The new, shortened week has begun with at least one big overhang removed, as the debt ceiling battle looks to be behind us. This past weekend, House leader McCarthy announced that he had reached a compromise with the Biden Administration acceptable to his Republican caucus, and a bill could come to a Congressional vote this week.

In other news, core inflation is still elevated, the labor market is strong, and the housing data may be turning upwards – all pointing toward the Fed keeping interest rates higher for longer. However, quit rates, jobless claims, and job openings point to a slower labor market. Overall inflation appears to be falling, and the Fed’s high rates are causing a credit crunch with a risk of recession – all indicating a potential Fed pivot this year.

With this as backdrop, the policy makers have plenty to mull over, as Raymond James’ CIO Larry Adam points out. “With the glide path of the economy remaining uncertain,” Adam said, “it begs the question: are policymakers still comfortable with a 5.1% (the mid-point between the 5.0% – 5.25% target range) terminal rate? As a reminder, seven (out of 19) committee members expected fed funds to peak above 5.25% in the March dot plots, with a median forecast of 4.1% in 2024. Our economist believes the Fed is done, or should be done, raising rates this year, although no cuts are on the immediate horizon.”

In the meantime, Raymond James’ Stephen Laws, a 5-star analyst rated in the top 2% of the Street’s stock pros, has been seeking out stocks that he believes are set to outperform in the months ahead, regardless of the macro environment. Laws specifically recommends some high-yield dividend stocks. So, if you are looking for a dividend stock yielding 15% to guarantee a return in today’s environment, a pair of Laws’ picks might just be the ticket.

TPG RE Finance Trust (TRTX)

We’ll start in the world of commercial real estate, with a real estate investment trust (REIT). These companies have long been known as dividend champs; they exist to buy up, own, lease, operate, and manage various real properties, and government regulators require them to pay out a high proportion of income directly back to shareholders. Dividends are a common mode of compliance.

TPG is a typical example of the breed, with its particular focus on commercial properties. The company will invest in all major commercial real estate asset classes, and its loan operations are geared toward large holdings. The company makes loans greater than $50 million, and targets its operations in the top 25 markets for US commercial properties. A look at the map shows that TPG holds properties in California, on the East and Gulf coasts from New England around to Texas, and in the Midwest.

The company’s portfolio is currently valued at $5.3 billion. Of that total, 35% is located in the East, 31% in the West, and just under 18% in the Southwest. The largest part of TPG’s holdings are in multifamily dwellings, which make up more than 45% of the portfolio. The company also has significant holdings in office space (26.5%) and hotels (10.8%).

In its last reported quarter, 1Q23, TPG realized an EPS of 5 cents, based on $3.8 million in net income attributable to common shareholders. This EPS figure, while it remained profitable, missed the forecasts by 20 cents. On a positive note, TPG finished Q1 with plenty of liquidity – over $662 million available. Of this total, some $132 million was in cash and other immediately investable liquid assets.

The company’s assets backed up its dividend, which was declared in March, and paid out in April, at 24 cents per common share. At this rate, the dividend yields an impressive 15.7%.

In his coverage for Raymond James, top analyst Laws looks under the hood at TPG and finds reason for optimism. He is upbeat on the dividend, and believes that the company is adapting its portfolio composition to better fit current conditions.

“Given our portfolio return estimates, we expect TRTX to maintain the current dividend. Our Strong Buy rating reflects the compelling risk-reward given the attractive portfolio characteristics (floating rate senior loans, declining Office exposure, high mix of non-mark-to-market financing, and CLO reinvestment capacity) and relative valuation, as shares trading at a material discount to peers,” Laws stated.

That Strong Buy rating is backed by a $9 price target that implies a solid ~47% upside in the coming year. Based on the current dividend yield and the expected price appreciation, the stock has ~63% potential total return profile. (To watch Laws’ track record, click here)

Tuning now to the rest of the Street, where based on an additional 2 Buys and 3 Holds, this stock claims a Moderate Buy consensus rating. The shares are selling for $6.11 and the $7.70 average price target suggests a one-year gain of 26%. (See TRTX stock forecast)

Ares Commercial Real Estate (ACRE)

The second dividend stock we’ll look at is Ares Commercial Real Estate, another REIT and another operator in the commercial real estate sector. Ares has a portfolio based on debt-related investments in commercial properties, and focuses on generating value and returns for shareholders. The company has 53 loans in its portfolio, with total originated loan commitments worth $2.5 billion.

