Salesforce (NASDAQ:CRM) will report its second-quarter Fiscal 2024 results on August 30 after the market closes. Ahead of the earnings release, CRM stock received mixed views from analysts, with two of them giving it a Buy rating and the other two maintaining a Hold.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Before taking a closer look at analysts’ views, it’s worth mentioning that CRM has an exceptional track record of beating earnings expectations. The company surpassed estimates in each of the last 15 quarters.

This time, Wall Street expects Salesforce to post adjusted earnings of $1.90 per share, which is on the higher end of the company’s guidance and nearly 60% higher than the year-ago figure of $1.19 per share.

Meanwhile, revenue estimates are pegged at $8.53 billion, which is also on the higher end of the company’s outlook and represents 10.5% year-over-year growth.

Here’s What Analysts Expect from CRM’s Q2 Results

One of the bullish analysts is Brent Thill from the research firm Jefferies. The analyst maintained his price target at $250, which reflects 18.1% upside potential. Regarding fiscal second-quarter results, the analyst noted that performance might be influenced by “mixed demand checks and relatively tough comparisons.”

However, Thill believes that the stock offers an attractive risk-reward profile. Furthermore, he’s optimistic about Salesforce’s long-term value and its ability to achieve long-term goals, thanks to its attractive business model and growth potential in the market.

Among the analysts with a neutral stance is Brian White from Monness, Crespi, Hardt & Co. In a research note to investors on August 21, the analyst said he expects the company to meet the Q2 revenue forecast of $8.65 billion and EPS estimate of $2.02. Going forward, White believes Salesforce is well-poised to “capitalize on digital transformation with a strong cloud portfolio and leverage a leaner cost structure.”

Is CRM a Good Stock to Buy, According to Analysts?

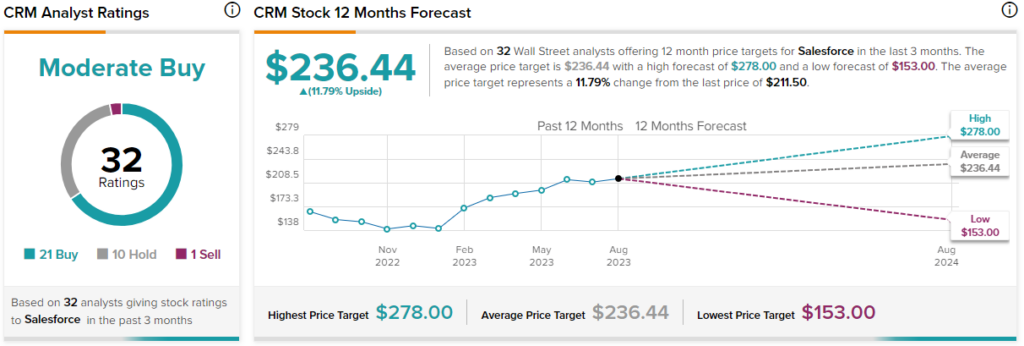

Wall Street is currently cautiously optimistic about CRM stock. On TipRanks, Salesforce has a Moderate Buy consensus rating based on 21 Buys, 10 Holds, and one Sell rating. The average Snowflake stock price target of $236.44 implies 11.8% upside potential from current levels. Meanwhile, the stock has gained 57% so far this year.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in CRM stock to move by +/-6.7% after reporting earnings. Last quarter, the stock fell by 4.69% after the company recorded the smallest increase in quarterly revenues since 2010.

The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Ending Thoughts

Salesforce’s impressive earnings history points to its potential to outperform market expectations. However, softening demand trends in its Financial Services, Technology, and Marketing Cloud segments might impact the company’s performance to some extent. While analysts have mixed opinions about CRM’s near-term performance, they are optimistic about its long-term trajectory.