No matter how the economy turns, it will stand on basic commodities. From construction materials to industrial and agricultural chemicals to the raw ingredients of computer processor chips – the materials sector forms the foundation of almost everything we do.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And that makes materials a solid choice for long-term investors. Despite headwinds in recent years – including rising prices in the commodity markets, high interest rates that put a crimp on credit, and slowing demand in multiple industries – materials remain a top sector for investors seeking real value. Share prices are down, while prospects in many areas of the materials landscape are up.

That’s the thesis behind analyst Chris Parkinson’s view. In his write-up on materials stocks for Wolfe Research, Parkinson notes the sector’s recent underperformance but goes on to explain why value investors should give this area a closer look.

“Materials have materially underperformed the S&P over the past ~12 months, and on a relative basis are trading slightly below 5-year averages. However, we want to avoid setting the stage too broadly… we feel positioning with a value / GARP angle is more appropriate than chasing cyclicals (growth),” Parkinson noted.

The Wolfe expert follows these comments with specific stock picks – three materials stocks to buy now, especially for investors looking for value shares. We’ve used the TipRanks database to find out the consensus view from the Street on these stocks and found broad agreement. Let’s delve deeper and explore the reasons behind these recommendations.

Corteva (CTVA)

We’ll start in the world of agricultural materials and chemicals. Corteva, the first stock on our list, spun off from its parent firm DowDuPont in 2019, as an independent operator of the older chemical company’s agricultural segment. Corteva today is an important producer in the world market for seeds and agricultural chemicals, making a wide range of products designed to increase farmers’ acre-productivity and general output. Corteva’s product line is wide and varied, and includes insecticides, herbicides, and fungicides in the chemical section and high-performance seeds, sold under the brand names Pioneer and Brevant, in the crop section. For the company’s customers, the goal is to maximize agricultural output.

Despite holding a leading role in an essential industry, and boasting a solid customer base with a global footprint, Corteva has seen year-over-year declines in revenue for the past few quarters. The company’s shares reflect this, and the stock is down more than 14% in the last 12 months. Nevertheless, there is a bright spot on the horizon.

Corteva’s stock jumped at the start of February, with the release of the 4Q23 and full-year 2023 results – and with a forecast that the company’s sales will rebound this year. Management has forecast net sales for 2024 in the range of $17.4 billion to $17.7 billion, with translates to a modest, but real, 2% gain at the midpoint. On top of that upbeat forecast, the company’s Q4 results beat the forecast at both the top and bottom lines – and the stock surged almost 19% when investors digested the earnings release.

Looking at the Q4 earnings release, we see that Corteva reported $3.71 billion in quarterly net sales, beating the forecast by $120 million despite a 3% year-over-year decline, and had a bottom line of 15 cents per share in non-GAAP measures, 9 cents per share better than had been anticipated. The company boasted $17.23 billion in total revenues for 2023, had operations in 125 countries, and even though sales and earnings were down in 2H23, still returned $1.2 billion to shareholders in the year.

For Parkinson, all of this adds up to a ‘top pick.’ He sees solid prospects that Corteva will meet its optimistic guidance, and writes, “Our Top Pick is CTVA due to (i) further LT margin upside in both seed / CPC in ’24-’26; (ii) an under-appreciation for its R&D portfolio contributions in ’24-’28 (subsequent net royalty decline, gene editing optionality, etc.); and (iii) the ‘return of capital return.’”

Looking ahead, the analyst sets up a case for continued growth, saying, “Based on our faith in ‘24/’25 #s, it’s our belief CTVA remains materially undervalued – trading at 18x P/E ratio vs. a 5-yr avg. of +/- 20x P/E. Given stable execution, further execution on CPC margins, and a greater degree of confidence in royalty reduction, we see valuation >20x P/E.”

In concrete terms, this stock gets an Outperform (i.e. Buy) rating from Wolfe Research, with a $67 price target that implies a 25% gain in the next 12 months. (To watch Parkinson’s track record, click here)

