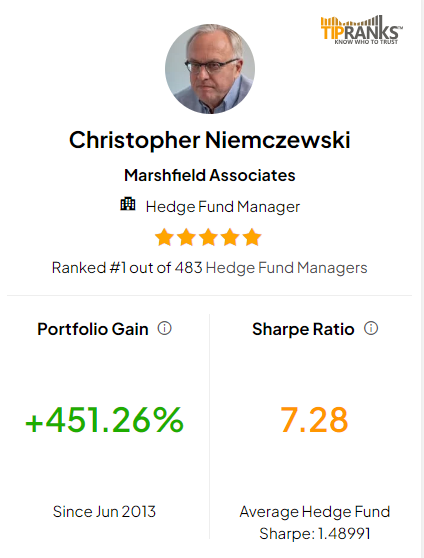

Investors looking to invest in retail stocks may rely on expert guidance for informed decisions. TipRanks provides a range of tools, including Top Hedge Fund Managers, which ranks these professionals based on success rates, average returns, and the significance of their trades. As per the ranking, Christopher Niemczewski of Marshfield Associates bags the first spot among 483 hedge fund managers covered by TipRanks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Remarkably, since June 2013, Niemczewski’s portfolio has gained 451.26% and witnessed an average return of 13.79% in the last 12 months. A majority of the hedge fund manager’s investments are focused on the Consumer Cyclical sector (42.5%), followed by the Financial sector (38.67%).

Let’s explore Niemczewski’s top three retail picks and the recommendations from Wall Street analysts regarding these choices.

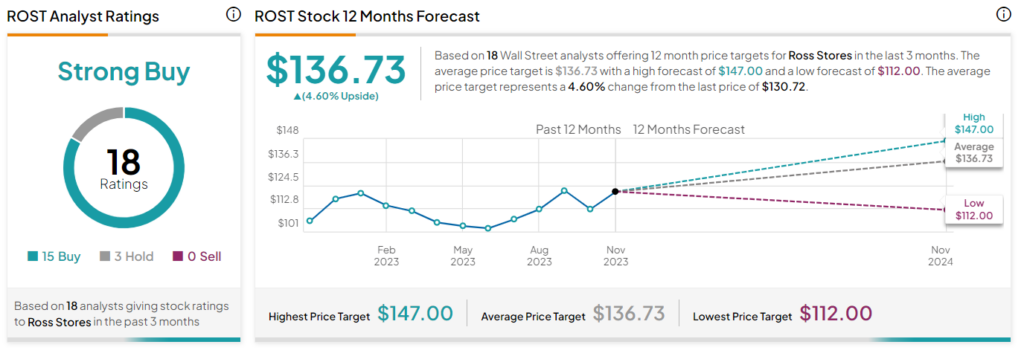

Ross Stores (NASDAQ:ROST)

Ross Stores is a discount retailer offering off-price clothing, footwear, and home accessories in the United States. ROST is the second-largest holding in Niemczewski’s portfolio, with an exposure of about 9.83%.

Wall Street is highly optimistic about Ross Stores stock. It has a Strong Buy consensus rating based on 15 Buys and three Holds. Further, the average price target of $136.73 implies a 4.6% upside potential to current levels. So far in 2023, ROST shares have gained 13.9%.

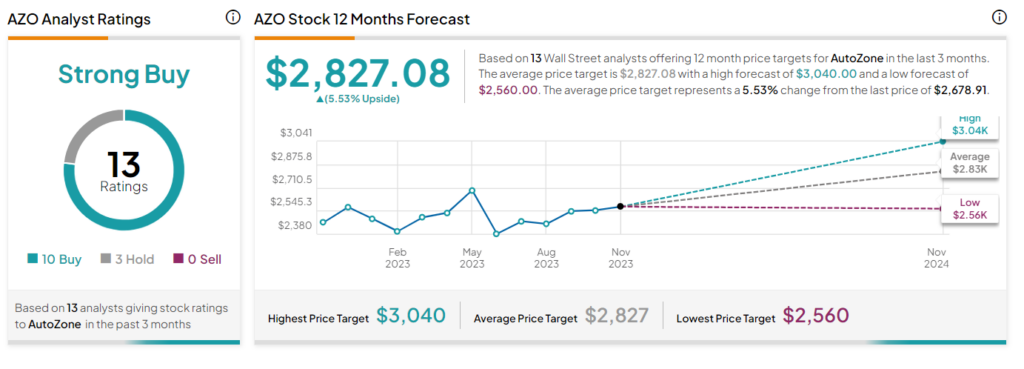

AutoZone (NYSE:AZO)

The company is a retailer and distributor of automotive replacement parts and accessories. The stock constitutes 9.38% of Niemczewski’s portfolio.

With 10 Buy and three Hold ratings, the stock commands a Strong Buy consensus rating. On TipRanks, the average AutoZone stock price target of $2,827.08 implies 5.6% upside potential from current levels. Year-to-date, AZO stock has gained 10.1%.

TJX Companies (NYSE:TJX)

TJX Companies is a multinational retail corporation, operating off-price department stores including T.J. Maxx, Marshalls, HomeGoods, and more. With an exposure of 6.76%, TJX occupies the fourth position in Niemczewski’s portfolio.

On TipRanks, TJX stock also has a Strong Buy consensus rating. This is based on 15 Buy and two Hold recommendations. The average price target of $102.26 implies 14.8% upside potential. Shares of the company have gained 14.5% year-to-date.

Concluding Thoughts

Niemczewski’s consistent record of generating high returns could encourage investors to adopt his portfolio allocation strategy. By following the guidance of experts, investors can leverage their knowledge and make well-informed decisions.