One of the market’s most popular dividend ETFs, the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD), is looking to return to its winning ways after a fairly underwhelming performance in 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the widely-owned ETF managed to post a total return of 4.6%, this trailed the broader market by a significant margin. The S&P 500 (SPX) returned a far superior 23.6% for the year.

However, this doesn’t mean investors should now throw in the towel on the popular ETF. SCHD looks like an attractive investment for the year ahead and beyond. I continue to be bullish on the fund based on its strong long-term track record, attractive dividend yield, minuscule expense ratio, and compelling portfolio of blue-chip dividend stocks that offer a mix of yield and potential capital appreciation.

What is the SCHD ETF’s Strategy?

SCHD’s sponsor, Charles Schwab (NYSE:SCHW), says that the goal of this $52.2 billion ETF “is to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100 Index,” an “index focused on the quality and sustainability of dividends.”

Long History of Strong Returns

Why do I believe that SCHD can bounce back after its relatively lackluster 2023? First and foremost, the ETF has a long and proud history of delivering stellar returns to its holders.

As of November 30, the ETF generated a strong annualized five-year return of 10.7%. Zooming even further out, SCHD produced an impressive double-digit annualized return of 10.5% over the past 10 years. Going back to its inception in 2011, the fund has generated an annualized return of 12.6%.

Investing in a fund accruing double-digit annualized returns over the long term is a winning strategy for compounding the size of one’s portfolio. Think of it this way: on a cumulative basis, an investor who put $10,000 into SCHD 10 years ago would now have an investment worth just over $28,000.

Portfolio of Blue-Chip Dividend Stocks

The next reason SCHD remains attractive is that it owns a portfolio of blue-chip dividend stocks. SCHD owns 102 stocks, and its top 10 holdings make up a reasonable 40.5% of the fund’s assets.

Below is an overview of SCHD’s top 10 holdings from TipRanks’ ETF holdings tool.

The fund owns plenty of widely-recognized longtime dividend stalwarts like Coca-Cola (NYSE:KO) and Pepsi (NASDAQ:PEP), stable consumer staples businesses that have been paying and increasing their dividends for decades. Coca-Cola yields 3.1% and has increased its dividend payout for an incredible 61 years in a row. Meanwhile, Pepsi yields 2.9% and has increased its own payout for 51 consecutive years.

While SCHD owns many of these steadfast dividend stocks, this doesn’t mean its portfolio is limited to staid, old-school companies with lower growth prospects. Its top holding is Broadcom (NASDAQ:AVGO), the cutting-edge semiconductor stock that has returned more than 2,600% over the past decade. While Broadcom is best known as a high-powered growth stock, it’s a compelling dividend stock in its own right, with a yield of 1.9% and 13 consecutive years of dividend increases under its belt.

Broadcom is joined on the list of SCHD’s top 10 holdings by fellow semiconductor company Texas Instruments (NASDAQ:TXN), which sports a 3.1% dividend yield and has increased its dividend payout for the last 18 consecutive years. Other notable top 10 holdings include pharmaceutical giants like AbbVie (NYSE:ABBV), Amgen (NASDAQ:AMGN), and Merck (NYSE:MRK), plus household names like Home Depot (NYSE:HD), Chevron (NYSE:CVX) and Cisco (NASDAQ:CSCO).

Another nice thing about SCHD’s portfolio is that its holdings aren’t particularly expensive. The average price-to-earnings ratio of SCHD’s holdings is just 15.2. This represents a nice discount to the S&P 500, which sports an average price-to-earnings ratio of 21.9.

Also, many of these top holdings look compelling based on their strong Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight key market factors. A score of 8 or above is equivalent to an Outperform rating.

Broadcom and AbbVie boast ‘Perfect 10’ Smart Scores, while Amgen, Merck, Pepsi, Home Depot, and Coca-Cola all feature Outperform-equivalent Smart Scores of 8 or higher.

An Attractive Dividend Yield

SCHD’s dividend yield of 3.5% is more than double the average yield for the S&P 500, which currently stands at just 1.5%. SCHD has paid and grown its dividend payout for 12 years in a row, dating back to its inception in 2011.

The nice thing about SCHD is that, unlike some dividend ETFs, investors aren’t solely relying on its dividend payout to earn a return. High-performing growth stocks like the top holding Broadcom also offer plenty of potential for capital appreciation.

SCHD’s Low Expense Ratio

With an expense ratio of 0.06%, SCHD is about as cost-effective as it comes. This 0.06% expense ratio means an investor will pay just $6 in fees annually on an investment of $10,000.

A low expense ratio like this saves investors considerable money over the long run and allows them to preserve more of the principal of their investment over time. For example, assuming that SCHD returns 5% per year and maintains this current expense ratio, an investor would pay just $77 in fees on their investment over the course of 10 years.

Is SCHD Stock a Buy, According to Analysts?

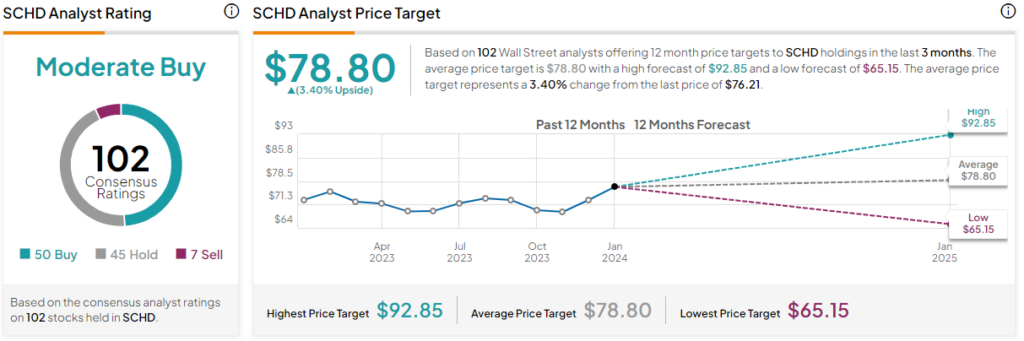

Turning to Wall Street, SCHD earns a Moderate Buy consensus rating based on 50 Buys, 45 Holds, and seven Sell ratings assigned in the past three months. The average SCHD stock price target of $78.80 implies 3.4% upside potential.

Looking Ahead

SCHD didn’t set the world on fire in 2023, with a total return that lagged that of the broader market by a significant margin. But for long-term investors, SCHD still looks attractive. The fund yields an attractive 3.5% and owns a portfolio of blue-chip companies that offer a nice mix of dividend payouts and potential for capital appreciation. This portfolio also trades at a tangible discount to the broader market.

SCHD’s long-term track record of double-digit annualized returns over many years also inspires confidence that this is still a good place to be in the long term. Lastly, SCHD’s expense ratio of just 0.06% is extremely favorable for investors, making this a compelling ETF to own in 2024 and beyond.