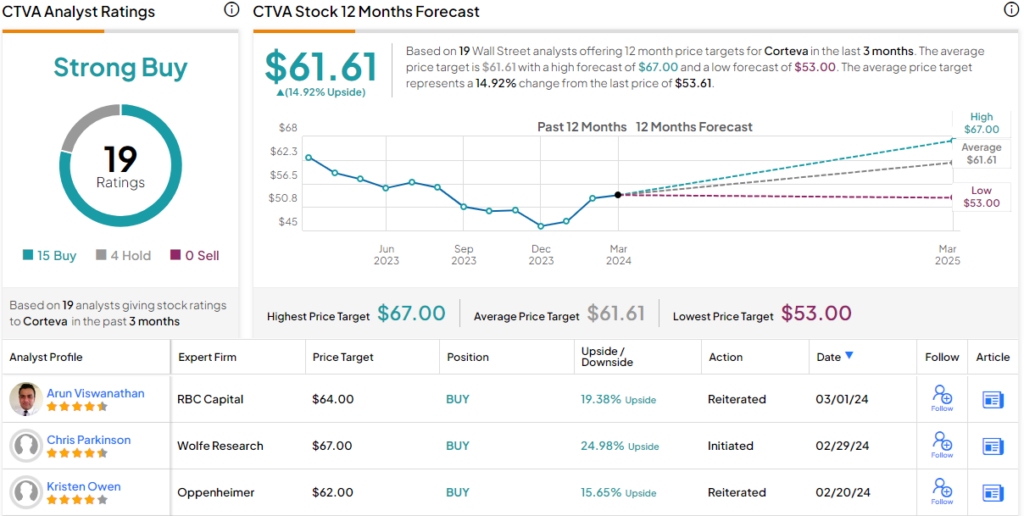

Overall, Corteva has a Strong Buy consensus rating from the Street’s analysts, based on 19 reviews that include 15 Buys to 4 Holds. The shares are trading for $53.61 and their $61.61 average price target suggest a one-year upside potential of 15%. (See Corteva stock forecast)

CF Holdings (CF)

Next up is CF Holdings, a materials provider that works with both the energy and agriculture industries. This company has a global presence in the important manufacture of hydrogen and nitrogen products, which are vital in several areas: clean energy, abatement of industrial emissions, and agricultural fertilizers. The company has a widespread network of transport, storage, and distribution facilities across North America, backed up by manufacturing infrastructure in the US, Canada, and the UK.

CF Holdings’ product lines include a range of chemicals, many with multiple uses. Prominent among them are ammonia and its derivatives, used in both fuels and fertilizers; granular urea, a solid nitrogen fertilizer; urea ammonium nitrate (UAN), a form of liquid fertilizer; and diesel exhaust fluid, used in selective catalytic reduction systems to lower diesel engine emissions. Fertilizer products make up the larger share of the company’s product output.

In recent quarters, CF’s revenues have been trending downwards – although the last report, for 4Q23, showed a reversal of the trend. When we zoom in and look at the 4Q23 report, we find that CF had a top line of $1.57 billion for the quarter, down 40% year-over-year but $70 million over the estimates and representing a 23.6% sequential increase. The company’s earnings came in at $1.44 per share by GAAP measures – 16 cents per share below the forecast. For the full year, the company generated $1.8 billion in free cash flow.

Of interest to return-minded investors, CF Holdings declared, on January 31, a dividend of 50 cents per share. While the annualized rate of $2 gives a yield of just 2.5%, not quite high enough to fully offset inflation, the 50-cent figure represents an increase of 25% over the previous quarterly payment.

When Parkinson looks at CF, he sees a company that is leading in its industry – and that represents a solid opportunity for investors. He writes, “As our baseline, CF is the best operator within the global nitrogen industry (N-unit optionality, average operating rates, etc.) with top-tier FCF profile of any global fertilizer. CF has the highest degree of market optionality (access to capital, diverse asset base), core to harnessing NE Asia opportunities. We’ve long argued CF’s normalized EBITDA baseline is +/- $2.4bln, which accounts for the legacy asset, but are now adding ≥$150mm for normalized Waggaman EBITDA (+better op performance likely), but leave +/- $100mm for the XOM CO2 deal in ’25 as upside.”

“CF also stands to benefit in a changing competitive landscape,” the analyst goes on to add. “Historically, the majority of new NH3 capacity fails to materialize ex-core producers. There is a worthy argument for further NH3 capacity closures in Europe. Higher production rates in Trinidad & Tobago and India are already largely priced in, in our view.”

For Parkinson, the bottom line here is an Outperform (i.e. Buy) rating, with a $99 price target that indicates room for a 24% upside in the coming year.

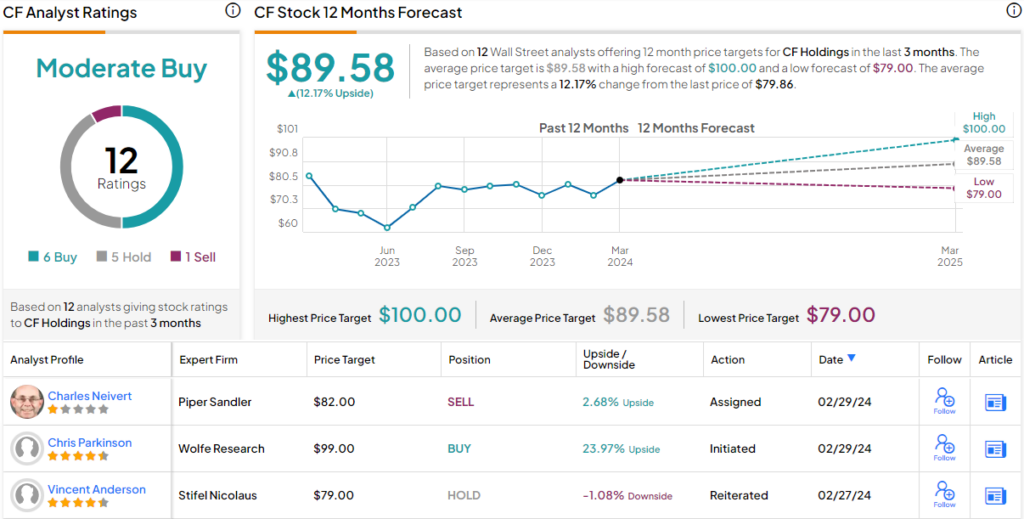

The Moderate Buy consensus on this stock is built on 12 recommendations, that split 6-5-1 to Buy-Hold-Sell. The shares are trading for $79.86, and their $89.58 average price target implies the stock will gain 12% this year. (See CF stock forecast)

