The big market headline last year has been the steady fall in stocks. The S&P 500 tumbled 19% for 2022, and the NASDAQ has fallen a disastrous 33%. And while recent data shows that there may be some hope on the inflation front, there may still be storm clouds massing for this year’s stock market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In times like these, it’s natural to turn to the high-yield dividend payers. These stocks offer the twin advantages of a steady income stream through regular, reliable dividend payments – and dividend yields that can beat the high inflation we’ve been coping with since last year. For investors seeking a strong defensive option, the high yield div stocks are sound play.

With this in mind, using the TipRanks database, we’ve looked up two stocks that are offering dividends of at least 10% yield – that’s more than 4x higher the average yield found in the markets today. Each of these is Strong Buy-rated, with some positive analyst reviews on record. Let’s take a closer look.

Ellington Financial, Inc. (EFC)

First up is a real estate investment trust (REIT). These companies, which buy, own, operate, and lease a wide range of real properties and mortgage assets, are well-known as perennial dividend champions. Ellington Financial acquires and manages financial assets, especially mortgage-related assets including mortgage-backed securities and equity investments in both the commercial and residential mortgage loan markets. As of September 30, 2022, the company had $10.3 billion in total assets under management.

In Ellington’s last quarterly financial update, for 3Q22, the company reported a net loss of 55 cents per common share. The company attributed this loss to effects of the generally deteriorating economic situation, as well as higher expenses caused by increasing interest rate. The losses were partially offset by strong performance in the loan portfolios and interest rate hedges.

On a more positive note for investors, despite running a steep net loss Ellington was able to record a sequential increase in adjusted distributable earnings – the metric that directly supports the dividend – of 7%, to 44 cents per common share.

Turning to that dividend, Ellington declared on December 7 a regular monthly common share payment of 15 cents, for next payment in January. This monthly dividend is equivalent to 45 cents per common share per quarter, or $1.80 annualized, and yields an impressive 14.3%. Investors should note that Ellington’s current dividend yield is more than double the last reported inflations numbers, the 7.1% annualized rate from November.

BTIG analyst Eric Hagen describes EFC as a ‘top pick,’ and explains his position, saying, “EFC is our top pick among the hybrid/non-Agency residential mortgage REITs. We think the company is among the mortgage REITs best prepared with liquidity and a balanced capital structure to be active in new loan origination/aggregation, including non-QM and investor property loans, smallbalance commercial, and consumer loans. We’re watchful of credit trends and prepayment speeds, but we see the company’s loan strategies carrying higher potential for value creation given well-supported financing channels, particularly through securitization.”

Looking ahead, Hagen rates EFC shares a Buy, and his $17 price target suggests a one-year gain of 35% for the stock. Based on the current dividend yield and the expected price appreciation, the stock has ~49% potential total return profile. (To watch Hagen’s track record, click here)

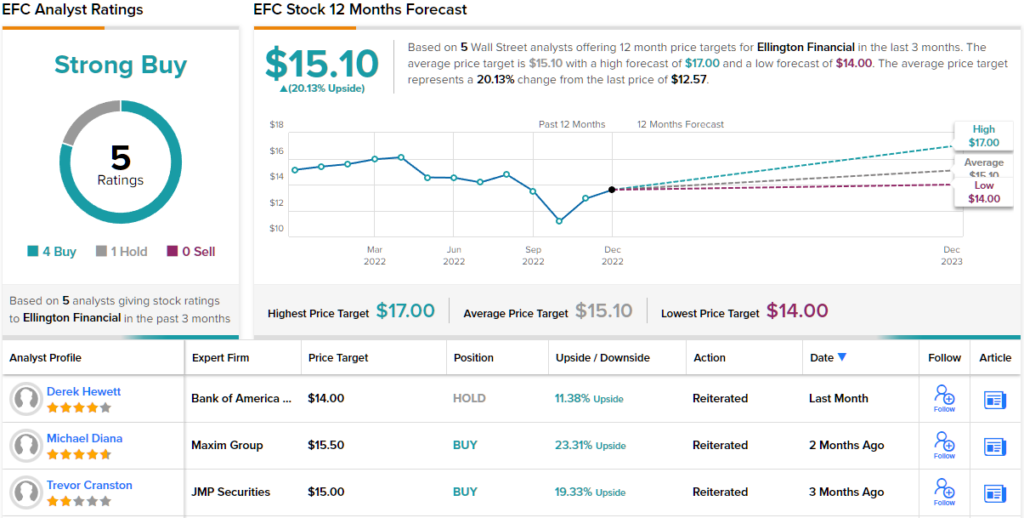

Overall, Ellington’s Strong Buy consensus rating is based on 5 recent analyst reviews, breaking down 4 to 1 in favor of Buys over Holds. The stock is selling for $12.57 and its average price target, of $15.10, implies an upside potential of ~20% on a one-year timeline. (See EFC stock forecast on TipRanks)

Hercules Capital, Inc. (HTGC)

The next high-yield dividend payer is Hercules Capital, a business development company, or BDC. Like REITs, BDCs are known for their high-yield dividends, and Hercules does fit that bill. The company has focused on venture debt, providing funding and financing for pre-IPO emerging firms that would otherwise turn to venture capitalists. In its 20 years of operation, Hercules has funded more than 600 such firms to the tune of more than $16 billion, and currently has over $2.9 billion in assets under management.

