It’s not just the Magnificent Seven tech stocks that stand to gain from the ongoing generative artificial intelligence (AI) revolution. There’s plenty of growth potential elsewhere. Therefore, in this piece, we’ll use TipRanks’ Comparison Tool below to check out three lesser-known tech companies — SAP, WIX, and GTLB — with AI tailwinds that deserve more attention from investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Each name has a “Strong Buy” rating from the analyst community, and for a good reason: they’re AI GARP (or AI growth at a reasonable price) plays that look every bit as impressive as the deep-pocketed mega-cap firms are sparing no expense when it comes to AI investments.

SAP (NYSE:SAP)

SAP is a German enterprise software company that many U.S. investors may have written off in recent years. The stock took a massive hit to the chin during the 2022 sell-off, eventually shedding more than 50% of its value from its 2020 peak to its 2022 trough. Since bottoming out in September 2022, SAP stock has been off to the races.

Its impressive cloud comeback and improved profitability (earnings surged 44% in Q4 2023) are a major reason why the stock’s been able to break past its multi-year ceiling of resistance en route to a new high. Though shares have pulled back in recent weeks, I’m inclined to stay bullish as dip-buyers look to land a better entry point.

In the firm’s latest quarter, management also remarked on Business AI, which it believes will help position SAP for long-term growth. With a restructuring program in place that entails 8,000 job eliminations, it certainly seems like SAP is taking a page out of the playbook of most other firms engaged in their own “years of efficiency.”

SAP is making strategic bets on a variety of budding AI firms, including Claude-maker Anthropic and Canada’s Cohere, and has formed a partnership with Nvidia (NASDAQ:NVDA) to accelerate AI adoption in enterprises. This positions SAP as a potential beneficiary alongside some of the most influential members of the ‘Magnificent Seven’ as the advantages of AI expand.

What Is the Price Target of SAP Stock?

SAP stock is a Strong Buy, according to analysts, with five Buys and one Hold assigned in the past three months. The average SAP stock price target of $207.33 implies 12.5% upside potential.

Wix (NASDAQ:WIX)

Wix is an Israel-based e-commerce play that also stands to win a bit as it loosens the purse strings on AI spending. The firm behind its intuitive (and now AI-powered) web builder has been viewed as a pioneer of sorts in AI-assisted web development. As Wix continues making its web builder smarter and easier to use, I have to stay bullish on the stock, even with the recent momentum that has taken it up more than 15% year-to-date.

One analyst over at Bank of America (NYSE:BAC) referred to Wix as the “TurboTax of website building” late last year. That’s a rather amusing comparison, but it’s one not to be taken lightly, given that TurboTax is pretty much synonymous with tax filing software. Bank of America also stated that Wix has an “underappreciated margin inflection story” as the firm continues its growth.

Overall, website building and AI seem like the perfect match. We’ve heard a great deal about AI-assisted coders (or Copilots) lately, but not as much about AI web tools that don’t require a designer to touch any HTML or CSS. Wix has been in the web-building game for a long time. With AI thrown in, the firm may just be able to widen its moat further.

Further, as spatial computing interface design grows in popularity, I view AI tools as the solution to help people build the absolute best spatial web presence without having to re-learn the ropes for the next generation of the web.

“AI is a natural extension of what we do, and the better AI algorithms get, the better Wix will become,” said Wix co-founder and CEO Avishai Abrahami. I couldn’t agree more. Mr. Abrahami and his team have been well ahead in the AI race every step of the way.

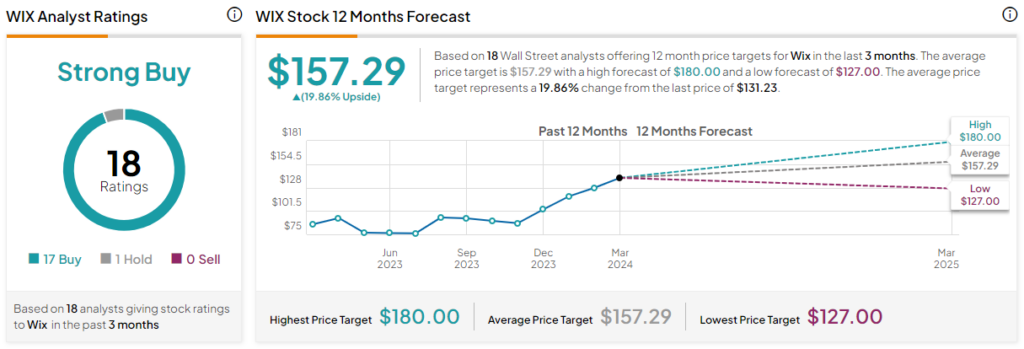

What Is the Price Target for WIX Stock?

WIX stock is a Strong Buy, according to analysts, with 17 Buys and one Hold assigned in the past three months. The average WIX stock price target of $157.29 implies 19.9% upside potential.

GitLab (NASDAQ:GTLB)

GitLab is a DevOps (development and operations) and DevSecOps (with security thrown in) solution provider that’s endured quite a rocky past few years since going live on the public markets. Since its opening day peak, shares have shed around 48% of their value.

As the $9.2 billion tech firm looks to add to its AI toolkit, the stock may have what it takes to eclipse its all-time high of $137 per share once again. With management’s emphasis on generative AI “grounded in privacy, security, and transparency,” I can’t help but stay bullish on the mid-cap as it looks to set the stage for its recovery.

With GitLab Duo (which helps with coding), the firm seems to be in the running to build a rather powerful AI ecosystem for DevSecOps developers. From AI-driven code suggestion to vulnerability detection and explainability (an impressive feature also touted by Amazon (NASDAQ:AMZN) CodeWhisperer), GitLab Duo may just be the secret weapon to fire back at its much larger rivals.

With a fresh Buy rating recently rewarded from Wells Fargo (NYSE:WFC) alongside a $70.00 price target, GTLB stock looks like a must-watch for AI investors looking for overlooked growth plays. Wells referred to the Duo Pro product as an accelerator of DevSecOps productivity.

What Is the Price Target for GTLB Stock?

GTLB stock is a Strong Buy, according to analysts, with 16 Buys and four Holds assigned in the past three months. The average GTLB stock price target of $73.35 implies 26.6% upside potential.

Conclusion

As the number of AI winners begins to grow, including some forgotten legacy companies and relatively unknown small caps ready to step things up, investors should consider broadening their screeners. This expansion should encompass more than just seven (or fewer) stocks. Among the trio, analysts anticipate the largest gains (~26.6%) from GTLB stock in the next year.