Roblox (RBLX) investors got some welcome relief on Monday after what has been a brutal 2022 for the online gaming platform. Shares surged by 20% after the company posted some impressive metrics for September. Still, it will take a while to claw back the year’s losses. Since the onset of 2022, the stock has toned down 58%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The KPIs (key performance indicators) for the month were strong with daily active users (DAUs) growing by 23% year-over-year to 57.8 million. For Needham analyst Bernie McTernan, the “highlight” were bookings increasing by 19% (constant current) at the midpoint (13% on a reported basis) to between $212 million and $219 million, which despite bigger-than-anticipated FX headwinds came in ~8% above the analyst’s expectations.

As such, on the back of the better-than-expected September results, McTernan raised his bookings estimate for 4Q22E by 4% from $824 million to $852 million. That, however, could “prove to be conservative if prior seasonality holds off of this September outperformance.”

On a side note, McTernan highlights another metaverse rival’s struggles which could point to Roblox’s “strategic importance.” According to a WSJ article, META’s Horizons World’s current engagement stands below the 200,000 mark and the company has even lowered its year-end monthly users target from 500,000 to 280,000.

“In our view, this highlights the strategic value of RBLX with 58B daily active users,” says McTernan. “To be fair, comparing the number of users is not a fair fight, given the largely ubiquitous distribution access for RBLX but scale can determine winners and losers in social and could matter even more in the metaverse.”

McTernan thinks Roblox is an “envious position” here, despite the user base presenting its own set of challenges for the company as it targets further growth and monetization across different demographics and geographies.

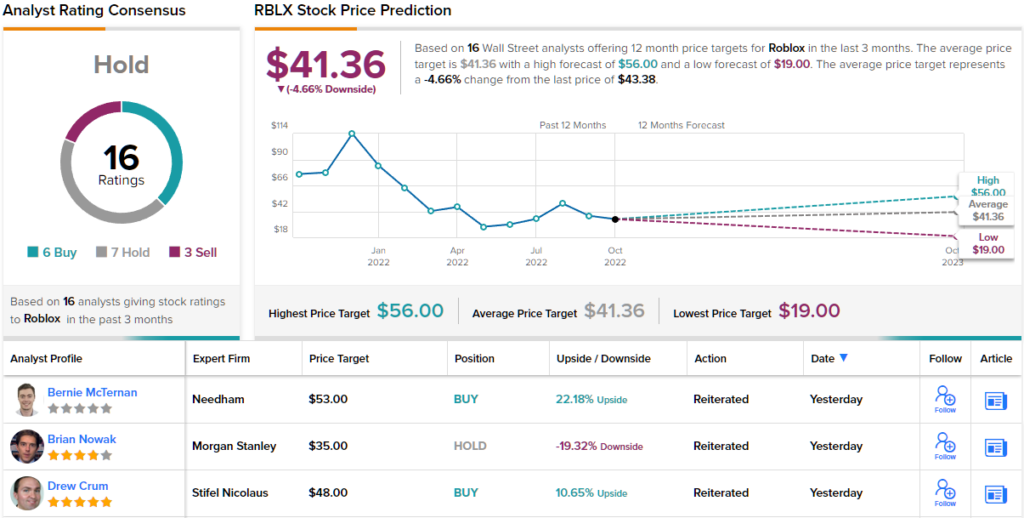

So, down to the nitty-gritty, what does it all mean for investors? McTernan sticks with a Buy rating and $53 price target, suggesting shares can climb 22% higher over the coming months. (To watch McTernan’s track record, click here)

Not everyone on the Street is quite as confident; based on 6 Buys, 7 Holds and 3 Sells, the stock claims a Hold consensus rating. The average price target stands at $41.36, suggesting shares are currently overvalued by ~5%. (See Roblox stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.