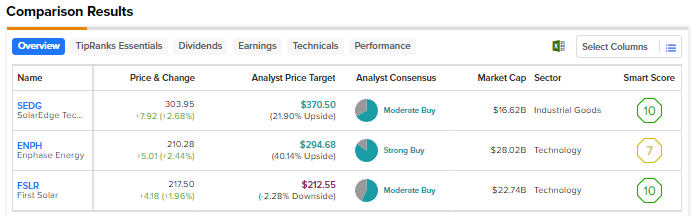

Governments across the world are focusing on the transition from fossil fuels to renewable sources of energy. This week, the European Union reached a preliminary deal to source 42.5% of its energy consumption from renewables by 2030, up from the previous target of 32%. Solar companies are expected to gain tremendously from the growing demand for clean energy in the U.S., Europe, and elsewhere. With that thought in mind, we used TipRanks’ Stock Comparison Tool, to place SolarEdge (NASDAQ:SEDG), Enphase Energy (NASDAQ:ENPH), and First Solar (NASDAQ:FSLR) against each other to pick the best solar stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SolarEdge Technologies (NASDAQ:SEDG)

SolarEdge and Enphase are dominant players in the U.S. residential solar inverter market. Last month, SolarEdge reported upbeat fourth-quarter results. The company’s adjusted EPS jumped to $2.86 from $1.10 in the prior-year quarter, driven by a 61% rise in revenue to $891 million and enhanced margins.

Following the results, JPMorgan analyst Mark Strouse increased the price target for SEDG to $361 from $358, calling it “one of the few solar stocks that is consistently profitable, generates cash and has a solid balance sheet.” Strouse expects the weakness in the U.S. residential solar market to be offset by the shipments to Europe, which could limit the downside risk.

Meanwhile, KeyBanc analyst Sophie Karp recently initiated coverage on SolarEdge with a Hold rating. The analyst highlighted that the company has a “duopolistic position” in the U.S. with nearly 50% market share, which helps in generating steady margins and growth rates.

Karp also noted SolarEdge’s diversification and greater international presence compared to rivals, which gives greater growth stability “at the expense of somewhat lower gross margin due to a more price competitive environment outside of the U.S.” Nonetheless, the analyst is sidelined on the stock as she believes that it is almost fairly valued.

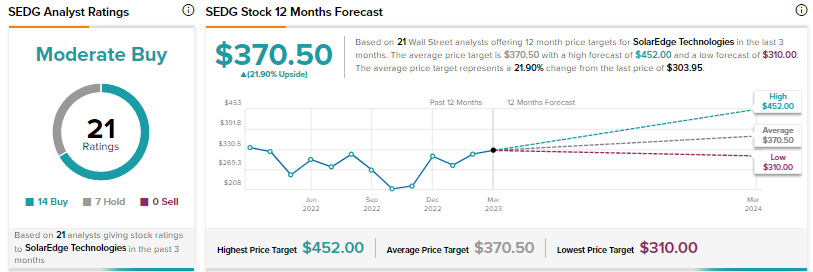

Is SolarEdge a Good Stock to Buy?

Overall, SolarEdge scores a Moderate Buy consensus rating based on 14 Buys and seven Holds. At $370.50, the average SEDG stock price target implies nearly 22% upside potential. Shares have risen over 7% year-to-date.

Enphase Energy (NASDAQ:ENPH)

Enphase, a leading supplier of microinverter-based solar and battery systems, experienced solid demand for its energy systems in the fourth quarter of 2022. Revenue increased almost 76% to $724.7 million and adjusted EPS surged 107% to $1.51.

However, investors were concerned about Enphase’s guidance about its U.S. business for the first quarter of 2023, even though the company’s overall Q1 2023 revenue outlook was ahead of expectations due to strength in the European market. The company expects its Q1 2023 U.S. business to be slightly down compared to Q4 2022 due to seasonality and the macroeconomic backdrop.

Nevertheless, Wall Street is bullish about Enphase’s growth potential. Recently, Raymond James analyst Pavel Molchanov upgraded the stock to Buy from Hold with a $225 price target, citing the steep decline in the shares.

Molchanov also acknowledged that the company has done “a phenomenal job” of expanding into Europe, which was the leading growth driver in 2022. The analyst expects “even more” growth in the European market in the years ahead.

What is the Price Target for ENPH Stock?

With 17 Buys and three Holds, Enphase scores Wall Street’s Strong Buy consensus rating. The average ENPH stock price target of $294.68 suggests 40.1% upside. Shares have declined nearly 21% since the start of 2023.

First Solar (NASDAQ:FSLR)

First Solar, a provider of solar modules, saw its Q4 2022 revenue grow 10.5% year-over-year to $1 billion, reflecting increased module sales and the sale of the company’s Luz del Norte project in Chile. However, the company slipped into a GAAP loss per share of $0.07 from EPS of $1.23 in the prior-year quarter.

The company is optimistic about 2023 based on “a significantly stronger commercial, operational, and financial position,” higher research and development investment, new domestic and international capacity, and its new Series 7 product.

While First Solar’s Q4 2022 operating loss was driven by significantly higher operating costs, essentially related to production start-up expenses, Argus analyst Bill Selesky expects a “monumental swing” to profitability this year, driven by lower cost inflation and the waning of most supply-chain issues.

Selesky feels that the Inflation Reduction Act is a huge advantage for First Solar, with the company expected to benefit for years to come. Based on his bullish thesis, Selesky increased his price target for FSLR stock to $261 from $176 and reaffirmed a Buy rating.

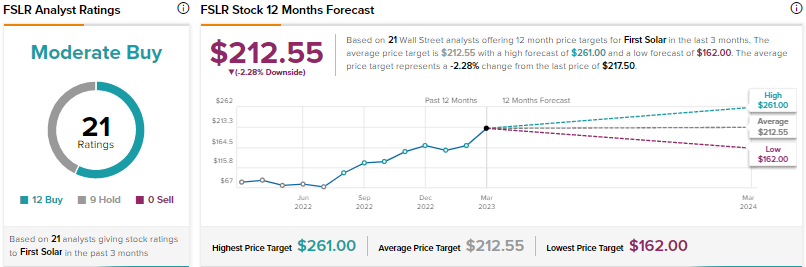

Is First Solar a Buy Now?

Wall Street is cautiously optimistic about First Solar based on 12 Buys and nine Holds. Given the 45% year-to-date rally in the stock, the average price target of $212.55 indicates a possible downside of 2.3% from current levels.

Conclusion

While macro headwinds might put some pressure on solar companies over the near term, the future looks bright due to the growing focus on renewable sources of energy. Wall Street sees a good opportunity to buy the dip in Enphase shares and estimates higher upside in the stock compared to SolarEdge and First Solar.