The portfolio is composed mainly of senior mortgage loans, which make up 98% of the total. On property types, the company has created a diverse mix of investments. Office space and multifamily residences take up the largest shares, with 38% and 23% respectively, but there are significant holdings in mixed-use (10%) and industrial (also 10%) properties. Geographically, Ares has also diversified; 28% of its properties are in the Southeast, 25% in the Mid-Atlantic/Northeast, 19% in the Midwest, and 17% in the West.

Ares reported some so-so results in its last financial release, from the first quarter of this year. At the top line, the company had total revenues, from its portfolio investments, of $26.5 million. This was up $2.5 million, or 10.4%, from the prior-year quarter – but it also missed the forecast by $1.75 million. At the bottom line, while positive, the non-GAAP EPS of $0.27 came in 3 cents below the estimates.

On the dividends front, Ares shines. The company has been paying out a 33-cent per common share dividend since 2019, and since 2021 it has been adding a 2-cent supplementary payment to that dividend. The total current dividend, of 35 cents per common share, annualizes to $1.40 and yields an attractive 15.2%.

When we check in again with analyst Laws, we find that he sees this company as a sound investment, despite ongoing challenges. He writes: “We are maintaining our Outperform rating, which is based on ACRE’s attractive portfolio characteristics (floating rate senior loans, low leverage), our portfolio return estimates, solid dividend coverage, and our belief the current valuation overly reflects potential losses in the portfolio. While there is material upside to our target, we believe our Outperform rating is appropriate given our expectation of little, if any, near-term growth and sector headwinds persisting.”

Alongside the Outperform (i.e. Buy) rating, Laws’ $10.50 price target suggests room for 14% share appreciation in the coming months.

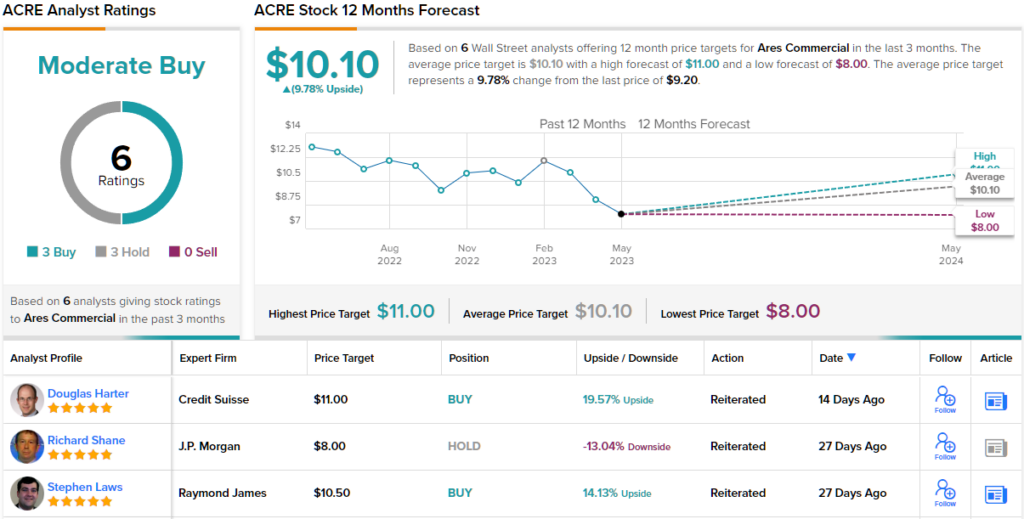

Once again, we’re looking at a stock with a Moderate Buy consensus rating and 6 evenly split analyst reviews – 3 to Buy, 3 to Hold. Shares in ACRE are selling for $9.20 and their $10.10 average price target implies a one-year gain of ~10%. (See ACRE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.