Roblox (NYSE:RBLX) shares are off to a good start this year, having notched gains of 26% so far in 2023. A big chunk of that came in the wake of a key performance metrics update for December. Roblox put in a strong showing, marking a significant turnaround from November’s figures.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

DAUs (daily active users) rose by 18% year-over-year, hours engaged on the platform increased by 21%, and estimated bookings showed a 17% to 20% YoY uptick to come in between $430 million and $439 million. In what amounted to a record number, December’s 61.5 million DAUs marked an 8% month-over-month increase.

Following months of deceleration (September/October/November showed +19%/+15%/+11%), Needham analyst Bernie McTernan thinks the most important metric on display was the “reacceleration of constant currency bookings growth.”

“This is a strong way to end the year,” said the analyst although it remains to been what is the real cause behind the spike. “The key question is how much of this beat is organic vs one-time benefits like holiday gift cards and one extra weekend day,” the analyst explained. “We assume the beat was largely organic and forecast high teens reported bookings growth in FY’23E, relative to the 21% constant currency growth in Dec. ’22. Our estimates move higher in ’23E and beyond.” For 2023, McTernan has raised his bookings estimate by 7% and pushed the adj. EBITDA forecast 67% higher.

Roblox is unusual in that it has been reporting monthly metrics since going public in March 2021, but the company has announced that it will stop doing so after March of this year. McTernan thinks this is the right move. “While we are always supportive of more data, we think monthly results put more emphasis on short-term trends for investors for what should be a long-term secular growth story,” he opined.

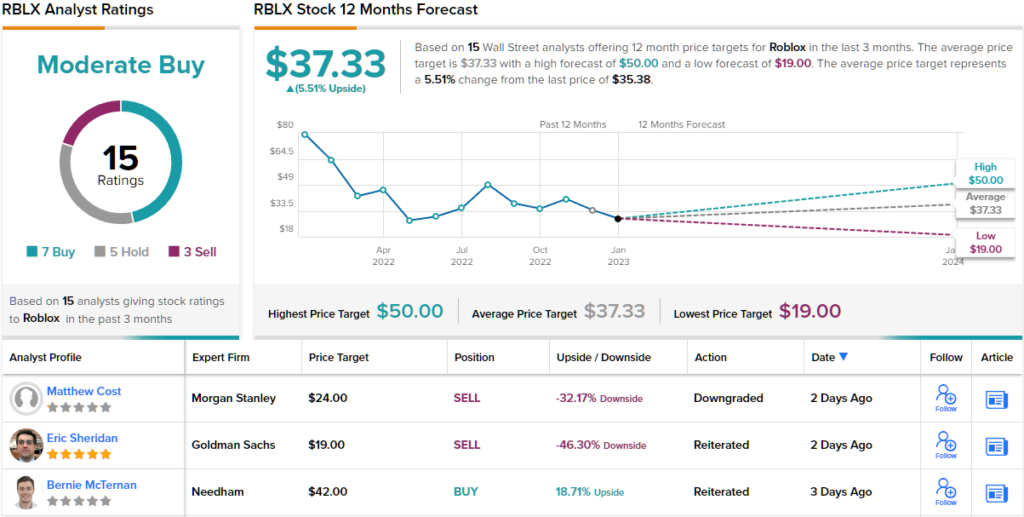

All told, McTernan reiterated a Buy rating and nudged the price target up from $39 to $42. This suggests room for further gains of ~19% over the coming year. (To watch McTernan’s track record, click here)

Looking at the consensus breakdown, based on 7 Buys, 5 Holds and 3 Sells, the stock claims a Moderate Buy consensus rating. Considering the average target stands at $37.33, there is room for modest gains of 5.5% over the one-year horizon. (See Roblox stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.