It’s all falling into place for Roku (NASDAQ:ROKU). Shares were surging in Thursday’s trading after the streaming ace hit plenty of the right notes in its Q3 report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While it wasn’t a perfect display, investors seemed happy enough to overlook the negative part and focus on the many positives of the print.

On the disappointing side, the Q3 net loss stood at $330.1 million, translating to EPS of -$2.33, almost triple the loss of $122.2 million, or EPS of -$0.88, delivered in the same period last year.

That figure was countered, however, by solid revenue growth of almost 20% on a year-over-year basis as the top-line figure reached $912 million, in turn beating Wall Street’s forecast by $56.34 million. The company attributed the strong showing to robust results in content distribution and video advertising, as well as the successful sales of Roku-branded TVs introduced earlier this year.

Active accounts also outperformed, reaching 75.8 million vs. the Street’s expectation for 75.33 million, as the company saw a net increase of 2.3 million active accounts compared to the prior quarter.

And where many stumble, Roku delivered a strong guide too, forecasting Q4 revenue of $955 million, above consensus at $951.26 million.

The results are enough for Pivotal analyst Jeffrey Wlodarczak to have a change of heart. While not quite ready to get the bull hat on, Wlodarczak upgraded his rating from the prior Sell to a Hold (i.e., Neutral). The price target also got a makeover, rising from $58 to $75, suggesting the shares are now going for just about the right price. (To watch Wlodarczak’s track record, click here)

Backing up his new stance, the analyst wrote, “we view the results set-up for 4Q and 1Q as favorable driven by: 1) nearly across the board price hikes from streaming players in early October (boosts revenue from ROKU’s revenue share agreements), 2) enhanced by what appears to be more aggressive promotional activity by most streamers taking price (higher potential marketing spiffs) which could extend into 1Q depending on the depth of subscriber churn, 3) while more of a medium term benefit it also appears the actor’s strike will be over soon and 4) management appears to be genuinely focused on operating far more efficiently which we view positively.”

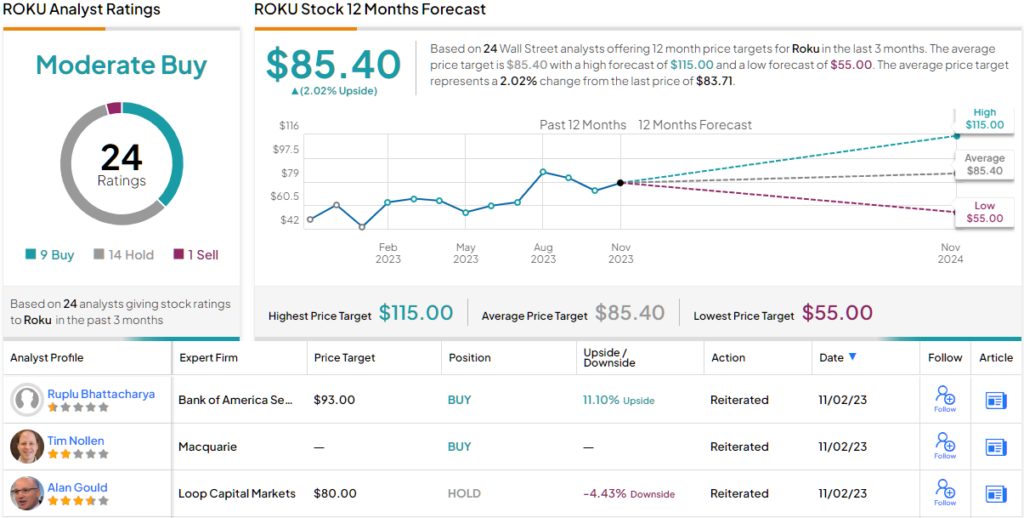

Most on the Street are thinking along the same lines. 13 other analysts are staying on the sidelines for now, yet with the addition of 9 Buys, the stock boasts a Moderate Buy consensus rating. Going by the $85.22 average target, ROKU shares are expected to remain range-bound for the foreseeable future. (See Roku stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.