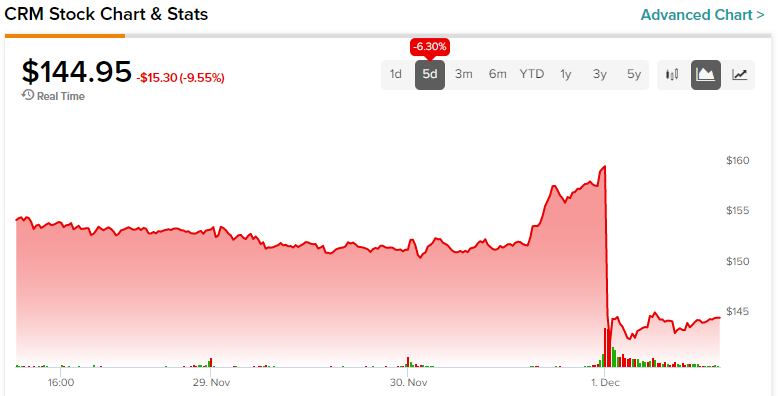

Salesforce (NYSE:CRM) stock has been part of the overall sell-off tech stocks have been experiencing over the past year, now trading close to 54% off its past highs. While bulls were hoping that Salesforce’s Q3 results would reignite investors’ interest, the market was apparently disappointed, with shares about 10% lower today. Are fears of a slowdown in revenue growth to blame? Are the high levels of stock-based compensation (paying employees with shares, diluting shareholders) irritating investors? I support that it’s the latter, which could, in turn, repress Salesforce’s valuation. Accordingly, I am neutral on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Was Salesforce’s Q3 Actually Bad?

The market may have reacted negatively to Salesforce’s Q3 results, but were numbers actually that bad? For starters, total revenues were $7.84 billion, up 14% year-over-year, driven by the company’s Customer 360 Advantage, continuously innovating industry solutions, and geographical expansion. The fact that Salesforce’s solutions continue to show high traction during such a harsh market environment is a testament to the quality and relevancy of its product line.

Also, it’s not just about the new customers that Salesforce is onboarding, but its existing customers are upsold over time, further aiding Salesforce’s top-line expansion. In fact, customers with five or more clouds rose ARR in excess of 20%, while seven of the company’s 13 industry clouds lifted ARR above 50% this quarter.

That said, revenue growth of 14% certainly implies a steep slowdown from Q2’s 21.8% growth and Q3-2021’s 26.7% growth. Still, we need to take into account that revenue growth was offset greatly by foreign exchange headwinds (strong dollar) due to the company’s heavy international exposure. For the quarter, the total unfavorable foreign exchange impact was $300 million, meaning that in constant currency, Salesforce would have reported revenue growth of around 19%. That doesn’t sound like a poor result.

Given the ongoing macroeconomic turmoil which has resulted in corporate spending getting squeezed, constant-currency revenue growth of 19% barely reflects any slowdown, which is quite impressive. I believe it showcases the critical nature of Salesforce’s solutions to enterprise customers, as they actually help with achieving savings, which is the most needed “solution” these days.

Stock-Based Compensation is Killing Salesforce’s Real Profitability

In terms of Salesforce’s profitability, its Q3 non-GAAP operating margin came in at an industry-leading 22.7%, powered by management’s ongoing focus on disciplined execution, a slowdown in hiring, and resource prioritization. Consequently, the company expects to end the year with an adjusted operating margin of 20.7%, which is certainly enticing. Here’s the caveat, though. By non-GAAP or “adjusted,” it means that the company is also adding back its stock-based compensation (SBC) expenses.

In fact, of the 20.7% adjusted operating margin, around 10.6% is attributed to SBC. This inherently reveals that SBC is a major chunk of Salesforce’s “adjusted” figures, which is certainly disappointing. For context, year-to-date, the company has reported nearly $23 billion in revenues and recorded $2.47 billion in SBC. Not only is Salesforce’s SBC rather scary against its revenues/overall size, but SBC actually grew 16.3% during the first three-quarters of 2022, year-over-year.

So, if SBC is growing almost as fast as revenues, what’s in it for shareholders? Investors are getting diluted at an almost equal rate as the company is growing. No wonder investors don’t like this setup, as it appears that the company is creating more value for its employees rather than its shareholders.

So, is Salesforce Overvalued?

For Fiscal 2023, management expects the company to deliver adjusted earnings per share between $4.92 and $4.94. At the midpoint, it would imply that the stock is trading at a forward P/E ratio of 30.4x. I would say that this is a hefty multiple, given that interest rates are rising, even if revenue growth were to remain in the double digits, moving forward.

However, once again, Salesforce’s “adjusted” numbers exclude SBC. In fact, out of the $4.93 (midpoint) in adjusted earnings-per-share, $3.26 is attributed to SBC, which just shows how much Salesforce’s profitability is artificially boosted this way. If we apply management’s GAAP earnings-per-share estimate of $0.55 to $0.57, then Salesforce’s real forward P/E ratio ends up at an elevated 267x.

In fact, this figure is much lower than last year’s GAAP earnings per share of $1.48, which further illustrates just how much SBC can negatively affect actual per-share metrics and the overall shareholder value creation prospects of the company.

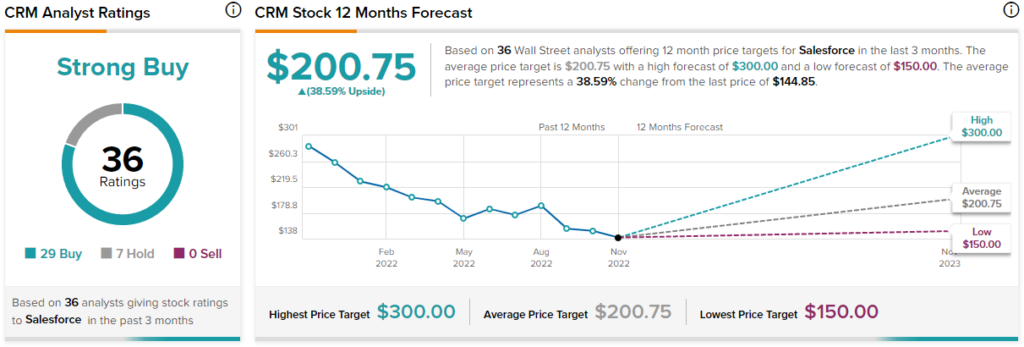

Is CRM Stock a Buy, According to Analysts?

Turning to Wall Street, Salesforce has a Strong Buy consensus rating based on 29 Buys and seven Holds assigned in the past three months. At $200.75, the average Salesforce price target implies 38.6% upside potential.

Takeaway: Growth Remains Compelling, but Beware of SBC

Salesforce’s growth story remains compelling, with its revenues advancing substantially on a constant-currency basis, despite the ongoing headwinds. That said, the company’s SBC expenses appear excessive, as shown by the major gap between its GAAP and non-GAAP (adjusted) figures. This point is especially important when valuing the company, as high levels of SBC can end up misleading investors about Salesforce’s real earnings-per-share growth prospects.