Standing here at the tail end of 2022, we can see the next couple of years through the mist of uncertainty – and for now, that view is dominated by high inflation and rising interest rates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Thursday, we’ll get the October inflation numbers. The September rate was running at 8.2% annualized and 6.6% month-over-month, setting up a bad trend of further increases. On interest rate, the Fed this month instituted a fourth 75-basis point hike in a row – and in his comments, Jerome Powell indicated that the central bank won’t even be thinking about a ‘pivot’ anytime soon.

So far, at least one forecaster is painting an even gloomier picture. In a note to clients, UBS economist Arend Kapteyn lays out his belief that the markets haven’t bottomed yet, and he predicts that the S&P will collapse a further 15% or more, to 3,200, by the second quarter of next year. He bases this on the increased risk of a deep global recession, exacerbated by the Fed’s current interest rate hike regime.

“Weak growth and earnings drag the market lower before a fall in rates helps it bottom… For the US, we now expect near zero growth in both 2023 and 2024, and a recession to start in 2023,” Kapteyn wrote.

This is a situation made for defensive actions. And that brings us to dividend stocks. This is a traditional defensive move that guarantees income through dividend payments.

Wall Street’s analysts have been doing some of the footwork for us, pinpointing two dividend-paying stocks that have kept up high yields, at least 10%. Opening up the TipRanks database, we examine the details behind those payments to find out what else makes these stocks compelling buys.

Ares Capital Corporation (ARCC)

We’ll start by looking at Ares Capital Corporation, a business development company (BDC). BDCs fill a mid- to low-end niche in the financial world, making capital available to companies that don’t necessarily qualify for loans or credit arrangement with the regular banking system. Ares’ focus is on small- and mid-market enterprises seeking new capital, credit facilities, and financial instruments; Ares provides these services, and more.

Ares’ portfolio, as of this past September 30, consists of investments in 458 companies, with backing from 224 private equity sponsors. The portfolio has a fair value of around $21.3 billion, and is highly diversified in asset class, sector, and even geography. The largest part of the portfolio, 44.6%, is in first lien senior secured loans, and another 17.85 is in second lien senior secured loans. Software and services companies, at 22.5% of the portfolio, are the largest sector, with health care services following at 10.1% of the total. Ares has invested mainly in firms located in the West, Midwest, and Southeast regions of the US, although it has invested in other regions and even internationally.

Ares Capital shares have outperform he broader markets this year thanks to strong gains in earnings and revenues. The company showed net investment income of $288 million in 3Q22, compared to $184 million in the year-ago period. On a per-share basis, this came to 57 cents in the current quarter versus 40 cents one year ago. Ares’ core EPS was reported at 50 cents per share, up more than 6% year-over-year.

Turning to the dividend, Ares declared a payment of 48 cents per common share on October 25. The dividend is payable on December 29 for the fourth quarter. Also to be paid at that time is a special dividend of 3 cents, declared back in February. Taking just the regular payment, Ares’ dividend annualizes to $1.92 and gives a yield of 10%.

5-star analyst Devin Ryan, from JMP Securities, notes Ares’ strong financial results, as well as the company’s deep cash holdings, and goes on to say, “Given elevated concerns around credit, we are optimistic that ARCC is well positioned to outperform given its track record of superior credit underwriting, an experienced and long-tenured management team, a best-in-class origination platform, and the benefit of a multicycle-tested business model. In short, we continue to view Ares Capital as one of the best-positioned BDCs to outperform in a more challenging macro environment…”

Ryan goes on to give ARCC shares an Outperform (i.e. Buy) rating and he sets a price target of $22, implying a one-year upside potential of ~16%. Based on the current dividend yield and the expected price appreciation, the stock has ~26% potential total return profile (To watch Ryan’s track record, click here)

