Commercial launch services provider Rocket Lab USA (NASDAQ:RKLB) seems like a risky venture. While the company represents one of the more credible entities within the space economy — launching its first mission for the new year recently — investors are also looking for a more credible path to profitability. That doesn’t seem to be coming anytime soon, leading to hefty bearishness. However, that could position Rocket Lab for a rebound. Nonetheless, I’m neutral on RKLB stock because of its high risk.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

RKLB Stock Attracts the Bears

Last week, Rocket Lab rapidly transitioned from a promising space economy outfit to one burdened with heavy question marks. As a result, RKLB stock dropped by 19% for the week. On a year-to-date basis, it’s now down 24%. Naturally, the bears put the satellite launching service in their crosshairs, and for good reason.

Primarily, management disclosed that preliminary fourth-quarter revenue should land between $59 million and $61 million. Unfortunately, this latest tally represents a conspicuous miss from its prior guidance of $65 million to $69 million. Specifically, Rocket Lab stated that one of its rocket launches was postponed, leading to a negative revenue impact. Subsequently, this hit on the top line aggravated concerns about viability in the bottom line.

Later, the company announced that it would commence a private offering of $275 million in convertible senior notes due 2029 to qualified institutional buyers. This news was “followed by a press release regarding the pricing of an upsized offering amounting to $300 million at 4.250%, with an option for initial purchasers to buy an additional $55 million,” according to TipRanks Newsdesk.

However, the market did not respond well to the private offering, yielding a 14% drop for RKLB stock. With so much negative attention on Rocket Lab, it was perhaps inevitable that the bears would chomp down on the security. On February 1, options flow data – which exclusively focuses on big block trades likely made by institutions – revealed a heavy concentration of bought puts across various strike prices and expiration dates.

In terms of the biggest trade based on premium paid for the puts, the 2,054 contracts bought of the Jan 16 ’26 3.00 Put rang up a premium of $166,000. Further, another “hot” put option was the 5,938 contracts bought of the Jan 17 ’25 3.00 Put, purchased for a premium of $90,000.

Rocket Lab’s Sold Calls Raise Even More Eyebrows

Frankly, the massive volume of bought puts is enough to make investors question RKLB stock. After all, traders are paying money for the privilege of the right to sell shares at a higher price. Obviously, in order for the transaction to make sense, RKLB must fall below the target strike prices – preferably well below.

However, major traders took an even bolder pessimistic approach to RKLB stock by selling (or writing) call options against it. Usually, call options tend to have a “positive” image because the holder has the right (but not the obligation) to buy the underlying security. However, when selling these calls, the call seller is effectively underwriting the risk that the security will not rise above the listed strike price.

Think of it like an insurance provider underwriting a driver’s insurance contract. The gamble is that the driver is going to keep his or her nose clean, and that allows the insurance provider to keep the premium paid free and clear. However, if the driver wrecks an expensive vehicle, then the insurance company ends up the loser in this arrangement.

Notably, options flow data recorded a massive volume of sold calls. Specifically, 6,006 contracts of the Jan 17 ’25 3.00 Call exchanged hands, resulting in a premium received of $600,854. Basically, the wager is that RKLB stock won’t stay above the $3 strike prior to January 17, 2025.

I’m not sure that’s a smart bet considering that RKLB stock trades at nearly $4. For one thing, analysts estimate that the small satellite launch market could exceed revenues of $69 billion by 2030. That’s a huge total addressable market for Rocket Lab.

Second, short interest in RKLB stock has been creeping up (8% short interest of float) since the end of November last year. The more it rises, the prospect of a short squeeze also increases. And if that happens, those aforementioned short calls could get blown up in a hurry.

Risk Factors to Consider

Having mentioned the upside possibility of RKLB stock, it’s also difficult to say that it’s a confidence-inspiring opportunity. It’s not. For instance, while Rocket Lab has been expanding its top line, the growth trajectory has definitely slowed down on a trailing-12-month (TTM) basis.

As well, RKLB’s technical sentiment doesn’t provide much confidence. Usually, when a security tumbles so sharply over a short period, it’s alarming. Consequently, TipRanks’ Technical Sentiment for RKLB stock shows an overall Sell consensus on the one-day time frame.

Is Rocket Lab USA Stock a Buy, According to Analysts?

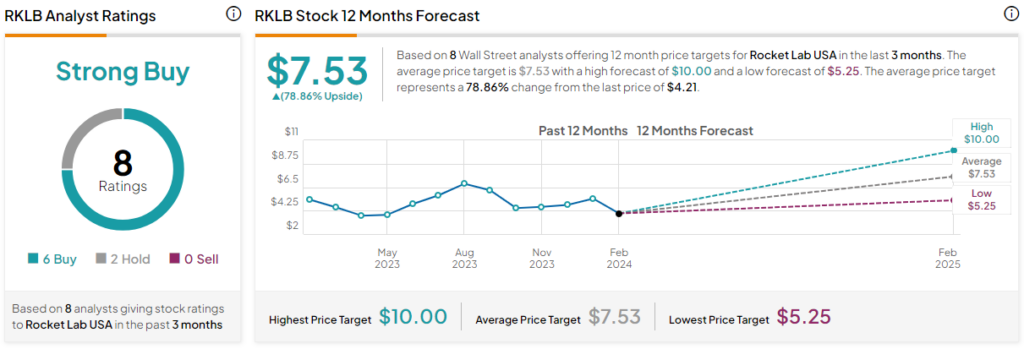

Turning to Wall Street, RKLB stock has a Strong Buy consensus rating based on six Buys, two Holds, and zero Sell ratings. The average RKLB stock price target is $7.53, implying 78.9% upside potential.

The Takeaway: For Hardened Gamblers, an Opportunity Exists in RKLB Stock

For those who live life on the edge, a contrarian market opportunity exists in RKLB stock. Yes, the poor preliminary Q4 earnings print didn’t help matters, attracting swarms of bears. However, with so many trades stacked on one side of the table, a little push to the positive could yield massive gains. Nevertheless, it’s a super-risky proposition because of slowing growth projections and a discouraging technical profile.