When faced with an economic downturn, the natural response for a recession-resistant stock would focus on demand inelastic sectors, such as food or energy. However, a consumer discretionary play like Ferrari (NYSE:RACE) may buck this usual assumption. Given that the iconic Prancing Horse brand focuses exclusively on a financially insulated consumer base, it can maintain its momentum. Therefore, I am bullish on RACE stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At first glance, the bullish narrative for Ferrari might seem like a value trap. After all, with major headwinds brewing, several technology firms decided to cut unnecessary weight, laying off their employees. If business enterprises believe it’s prudent to reduce costs, surely, many of the uber-wealthy should feel the same.

Let’s face reality – buying an exotic car only represents a portion of the total financial cost. The other components involve maintaining such a specialized machine, along with mundane expenses such as insurance.

However, the hard data suggests that RACE stock may be one of the more promising investments in the new normal. For one thing, there’s the market performance itself. Since the January opener, Ferrari stock has gained over 21%. In the trailing year, shares swung higher to the tune of over 16%. No matter how you cut it, these stats rank well above the benchmark S&P 500 (SPX).

Second, Ferrari delivers the goods financially. Growing its revenue by double-digit percentages on a year-over-year basis for the fourth quarter, the Prancing Horse beat estimates for both the top and bottom lines.

Not only that, management will increase prices to offset the impact of inflation, and Ferrari customers will be all too happy to pay up, bolstering the case for RACE stock.

The Wealth Gap Will Benefit RACE Stock

Frankly, the above point about rising prices tells investors all they need to know about RACE stock. Unlike other retail enterprises where the collective consumer base’s ability to pay dictates market rates, Ferrari makes its own rules. Moreover, as the wealth gap widens, this social inequity will only cynically serve to lift RACE even higher.

To use a colloquial metaphor, Ferrari’s business model is akin to the popular Russian reversal joke. In this case, you don’t buy a Ferrari, Ferrari buys you.

It’s dark humor, but it’s also true. You can’t just walk into a Ferrari dealership and buy a Ferrari. More than likely, you’ll be laughed out of the complex. Rather, Ferrari is very selective about who can own its exclusive vehicles.

A similar example comes from Rolex. If you have no relationship with Rolex, you’re not getting one of its iconic watches. Even newbies deemed worthy of wearing a “Rollie” must put their name on a waitlist – with no guarantee of ever getting one.

While both brands may engage in what regular working people perceive as ludicrous strategies, for the uber-rich, this coy marketing only ramps up demand. What’s more, the total addressable market for RACE stock has only expanded because of the COVID-19 crisis.

In Q1 2020, the share of total net wealth held by the top 1% of U.S. society was 29.7%. Two years later, this metric read 31.9%. In other words, the number of people that can comfortably afford a Ferrari expanded during the pandemic. That’s great news for the company, thereby boosting RACE stock.

The Numbers Speak for Themselves

To be fair, RACE stock – like its underlying exotic vehicles – isn’t cheap. Currently, the market prices shares at a forward earnings multiple of 35.84. In this metric, Ferrari ranks worse than 92.42% of automotive industry members. Do the good folks at Maranello, Italy care? Absolutely not. Ferrari doesn’t sell cars – it sells power, prestige, and sex.

Indeed, the financials back up this blunt assessment. While Ferrari generates growth – for instance, its three-year revenue growth rate of 8.6% ranks better than 74% of the competition – its main focus centers on profitability. In this arena, it’s almost unrivaled. The company’s net margin stands at 18.92%, ranked above 96.47% of the auto industry.

Plus, with management raising prices combined with the expansion of the uber-wealthy, Ferrari’s margins may improve. Therefore, RACE stock might not be as overvalued as its print implies.

Is RACE Stock a Buy, According to Analysts?

Turning to Wall Street, RACE stock has a Moderate Buy consensus rating based on four Buys, four Holds, and zero Sell ratings. The average RACE stock price target is $280.98, implying 7.5% upside potential.

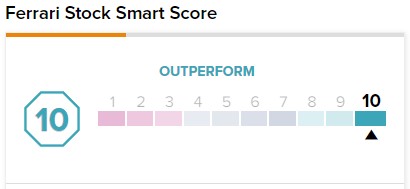

Notably, RACE stock has a ‘Perfect 10’ Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

The Takeaway: RACE Stock Aligns with Social Realities

Nothing about RACE stock natively charms onlookers, especially in the current social climate. At its core, Ferrari symbolizes an elitist, discriminatory organization in that it views most of the upper class as inadequate.

To own a Ferrari, you must be good enough for Ferrari. Fortunately, in a potentially recessionary environment, the Prancing Horse’s takers have expanded conspicuously. Like it or not, that’s a net positive for RACE stock.