Roblox’ (RBLX) latest quarterly update was by no means a success. The online gaming platform missed on the top-line and more pronouncedly on the bottom-line. Deutsche Bank’s Benjamin Black says the miss (adj. EBITDA of ~$68 million fell short of the Street’s $100 million estimate by more than 30%) was on account of higher-than-expected developer expenses, headcount, and infrastructure costs such as trust & safety spend.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That said, investors reacted positively to the print, which Black attributes mostly to the bullish noises made by management on the earnings call.

For one, the company sounded upbeat around user acquisition and retention trends. This particularly pertains to the users it acquired during the height of the pandemic. For example, pre-Covid, for the US 9-12 cohort – a significant demographic for the company – DAUs (daily average users) were at 2 million with those spending less than 5 million hours per week on the platform. During the pandemic, this grew to 3 million DAUs spending 10 million hours a week. Now, the company has kept hold of the 3 million users, with these spending 8 million hours per week.

“This retention is better than our prior expectations and as such we believe reflects a potentially sticky userbase in a post COVID-world,” Black said.

The company is also making inroads abroad, where Black thinks there is “significant runway and headroom for further growth.” For example, investment in a data center in India helped drive “rapid growth” with users increasing by 160% year-over-year to just under 1 million DAUs. Additionally, the company has also set its sights on user growth in Japan.

There are also initiatives intended to increase monetization, with a specialized “Economy” team that is “focused on driving monetization per hour.” The team is targeting three main areas – discovery, advertising and UGC catalog – to generate more growth.

“Overall,” Black summed up, “we come out of the 1Q with greater confidence around the sustainability of user growth, and are positively surprised by retention dynamics, particularly as it pertains to users acquired during lock-downs.”

As such, Black reiterated a Buy rating on RBLX although the price target is reduced from $60 to $45 due to “lower estimates and a lower market multiple.” No worries, the figure still implies 38% upside from current levels. (To watch Black’s track record, click here)

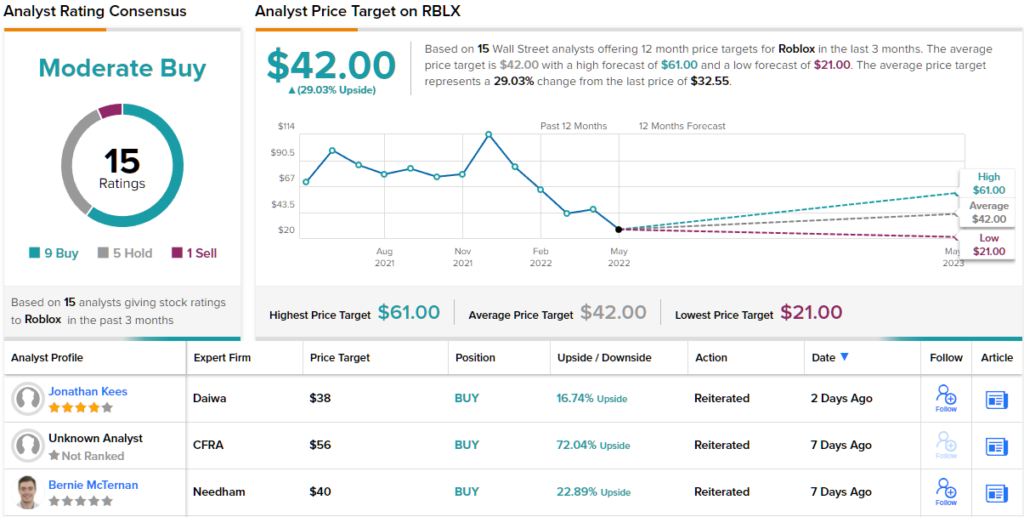

Looking at the consensus breakdown, based on 9 Buys, 5 Holds and 1 Sell, the stock claims a Moderate Buy consensus rating. The forecast calls for one-year gains of 29%, considering the average price target clocks in at $42. (See Roblox stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.