Do you love dividends? Of course you do — and rightly so!

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Scholars who study the stock market’s historical performance estimate that over time, the payment (and reinvestment, and compounding) of dividends have contributed anywhere from 30% to 90% of the S&P 500’s total returns. Simply put, if you’re not investing in dividend stocks, you’re doing it wrong.

Using the TipRanks platform, we’ve looked up two stocks that are offering dividends of at least 11% yield – that’s almost 6x higher the average yield found in the markets today. Each of these is Buy-rated, with some positive analyst reviews on record. Let’s take a closer look.

Vitesse Energy, Inc. (VTS)

First up is Vitesse Energy, an interesting player in the US oil and gas industry. Vitesse is a non-operator; that is, it does not produce oil and gas directly, but rather owns interests in productive wells operated by third parties. This allows Vitesse to keep its focus on ensuring shareholder returns by leveraging its experience and data to acquire and integrate into its portfolio a stale of revenue-generating oil and gas assets.

Vitesse has been investing in the hydrocarbon industry since 2014, at first as a private equity firm and more recently as a public entity. It spun off from its main shareholder, Jefferies Financial Group, earlier this year, and has been on the public trading markets since January 17. Over the years that it has been in operations, Vitesse has seen its oil and gas investments grow from $50 million $500 million, and has returned more than $124 million to its shareholders.

On February 13, Vitesse released its first quarterly financial release as a public firm. The report showed a net income for 2022 of $118.9 million. Year-over-year, this represented an enormous 682% increase from 2021. The company’s income was generated by a 2022 daily production of 10,376 barrels of oil equivalent (Boe), of which 68% was petroleum. The company saw a 2022 cash flow from operations of $147 million, of which $100 million was free cash flow.

What should catch the eye of dividend investors here is the company’s first cash dividend payment, scheduled to go out this coming March 31. The payment was set at 50 cents per common share; the annualized rate, of $2 even, gives a yield of 11.5%. That’s almost 6x higher than the average dividend yield found among S&P-listed companies, and more than 5 points higher than January’s annualized inflation rate.

This newly public stock has piqued the interest of 5-star analyst Stephen Richardson, from Evercore ISI. Richardson likes what he sees, and believes that Vitesse’s most likely path forward will include a reliable dividend.

“We expect the VTS management team to remain thoughtful stewards of shareholder capital, to remain patient in regards to M&A, and to tightly manage the business down to the well level (with the help of proprietary technology). Our rather simple view here is that yield will compress as the market becomes familiar with VTS and the strategy plays out, and it is deal flow and / or shrinking the capital base (via buybacks) that offer the most visible paths to accretions (outside of commodity price). The most likely outcome involve supporting the share price via dividends & buybacks,” Richardson explained.

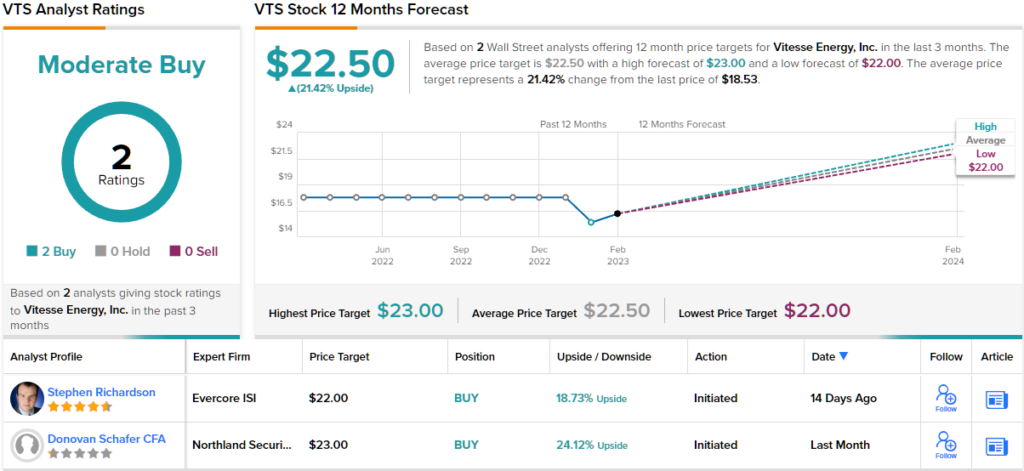

In line with this stance, Richardson rates VTS shares an Outperform (i.e. Buy), and his price target, set at $22, implies that the stock has a gain of ~19% waiting ahead of it. Based on the current dividend yield and the expected price appreciation, the stock has ~30% potential total return profile. (To watch Richardson’s track record, click here)

So far, this high-yield newcomer to the dividend world has picked up 2 recent analyst reviews, both positive, for a Moderate Buy consensus rating. The shares are priced at $17.39 and have an average price target of $22.50, suggesting a one-year upside potential of ~21%. (See VTS stock forecast)

Black Stone Minerals LP (BSM)

The next high-yield div payer we’re looking at is Black Stone Minerals, another firm that operates in the North American hydrocarbon sector. Black Stone is a mineral rights company, meaning it buys up large tract of land in rich oil and gas regions and collects income on the royalties from the hydrocarbon development of those properties. Currently, Black Stone Minerals owns more than 20 million acres of prime land for oil and gas exploration and production, across 40 states, including in such rich gas fields as Louisiana’s Haynesville basin.

This is a profitable business model, and in its 4Q22 financial results, released on February 21, Black Stone reported several quarterly records. These included an adjusted quarterly EBITDA of $131.7 million, and a distributable cash flow of $125.3 million. These results were supported by Q4 mineral and royalty production totals of 40,000 barrels of oil equivalent per day through the quarter. This figure was up 7% from 4Q21, and was the company’s highest ever reported mineral and royalty production total.

For the full year 2022, Black Stone saw $466.4 million in adjusted EBITDA, and increased its cash distribution to shareholders (its dividend payment) by 85%.

So let’s look at this dividend. In the Q4 report, Black Stone continued a long-running habit of increasing the common share payment; the $0.475 distribution was up 6% from the prior quarter, and 74% year-over-year. At an annualized payment of $1.90 per common share, the distribution gives a robust yield of 12.2%, far above both the average among peer companies and the current rate of inflation.

Analyst Derrick Whitfield, of Stifel, has been following Back Stone Minerals, and describes it as a stock with too many remunerative attributes to ignore.

“We believe the stock offers a compelling valuation (valued at ~27% discount to peer average using Fwd. 2023E EV/DACF), below-average leverage, and under-appreciated exposure to the Haynesville (one of the most capital-efficient dry gas plays in the Lower 48). Fundamentally, we believe the value of BSM’s Haynesville royalty position should re-rate due to an increasingly constructive natural gas macro backdrop and industry M&A, which could materially increase industry activity across its highest NRI acreage. Lastly, we estimate the company could return 100% of its enterprise value by 2030,” Whitfield opined.

Standing squarely in the bull camp, Whitfield rates BSM a Buy, and his $20 price target implies a 28% for the next 12 months. (To watch Whitfield’s track record, click here)

Overall, Wall Street’s view of this stock is also bullish, as the 4 recent analyst reviews include 3 to Buy against 1 to Hold – for a Strong Buy consensus rating. The average price target of $19.33 implies ~25% upside from the current share price of $15.55. (See BSM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.