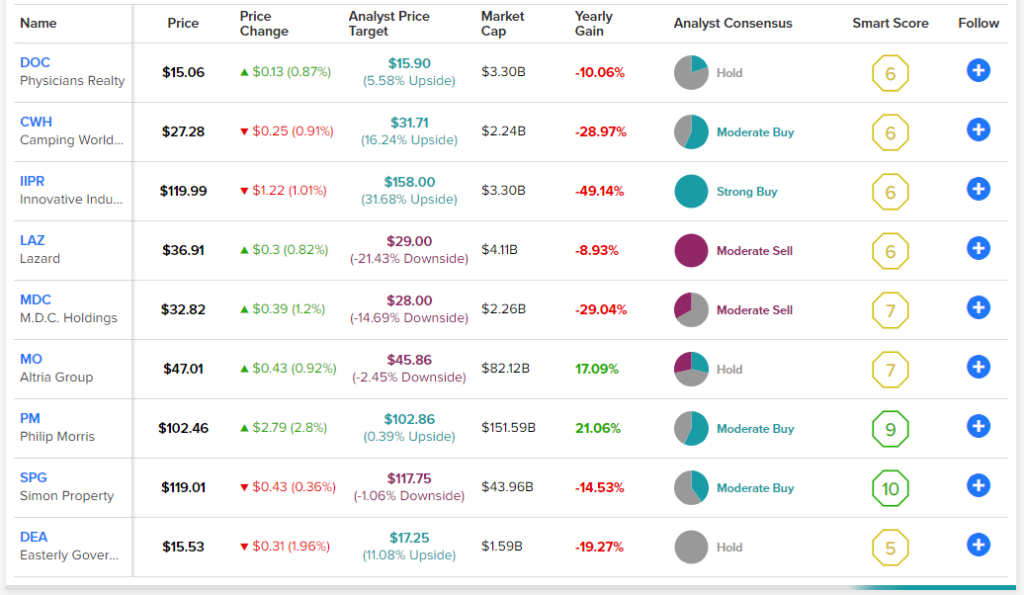

With inflation raging, interest rates on the rise, and the overall uncertainty in capital markets remaining elevated, stocks with above-average yields have grown in popularity. This is because investors can predict their future returns with higher accuracy in the current chaotic environment while ensuring a margin of safety against potential losses on their capital. Stocks that feature high yields often come with their fair share of risks. Thus, I have compiled a list of nine high-quality names whose dividends should remain well-protected as we advance toward 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Physicians Realty Trust (NYSE: DOC)

Dividend Yield: 6.4%

While Physicians Realty Trust has failed to achieve meaningful growth over the past decade, its 6.4% dividend yield is rock solid. In line with its rather stable funds from operations (also known as FFO, a profitability metric used by REITs), the company’s dividend has remained constant for five years in a row. Nevertheless, it has never been cut and should remain protected by the company’s unique qualities. The most significant quality is that the company’s medical properties are of critical nature, remaining in high demand regardless of the underlying state of the economy. Backed by a weighted average lease term of 5.7 years, DOC’s results should hold no negative surprises for quite some time while adequately covering the dividend.

Camping World Holdings (NYSE: CWH)

Dividend Yield: 9.3%

Camping World Holdings is not the most popular dividend stock out there, but the company has certainly been generous when it comes to its payouts. By being America’s largest retailer of recreational RVs and related products and services, the company has mastered this niche space, which should keep growing in popularity as consumers seek alternative types of living.

It’s also noteworthy that the company’s full-service repair facilities enable it to install all parts and accessories that it sells in its retail locations. By both selling and installing parts and accessories, the company has a competitive advantage over online and big-box retailers that lack this combined capability.

Innovative Industrial Properties (NYSE: IIPR)

Dividend Yield: 6.1%

Shares of Innovative Industrial Properties have experienced a rollercoaster ride over the past year, which has exhausted investors, but one thing remains clear: IIPR remains one of the fastest-growing REITs in the world.

IIPR’s AFFO/share and dividend per share have grown massively since its IPO, while the company’s acquisition pipeline continues to bring new properties that add incrementally to its results. Capitalizing on the growth of the cannabis sector, IIPR acquired 37 properties last year alone.

With its dividend remaining well-covered and leasing revenues coming in strong every quarter, IIPR appears to be the best way to get exposure in the cannabis space while collecting fat dividends.