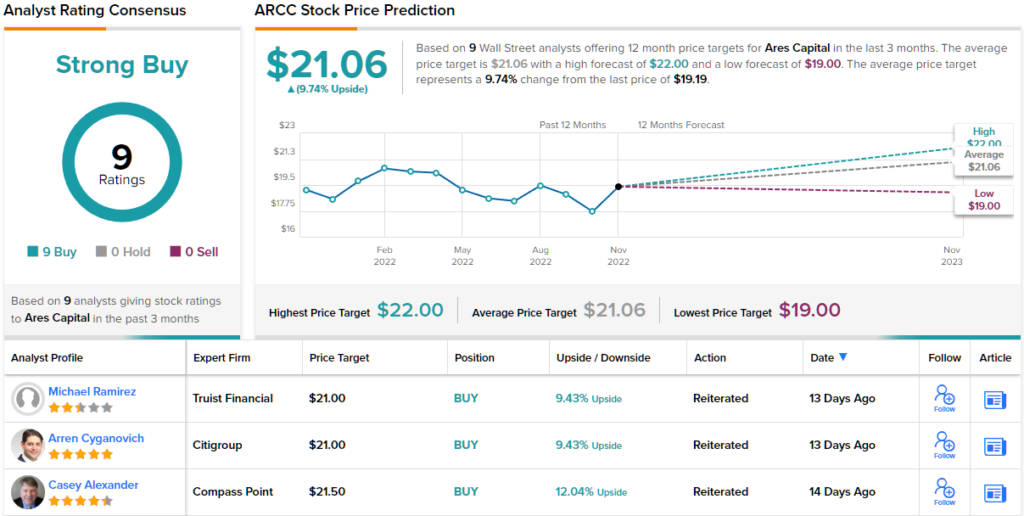

Overall, this fundamentally sound BDC has attracted plenty of positive interest from Wall Street – shown by the 9 recent analyst reviews supporting the unanimous Strong Buy consensus rating. Shares are priced at $19.19 and the average price target of $21.06 suggests ~10% gain in the year ahead. (See ARCC stock forecast on TipRanks)

Medical Properties Trust (MPW)

The second stock we’ll look at comes from the real estate investment trust (REIT) segment, another financial segment well-known for its generous dividends. Medical Properties Trust, MPW, is a REIT focused on the healthcare sector. The company owns and manages 434 properties in 10 countries, with over 44,000 licensed medical beds. Medical Properties’ assets are worth approximately $21.1 billion, and the company is the world’s second-largest non-government owner of hospital properties.

In the last few months, MPW has sold off some 15 of its properties. The sales moves helped the company to reduce debt and improve liquidity by close to $1 billion.

At the same time that MPW was liquidating some assets, it was also reporting sound financial results. The top line in 3Q22 came to $352.3 million; while this was down 9.8% y/y, it was still within the company’s historic range for quarterly revenues – and the 9-month total, of $1.16 billion, was up 2.5% from the first 9 months of 2021. MPW did better on earnings. It’s net income per share came to 37 cents, up 20% y/y.

The sound financial results supported the dividend payment. MPW declared a common share dividend of 29 cents, last paid out in October; the dividend is fully covered by the company’s income and FFO. On an annualized basis, the dividend pays $1.16 per common share – and is yielding a solid 10.3%. The company has been raising the dividend steadily for the past 14 years.

In his coverage of this company for Stifel, 5-star analyst Steve Manaker takes a look under the hood and decides that it’s worth a Buy rating.

“We rate MPW Buy, given very attractive valuations on what appears to be a stable earnings base. The stock has among the highest short interest in REITland, based on the belief that operating pressure will hurt the ability of tenants to pay rent. At the present time, we aren’t seeing a large amount of that stress. Like many other segments of healthcare, MPW’s tenants are in the recovery phase, and operating results aren’t yet ‘stabilized’ or ‘normalized.’ But overall EBITDAR/rent remains strong,” Manaker opined.

Going forward from these comments, Manaker puts a $17 price target on MPW, showing confidence in an upside potential of ~47% in the next 12 months. (To watch Manaker’s track record, click here)

So, that’s Manaker’s view, how does the rest of the Street see the next 12 months panning out for MPW? Based on 6 Buys and 4 Holds, the analyst consensus rates the stock a Moderate Buy. The stock trading price is $11.58 and its $18.33 average price target is decidedly bullish, implying a 12-month upside of ~59%. (See MPW stock forecast on TipRanks)

To find dividend stocks that have received the most bullish recent ratings from the Street, visit TipRanks’ Analysts’ Top Stocks tool.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.