Entegris (ENTG)

Last on the list, Entegris, is a manufacturing company closely tied to both materials and high tech. Headquartered in Massachusetts, and holding offices and facilities across the US and in East Asia, as well as in Europe and Middle East, Entegris provides several lines of products that are essential in the fabrication of semiconductor chips. The company’s products solve several ‘bottleneck’ issues in chip making, as well as creating the specialized environments needed to maintain the quality and purity of silicon wafers during the chip-making process.

Specifically, Entegris’s products can be split along two lines – hardware and chemicals. The hardware includes filtration products, gas delivery systems, liquid systems, wafer carriers, and the shippers and trays needed for moving the final product. On the chemical side, we find materials – the gasses and fluids required to maintain sterile environments, coatings to create high-purity surfaces on the manufactured chips, and premium grade graphite and silicon carbide for high-end applications.

At the bottom line, these product lines are designed to solve a complicated set of problems in one of the most complex industries in the modern world – and an industry without which our digital economy could not survive. You may not have heard of Entegris, but they make possible most everything we do today.

That, in contrast to the other names above, has translated into solid stock performance over the past year. ENTG shares have gained 66% in the last 12 months, as the company has returned profitable results in a difficult environment.

And the business appears to be on a sound footing. The last quarterly report from Entegris, for 4Q23, showed beats at both the top and bottom lines. Revenue, at $812 million, was more than $31 million better than expected – even as it fell by 14% y/y. The bottom line, a non-GAAP EPS of 65 cents, was 7 ahead of the forecast.

This combination of better-than-anticipated results plus a rising stock price led Parkinson to take a bullish view here, and to add this stock to his list of materials picks – even though it is not strictly a value stock. The analyst says of Entegris, “The single ‘pure growth’ name we’re willing to jump onto is ENTG, as there is just too much to like over a multi-year period. We’re bulls on ENTG given its (i) best-in-class, competitive positioning driving share again across the semi manufacturing process; (ii) favorable secular content drivers in both Logic and 3D NAND (Materials and Purity); and (iii) high probability of swifter deleveraging vs. investor forecasts (PIM platform sale, etc.).”

Quantifying his stance, the Wolfe analyst rates the shares as Outperform (i.e. Buy), and he puts a $160 price target on the stock to suggest it will appreciate by 14% over the next year.

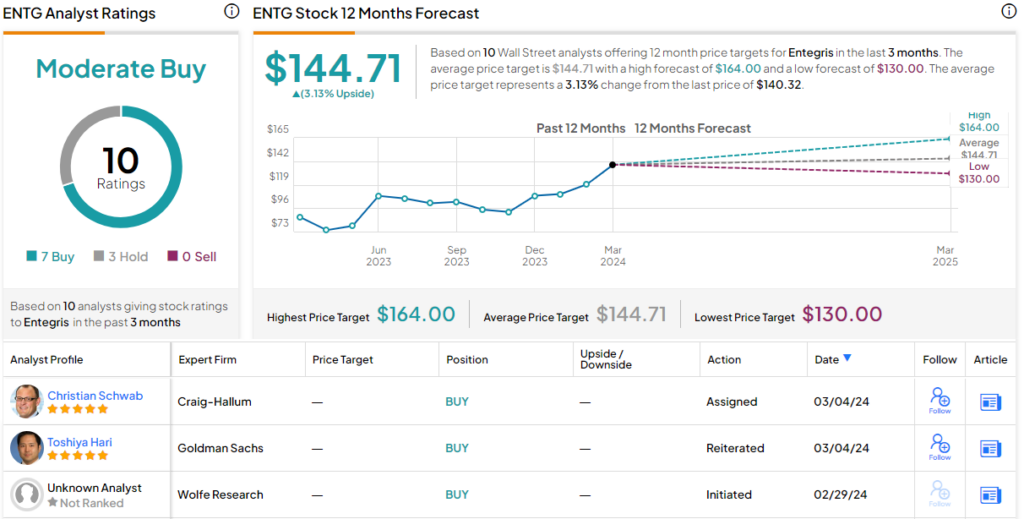

Looking at ENTG’s ratings, based on 10 reviews that break down to 7 Buys and 3 Holds, the analyst consensus rates the shares a Moderate Buy. Entegris’s stock is selling for $140.32, and its $145.45 average target price points toward a modest 3% gain on the one-year horizon. (See Entegris stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.