In this piece, I evaluated two biotech stocks, Prometheus Biosciences (NASDAQ:RXDX) and Ionis Pharmaceuticals (NASDAQ:IONS), to determine which is better. This comparison is a tale of two biotechs, one that has more than doubled in value over the last six months versus the other that has gained only 15%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A closer look reveals the reasons for the differences and that IONS may be a better pick, and it also answers one of the most critical questions right now: is there any upside left?

Prometheus Biosciences (NASDAQ:RXDX)

Shares of Prometheus Biosciences are up 129% for the last six months, driving the stock’s price-to-sales (P/S) ratio to 855 times. While the momentum for this stock is robust, the market seems euphoric over it, so the high degree of speculation makes it impossible to know how much more upside is left. Thus, a bearish view appears appropriate for Prometheus Biosciences, at least for now.

The three-year average P/S of the biotech industry is 6.9 times, slightly higher than the current P/S of 5.7 times but far below that of Prometheus Biosciences. The company raised $500 million in December via a stock offering, so it clearly has the support of Wall Street.

Prometheus evidently needed the cash because it only had $260.2 million in cash at the end of September. However, the December capital raise came only a month after management said in their November earnings report that they had enough to fund operating and capital expenditure requirements into mid-2024. They included the $260 million in cash and the company’s short-term investments, including the additional $1.1 million they raised under its at-the-market (ATM) facility.

Of course, Prometheus is a clinical-stage biotech firm, so it’s making very little revenue — $7.2 million for the last 12 months and $3.1 million for 2021. On the one hand, the latest batch of 13F filings suggests Wall Street is rotating from value back to growth stocks right now, which has been good for Prometheus.

However, its exorbitant valuation and lack of profitability suggest extreme volatility could be in order. All it would take is a negative set of results from a clinical trial to send Prometheus into a tailspin.

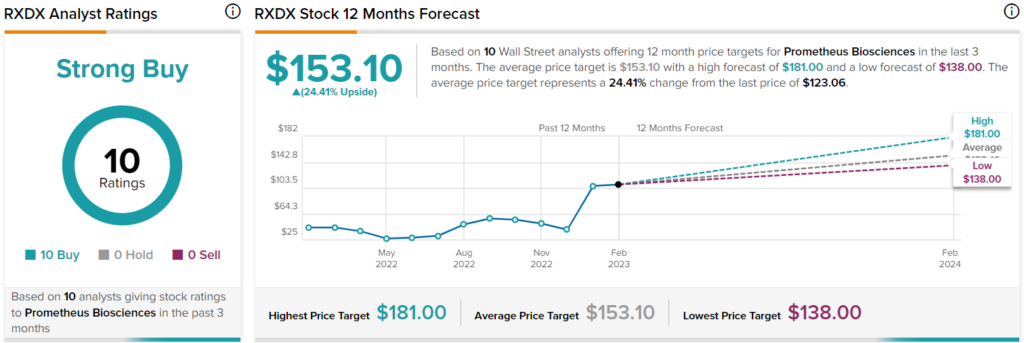

What is the Price Target for RXDX Stock?

Prometheus Biosciences has a Strong Buy consensus rating based on 10 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $145.60, the average Prometheus Biosciences stock price target implies upside potential of 24.4%.

Ionis Pharmaceuticals (NASDAQ:IONS)

Ionis is far more stable than Prometheus, generating $587.4 million in revenue for 2022. However, that’s a significant decline from 2021, when it reported $810.5 million in sales. Thus, the rotation back to growth stocks does not favor Ionis Pharmaceuticals, although clinical-trial results could trigger a sharp rally. The significant uncertainty suggests a neutral view may be appropriate for now.

The company is trading at a P/S of 8.8 times, which is far more reasonable than Prometheus’ ratio. Additionally, Ionis had about $2 billion in cash, equivalents and short-term investments at the end of December, compared to $2.1 billion at the end of December 2021. Given that Ionis repaid $50.7 million in debt in 2022, didn’t issue any new debt, and has roughly the same amount of cash on its balance sheet 12 months later, it is clearly stable, a fact the Street is not giving it credit for.

However, the Street just isn’t euphoric about Ionis like it is Prometheus, and Ionis insiders have sold $1.5 million worth of shares over the last three months. Ionis shares are up 8% for the last 12 months but remain in the red year-to-date, off 4% since January.

The company’s lack of momentum at a time with the tech-heavy Nasdaq Composite is up 11% year-to-date is a concern. However, like Prometheus, Ionis shares could rally or plunge sharply after significant clinical-trial results are announced.

What is the Price Target for IONS Stock?

Ionis Pharmaceuticals has a Moderate Buy consensus rating based on five Buys, four Holds, and two Sell ratings assigned over the last three months. At $47.64, the average Ionis Pharmaceuticals stock price target implies upside potential of 33.15%.

Conclusion: Bearish on RXDX, Neutral on IONS

The biotech sector is highly speculative right now, making this a challenging time to invest. Ionis Pharmaceuticals is much more stable than Prometheus Biosciences, but Wall Street remains unimpressed, even after the FDA granted fast-track approval for one of the company’s drugs in February.

A key factor could be the types of conditions these companies treat. With Prometheus targeting inflammatory and autoimmune conditions like Crohn’s, it could have a larger total addressable market than Ionis, which focuses on rare diseases. However, its exorbitant valuation seems excessive, and Ionis’s stability is attractive, suggesting a solid future.