Lazard Ltd (NYSE: LAZ)

Dividend Yield: 5.5%

Bermuda-based Lazard is one of the oldest and most creditworthy investment advisory companies, whose traces go back to 1848. A top-class reputation can be a tremendous advantage in the industry. Lazard’s prestige in building long-term relationships and advising on complex transactions often makes it the go-to firm for elaborate international M&A transactions and restructuring.

Last year’s dividend increase bolster further confidence in the stock, and with payouts accounting for around half the company’s net income, investors shouldn’t have any concerns regarding a potential dividend cut.

M.D.C. Holdings, Inc. (NYSE: MDC)

Dividend Yield: 6.4%

M.D.C. Holdings sits among the largest homebuilders in the U.S. On the one hand, the company’s prospects over the near future are rather bleak, as demand for residential properties has plummeted following last year’s craze. With rates/mortgages on the rise, the company should continue facing headwinds, as was the case in its most recent results.

In Q3, the company posted a 47% year-over-year drop in unit orders, while cancellations as a percentage of beginning backlog rose 970 basis points to 17.1% from 7.4% in the prior-year period. On the other hand, the dividend should remain rather well-covered even if its earnings were to plummet over the next couple of years. This is one of the riskiest names in this list, but a noteworthy one nonetheless.

Altria Group, Inc. (NYSE: MO)

Dividend Yield: 8.2%

Some love it, while others hate it. Regardless Altria is a cash cow that boasts 53 years of consecutive annual dividend increases.

While the company has seen declining volumes in its cigarette sales, you should remember that cigarettes are among the most inelastic products. Therefore, Altria can keep increasing its prices during the current highly-inflationary environment while recording no additional casualties from lower sales volumes.

In the meantime, the company has been repurchasing its own stock lately, which would help offset any declines in net income substantially. Simultaneously, by buying back large amounts of stock, Altria is essentially “saving” a great amount of cash that would be paid in the form of dividends in these shares as well. Thus, its payout remains healthy despite the annual dividend hikes.

Philip Morris International Inc. (NYSE: PM)

Dividend Yield: 5.2%

Altria’s cousin, Philip Morris, also offers a sizable yield. It’s not as high as Altria’s, but considering the company has significantly higher growth prospects, it makes sense that investors require a lower tangible return here.

While the strong U.S. dollar has pressured the company’s results lately due to the entirety of Philip Morris’ revenues being sourced in currencies other than the U.S. dollar, the company continues to deliver operating excellence. The acquisition of Swedish Match should be proven a fresh growth catalyst for the company as well.

Simon Property Group, Inc. (NYSE: SPG)

Dividend Yield: 6.2%

Retail giant Simon Property has been posting continuously improving financials since the brutal days of the COVID-19 pandemic. The REIT’s recovery has been rather speedy, with its funds from operations set to reach pre-pandemic levels this year.

While the dividend was cut in 2020, SPG has now increased its dividend for seven successive quarters. Following its most recent hike, the quarterly rate stands at $1.80, implying a 2.9% hike sequentially or a 9.1% hike year-over-year. Combined with a healthy payout ratio that stands at just over 60%, SPG should continue to serve income-oriented investors well.

Easterly Government Properties, Inc. (NYSE: DEA)

Dividend Yield: 6.7%

Last but not least, Easterly Government is one of my favorite high-yield stocks. With the company providing office space for several mission-critical U.S. Federal Agencies, its qualities are simply unparalleled. All of its cash flows are covered by Uncle Sam under multi-year leases. Further, the company’s properties are tailor-made to fit the needs of each individual agency. Therefore, Easterly does not actually compete with its conventional industry peers.

Despite being one of my favorite high-yielders, analysts are not that bullish on the stock. Easterly Government Properties features a Hold consensus rating based on one Buy and four Holds assigned in the past three months. At $17.25, the average DEA price target suggests around 11.1% upside potential.

Nevertheless, DEA provides one of the highest and safest yields out there, in my view.

The Takeaway

High-yielding stocks can provide an extra layer of safety in the current environment and achieve fruitful returns in an uncertain environment, assuming, of course, that the companies paying these dividends are of high quality and their payout can be relied upon. The nine names proposed here should be able to maintain and continue growing their dividends with relative ease. Nevertheless, always make sure you do your own research and that the stocks you invest in actually meet your investment criteria.