For the most part, analysts are optimistic about Salesforce’s (NYSE:CRM) growth prospects in 2024. However, analysts don’t all agree, and some of them are actually bearish on Salesforce. I am neutral on CRM stock because, when all is said and done, I like the company but am concerned about the elevated share price.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Salesforce specializes in customer relations management (CRM) software for businesses. The company, like practically every other large-cap software company in America, is now emphasizing its use of artificial intelligence (AI).

Consequently, while CRM stock isn’t a “Magnificent Seven” stock, it still rallied sharply last year. It’s always possible for the momentum to continue, but prospective investors should take note of both the bullish and the bearish arguments. Then, they need to think about Salesforce’s valuation, as it could be a major issue this year.

The Bullish Argument for Salesforce Stock

It’s not difficult to see why some folks are enthused about Salesforce right now. For instance, momentum-focused traders will undoubtedly like Salesforce stock’s performance in 2023. Amazingly, the stock zoomed from $140 to $250 in just 12 months.

When a stock rallies sharply like this, analysts typically raise their price targets because they practically have no choice. In the case of CRM stock, maintaining a $140 or $150 price target wouldn’t make sense anymore.

So, it makes sense that Baird analyst Robert Oliver would hike his Salesforce stock price target from $240 to $300. The Baird analyst also upgraded Salesforce from a Neutral rating to an Outperform rating, citing Salesforce’s price increases and the company’s push to deliver on margins.

$300 isn’t an extremely high price target for Salesforce stock, so I won’t disagree with it. In contrast, Morgan Stanley (NYSE:MS) analyst Keith Weiss upgraded Salesforce shares from Equal Weight (Hold-rating equivalent) to Overweight (Buy-rating equivalent) and raised his price target on the stock from $290 to a highly ambitious $350.

Like the Baird analysts, Weiss cited product price hikes. Specifically, Weiss stated, “Low investor expectations vs potential top-line upside drivers in price increases, product bundling and Data Cloud adoption frame an attractive risk/reward for CRM.”

Whether the risk/reward is “attractive” for Salesforce stock is debatable, but I’ll get to that in a moment. Before I veer away from the bull case, I should also mention that Salesforce has an arrangement with the almighty Amazon (NASDAQ:AMZN), known as the Buy with Prime for Salesforce Commerce Cloud integration.

As TheFly summed up, this collaboration enables Salesforce’s merchants to integrate Amazon’s “Buy with Prime into their existing shopping experience.” It’s certainly worth considering as part of the bullish argument for CRM stock.

Salesforce’s Valuation Problem

In opposition to momentum-focused traders, value investors might take issue with last year’s supersized rally in Salesforce stock. After all, a company’s price-to-earnings (P/E) ratio can become alarmingly high when a stock goes from $140 to $250.

When it comes to Salesforce, the Baird analyst referred to the company’s margins, but Wells Fargo (NYSE:WFC) analyst Michael Turrin feels that Salesforce has already “captured much of the value from its margin expansion story.” Hence, Turrin lowered his rating on CRM stock from Overweight to Equal Weight and chose not to raise his $280 price target on the shares.

In addition, I should mention that investment research firm Bernstein raised its price target on Salesforce stock from $159 to $212, which is still quite bearish, and reiterated its Underperform rating on Salesforce shares. Bernstein, according to TheFly, sees “only modest acceleration in IT spend growth and possibly softer growth in software segment growth” for Salesforce.

Finally, I must address the elephant in the room — Salesforce’s valuation, as measured by the company’s GAAP-measured trailing 12-month P/E ratio of 100.5x. For comparison, the sector median P/E ratio is 27.5x.

Is Salesforce Stock a Buy, According to Analysts?

On TipRanks, CRM comes in as a Moderate Buy based on 26 Buys, 11 Holds, and one Sell rating assigned by analysts in the past three months. The average Salesforce stock price target is $281.57, implying 4.8% upside potential.

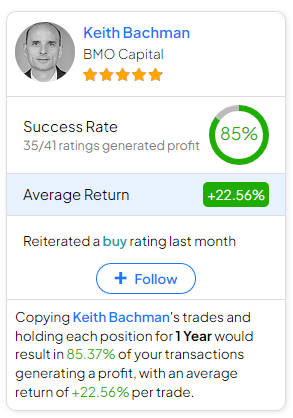

If you’re wondering which analyst you should follow if you want to buy and sell CRM stock, the most profitable analyst covering the stock (on a one-year timeframe) is Keith Bachman of BMO Capital, with an average return of 22.56% per rating and an 85% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Salesforce Stock?

Salesforce’s margin expansion is worth monitoring, but it’s definitely possible that the market already priced in Salesforce’s margin growth for 2023 and even for 2024. Also, while Weiss might see “low investor expectations” for Salesforce, I’m seeing overstated investor expectations as expressed in the company’s P/E ratio.

Don’t get the wrong idea. Salesforce is a good company with an AI connection, and there’s no denying that Salesforce has had a great earnings track record. All in all, I just want to see CRM stock pull back 10% or even 20% before I can feel comfortable with Salesforce’s valuation, so I am not considering the stock at its current price.