Since the initial Industrial Revolution of the 18th century, and through several technological revolutions that followed, the means of production have been becoming increasingly automated. Thus, automation isn’t only a secular megatrend – it has become an integral part of the very fabric of our increasingly technological civilization. From the first weaving loom to today’s AI-powered surgical robots, modern human history evolves around automating tasks to increase productivity, decrease costs, and improve performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Robot Revolution

The 1st Industrial Revolution brought us mechanization, powered by steam; the 2nd one delivered mass production, enabled by electricity. The 3rd Industrial Revolution, centered around electronics, brought us computers which, besides all else, permitted automation (not to be confused with mere automatization), i.e., computerized control of previously human-led tasks. Today, we are living through the 4th Industrial Revolution, which is primarily characterized by Big Data, Machine Learning (ML), total interconnectedness, which allows the Internet of Things (IoT), and, of course, Artificial Intelligence (AI).

While computers have been in use for more than half a century, it’s only in recent years that technological advancements have permitted them to actually manage various processes, taking charge of machines and minimizing human intervention. Thus, AI and robotics are increasingly intertwined, with AI technology powering industrial robots and other automation solutions, resulting in a powerful synergy, which, despite its seemingly broad use, is only getting started.

Although sci-fi, human-like, robots are probably still far in the future (with the main problem being ethics, not tech), industrial, medical, transportation, and service robots are increasingly incorporated into various complex tasks and processes in most industries.

Industrious Machines

The broad term “robot” can carry different meanings, from a vacuum-cleaning iRobot to a teleoperated patient care “nurse,” to a rover landing on Mars. However, when we discuss the Robotics industry, we usually mean industrial robots of all sorts, as this segment accounts for over 90% of the industry’s volume (not money value).

The global industrial robotics market size was estimated at around $35 billion at the end of 2022 and is expected to reach $62 to $85 billion by end-2030. Based on the current usage map, the largest market shares in the use of industrial robots are held by the automotive and electrical & electronics industries, each holding ~35% of the market, while metal & machinery and chemistry industries also have a significant presence. The automotive industry is expected to continue leading demand for robots, as they are an integral part of the shift towards electric and autonomous vehicles (EVs and AVs). In general, the fast growth of industrial robot implementation is aided by advances in technology and efficiency, driving down costs and expanding capabilities.

The service robotics market size was evaluated at approximately $20 billion at the end of 2022 and is expected to reach $63 billion by end-2030. This segment consists of machines that help humans in logistics, healthcare, agriculture, aerospace and defense, commerce, and, of course, domestic tasks. The service robotics’ very existence is enabled by information technology’s fast strides, and its growth is spurred by demographic factors, such as population aging and labor shortages, as well as rising labor costs and deglobalization. The commercial service robotics sub-segment is expected to continue driving fast growth and widening penetration of robots, led by growing demand from transportation & logistics, healthcare, retail, and other industries.

Notably, a fast-growing industry like robotics, which is undergoing frequent transformations on the back of meteoric technological advances, is notoriously hard to predict. Thus, some analysts liken the robotics advancements and penetration trends to the parabolic rise of mobile phones in the past and the Generative AI (exemplified by ChatGPT) now. As a result, they expect the whole global robotics industry to be worth trillions of dollars within a decade.

Can Robo-Advisor Help Make a Choice?

Now that we’ve established that we’ll soon ride robo-taxis, have our burgers flipped by bots, consult with robotic investment advisors, and trust robot caretakers to look after our elderly, it is time to try to distinguish which robot-makers present the largest potential for investors.

Robotics is a very capital-intensive industry, which requires extensive (and expensive) research and development processes. Thus, the field is dominated by giant industrial conglomerates and technology behemoths, which are constantly challenged by aspiring startups as well as established corporations, each working in a specific field within the robotics industry.

Thus, in the general service robotics sub-industry, the popular names are Kratos Defense & Security Solutions (KTOS), which supplies defense robotics; iRobot Corporation (IRBT), which provides buzzing cleaning helpers; Manhattan Associates (MANH), which provides automated supply chain solutions; and Symbotic (SYM), a robotics warehouse automation company. The best-known companies in medical-use robotics are Intuitive Surgical (ISRG), Medtronic (MDT), Stryker (SYK), and Thermo Fisher Scientific (TMO).

In the industrial-robotics sphere, the first names that come to mind are Rockwell Automation (ROK), Teradyne (TER), Ametek (AME), the Swiss giant ABB Ltd. (ABBNY), Honeywell International (HON), and the German KUKA Robotics Corporation (KUKAF).

In addition, numerous companies supply autonomy-supporting software, which powers robotic “brains,” permits machine-human or machine-machine communication, and more. Among these enablers, there are several more-or-less established names, such as Zebra Technologies (ZBRA), Trimble (TRMB), PTC Inc. (PTC), UiPath (PATH), and ServiceNow (NOW).

There are a myriad of global companies driving transformative innovations in robotics and automation; however, not all of them will succeed in their highly competitive field. The vast differences in these companies’ financial and business metrics, as well as their prospects, call for a thorough analysis, which requires digging into the data, analyzing companies’ finances, industry competitiveness, growth prospects and risks, and more.

Alternatively, investors can leverage the existing analysis, utilizing research done by Wall Street’s leading analysts. TipRanks has several tools, such as a stock screener, stock comparison tool, technical analysis screener, and others, that can help investors employ the vast amounts of data and research stored in its database, to their benefit.

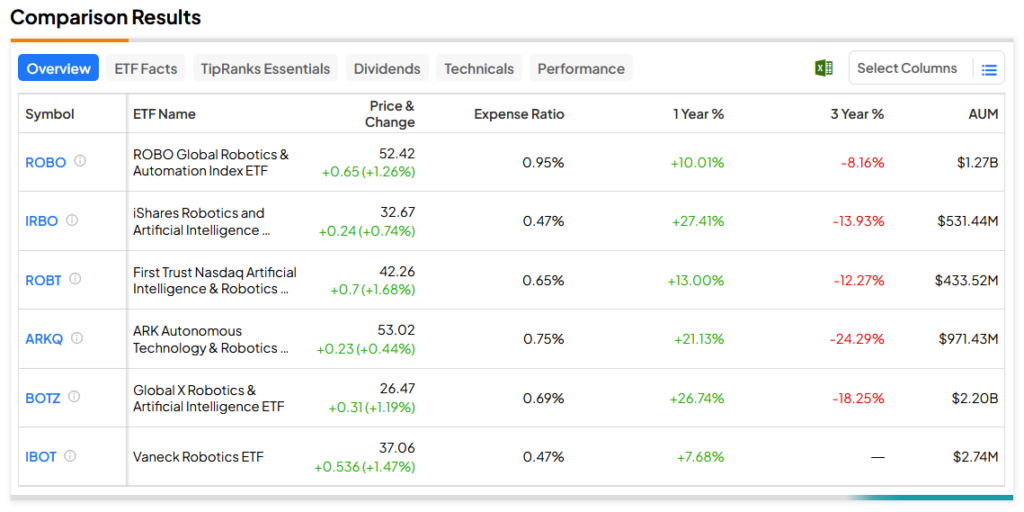

As another option, investors can buy into one of the robotics ETFs, utilizing one of the many TipRanks ETF tools to pick the winning fund:

To conclude, robotics industry stocks provide investors with an opportunity to profit from an accelerating 4th Industrial Revolution. However, it is important to take into account the companies’ finances and prospects to pick the winners that can create long-term value for their shareholders.