In a strategic move that set itself apart from other BDCs, Hercules has from its beginning focused on funding science-oriented companies. It’s client base emerges from the life sciences, sustainable/renewable tech, SaaS, and digital worlds. As of September 30, Hercules had total gross debt and equity commitments of $2.48 billion, and had made total gross fundings of $1.1 billion. Overall, Hercules’ portfolio generated $84.2 million in net interest income during the quarter, up 20% year-over-year. The quarterly net investment income came to 39 cents per common share, which provided 108% funding coverage of the company’s regular dividend payments.

In addition to its distributed earnings, Hercules also reported an undistributed earnings spillover of $134.1 million, or $1.03 per share. This spillover provides a cushion for dividend funding, and guarantees coverage of the payments.

This company’s highly reliable dividend (it has been covered since 2005) was declared in October at 36 cents per common share – and the same day, the company also declared a supplemental dividend payment of 15 cents. Both the regular and supplemental dividends were paid out in November.

The regular dividend alone annualizes to $1.44 per share, and gives a yield of 10.8%. This already beats inflation by 3.7 points – but we can’t ignore the supplemental dividend, which the company has held to since 2018. Adding in that payment, the dividend came to 51 cents per share and yielded over 15%.

Covering Hercules for RBC Capital, 5-star analyst Kenneth Lee believes that Hercules is a stable, well-positioned dividend generator, and describes it thus: “We expect HTGC to generate net investment income ROE above peer averages over the 2022 time frame. Further, we expect HTGC to be able to generate its ROEs while maintaining leverage levels roughly comparable to peer BDCs within our coverage. We believe HTGC’s dividends are well-supported. Further, HTGC’s spillover income should provide additional support for the common dividend.”

These comments support Lee’s positive outlook and Outperform (i.e. Buy) rating, while his $16 price target indicates his confidence in ~20% upside for the shares by the end of next year. (To watch Lee’s track record, click here)

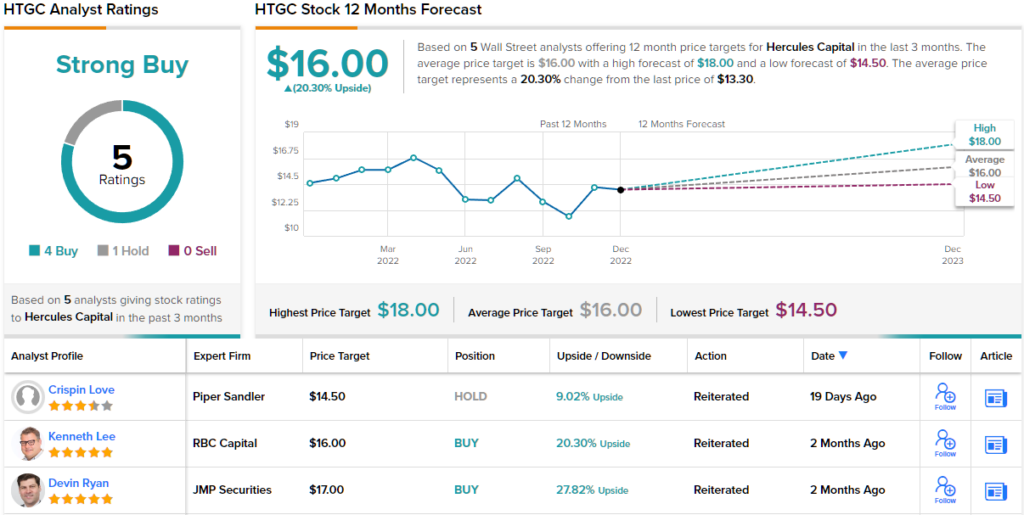

Overall, Hercules has 5 recent review on file from the Wall Street analysts, favoring Buys over Holds by 4 to 1 – for a Strong Buy consensus rating. The stock has an average price target of $16, matching Lee’s, and suggesting a 20% one-year increase from the current trading price of $13.30. (See HTGC stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.