Mutual funds offer investors a diversified portfolio of securities, reducing risk compared to individual stock investments. They also provide higher liquidity through easy buying and selling, coupled with low minimum investment requirements, making them accessible to a broader range of investors. Today, we have focused on two mid-cap-focused mutual funds – RPMGX and PESPX – with the potential to earn over 10% appreciation in the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a closer look at the two mid-cap index mutual funds.

T. Rowe Price Mid-Cap Growth Fund, Inc.

The T. Rowe Price Mid-Cap Growth Fund seeks long-term capital appreciation by investing primarily in mid-cap stocks with above-average expected earnings growth. As of today’s date, RPMGX has 122 holdings with total assets of $28.2 billion.

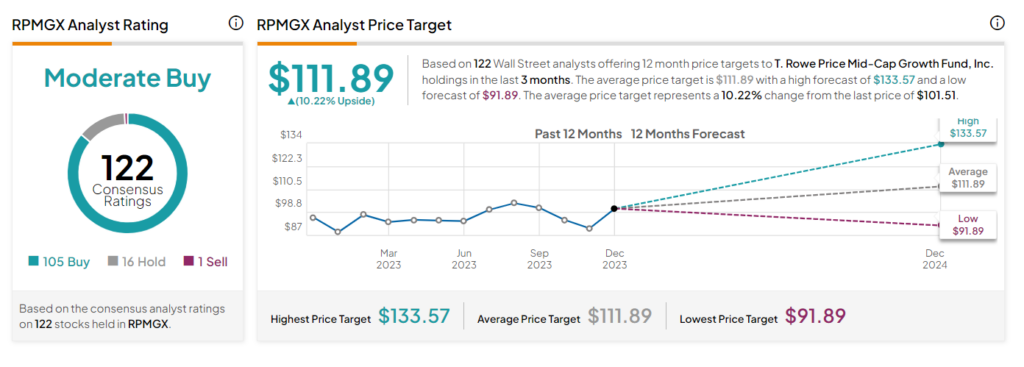

On TipRanks, RPMGX has a Moderate Buy consensus rating. This is based on 105 stocks with a Buy rating, 16 stocks with a Hold rating, and one stock will a Sell rating. The average RPMGX mutual fund price target of $111.89 implies a 10.2% upside potential from the current levels.

RPMGX has gained 14.6% so far this year. Its top five holdings are Microchip Technology (MCHP), Hologic (HOLX), Marvell Technology (MRVL), Textron (TXT), and Trade Desk (TTD).

BNY Mellon Midcap Index Fund, Inc.

The BNY Mellon Midcap Index Fund targets long-term capital gains through a diversified mid-cap portfolio. The index fund employs a passive strategy and boasts a low expense ratio, making it a cost-effective choice for investors seeking mid-cap exposure. As of today’s date, PESPX has 405 holdings with total assets of $1.68 billion.

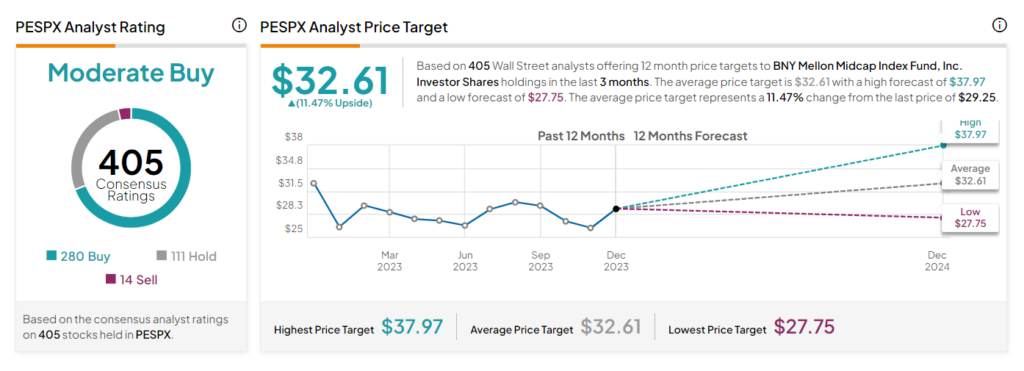

On TipRanks, PESPX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 405 stocks held, 280 have Buys, 111 stocks have a Hold rating, and 14 stocks have a Sell rating. The average BNY Mellon Midcap Index Fund price target of $32.61 implies 11.5% upside potential from the current levels.

Year-to-date, FNARX has gained 10.6%. Its top five major holdings include Builders Firstsource (BLDR), Reliance Steel & Aluminum (RS), Hubbell (HUBB), Super Micro Computer (SMCI), and Jabil (JBL).

Ending Thoughts

Investors seeking diversification within the mid-cap market should consider these passively managed index funds, which offer exposure to companies with competitive advantages and stronger financials than their small-cap peers. Investors can consider both PESPX and RPMGX, which offer further upside potential.