Companies like Amazon (NASDAQ:AMZN) and Starbucks (NASDAQ:SBUX) have teamed up to take on the labor shortage, with intriguing AI advancements. With two Amazon-Starbucks cashier-less locations in New York, both firms are experimenting with a concept that may change how we think about AI and its impact on the labor force.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As AI-equipped stores show success and work their way into the fundamentals in the form of juicier operating margins, I would not be surprised if AI efforts persist well after the labor shortage ends.

Recent labor shortages have been widely felt across numerous industries. While there’s a recession on the way, many firms have continued to find it incredibly difficult to fill certain spots. Even as the pandemic goes endemic, the labor shortage has made it tough on many firms. Indeed, upward pressure on wages, advertising campaigns to attract talent, and perks for just showing up to an interview have been a few attempts at solving ongoing labor woes.

With the coronavirus and surging inflation, many blue-collar workers are in no hurry to return to the labor force. Eventually, the labor shortage will resolve itself, likely through higher wages. However, many firms, especially those in the tech sector, seem unwilling to wait for the labor market to normalize. Indeed, it could take years before 2019 conditions return.

Undoubtedly, AI replacing human workers can be a jarring concept. It sounds sci-fi, even far-fetched. However, as AI in the workplace continues to take off, new regulations may need to be implemented.

AI’s move into work has been ongoing for many years, if not decades. However, the inflation-driven labor shortage, I believe, has only given the trend a significant shot in the arm.

Amazon: Leading the “AI for the Workplace” Trend

These days, Amazon is the disruptive company leading the charge in robotics. It’s the e-commerce and public cloud king, but it’s also been placing big bets on the future of AI technologies aimed at reducing the workload of employees. Now, human workers at Amazon warehouses aren’t going anywhere. There’s still a strong need for more workers amid ongoing labor shortages and unionization efforts.

One has to wonder, though, when a firm can leverage AI and robotics in such a way that unionization and labor shortages become a thing of the past. First, warehouses may operate alongside their human counterparts. Eventually, they may begin to replace them.

There are a lot of very smart machines working hard at Amazon’s numerous warehouses. Latest AI innovations promise to make warehouse jobs “safer, easier, and better” for workers. Though Amazon is committed to improving its safety track record, it’s hard to ignore the margin-driving benefits that its shareholders are sure to appreciate.

Eventually, continued robotics and AI innovations may bring forth the holy grail of a fully-autonomous warehouse. Over the medium term, though, Amazon needs as much help as it can get. Its workers aren’t going anywhere. The company is investing heavily in warehousing. Many critics slammed Amazon for overinvestment in prior quarters.

Regardless, Amazon seems to have its foot on the gas, even as other firms pull the brakes a bit heading into a higher-rate, recessionary environment. Indeed, Amazon’s “Buy with Prime” service brings forth the need for greater fulfillment capacity.

Over the next 10 years and beyond, expect Amazon to continue innovating to increase the presence of AI in its workplaces. Whether Amazon pursues acquisitions (think iRobot) or opts to build its own innovations, expect Amazon to be a top dog in the “AI for the workplace” trend. Further, many big-league firms may team up with Amazon to help introduce AI at their own workplaces.

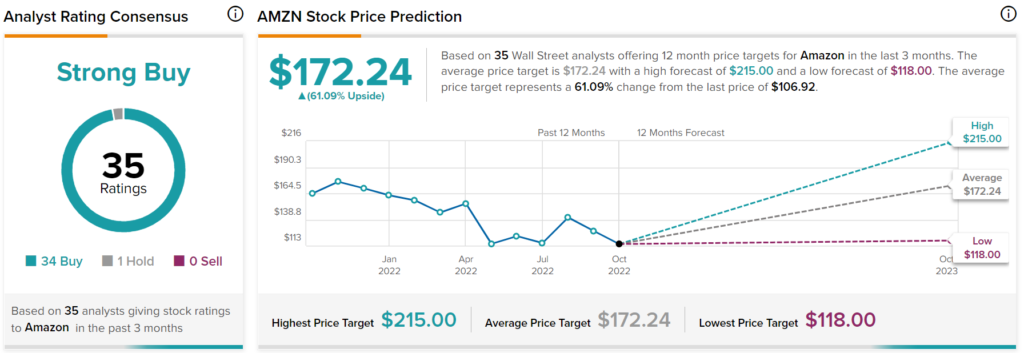

Is Amazon Stock a Buy, Sell, or Hold?

Amazon has a Strong Buy consensus rating based on 34 Buys, one Hold, and zero Sells assigned in the past three months. The average AMZN stock price target of $172.24 implies 61.1% upside potential.

Starbucks: Teaming Up to Enhance Workplace AI Capabilities

Like Amazon, Starbucks has been introducing cutting-edge tech (think DeepBrew AI) across locations to get more coffee into customers’ hands. A busy Starbucks location can be quite hectic and stressful for baristas. Though Starbucks is nowhere close to replacing its human workforce with the likes of AI innovations, I do think its partnership with Amazon on its cashier-less store model could be a glimpse of what to expect in the distant future.

As more quick-serve restaurant (QSR) firms look to replicate such a futuristic employee-light concept, I don’t think it’s far-fetched to expect Starbucks’ rivals to come knocking on Amazon’s door.

The cashier-less store model is still in the experimental phase. However, I think it’s safe to say that labor shortages have accelerated progress. Perhaps a cashier-less restaurant may be the technological trend that will define the next decade.

In any case, Starbucks and Amazon are pioneers in the “AI for the workplace” or “AI for humanity” trends.

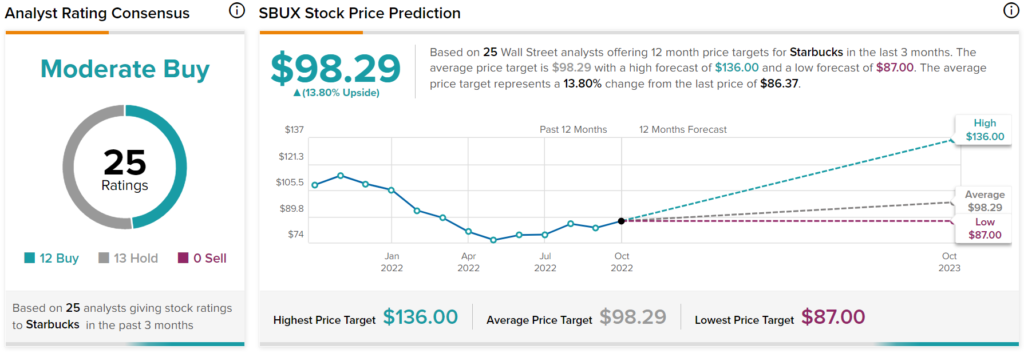

What is the Target Price for SBUX Stock?

Starbucks has a Moderate Buy consensus rating based on 12 Buys, 13 Holds, and zero Sells assigned in the past three months. The average SBUX stock price target of $98.29 implies 13.8% upside potential.

Takeaway: AI is Going to Become More Prevalent

Like it or not, AI is coming to a workplace near you. Amazon and Starbucks seem to be today’s pioneers. In the future, firms across a broad range of industries may wonder how they managed without at least some help from AI technologies.