Shares of Roblox (NYSE:RBLX) have continued to drag their feet after a catastrophic implosion that began late last year. Though Roblox is nowhere close to making a sustained profitability push, it’s tough to pass up its growth profile at these depressed valuations (shares currently go for 8.6x sales). With robust user growth and the means to improve monetization via ads, there are a lot of levers that Roblox can pull as it looks to separate itself from other less-worthy innovation stocks that’ll have a tougher time recovering from their 70%-90% crashes.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

There are some pretty dark days ahead, but there’s already so much doom and gloom baked into the share price here. Indeed, the stage could be set for a very fruitful rally once the next phase of the next economic cycle kicks off and Roblox is back to experiencing the kind it growth it commanded in prior years.

It’s hard to catch a bottom in tech stocks that have crumbled so quickly. Still, Roblox has a magnificent product and many arenas that can improve its profitability prospects. Recession or not, Roblox isn’t ready to slow down on the innovation front either. The firm still has its foot on the gas, which could make it far harder for potential metaverse competitors to replicate Roblox’s success.

I remain bullish on shares of Roblox.

Roblox: A True Innovator Dragged Down with the Market

The negative momentum has mostly subsided in the speculative tech scene. I find Cathie Wood’s ARK line of funds to be a good gauge of how the broader basket of unprofitable innovation stocks is doing. Right now, there seems to be a bit of support for the group. As investors move beyond rate hikes, we could see a divorce between the true innovators and the firms that may be on their way out. Roblox is likely one of the companies that will live to see better days.

In my view, Roblox stock looks like one of the babies thrown out with the bathwater in the tech scene. With that, its stock could be quicker to recover than other fallen hyper-growth plays.

With inflation showing signs of calming and the bond market pointing to fewer oversized rate hikes moving forward, the worst may already be in the rear-view mirror for ARK-like innovation stocks. True innovators could begin the recovery process, while the non-innovative bubbles could continue to drag their feet until their debt burdens and cash bleed become too great to handle.

In the meantime, Roblox faces challenges as we enter a likely recession year. The company now expects bookings growth to lie in the mid-teens in 2023, down from original expectations calling for high-teens growth. As a recession weighs on consumer spending, bookings could easily fluctuate wildly in the new year. Still, I do think there’s a good chance that bookings growth could return to the high teens once these tough times inevitably become better.

User growth and engagement could easily continue to improve through a recession year. At the end of the day, Roblox is a low-cost entertainment for its many youthful users, who could spend more time on the platform as gaming budgets feel the pinch.

Further, Roblox is investing heavily in its content creators. More experiences are likely to translate into more engagement and more users. Bookings may be up or down in any given quarter, but the longer-term trend, I think, is higher, as it’s likely to follow user growth and engagement.

For the third quarter, DAUs (Daily Active Users) rose to 58.8 million, up from 47.3 million a year ago. The real issue was with steepening operating losses. Per-share losses came in at $0.50, wider than the $0.32 Wall Street consensus estimate. With rates rising as quickly as they are, mounting losses are a concern.

For those willing to think longer term, I view climbing losses as the nearer-term haze clouding a robust long-term growth story.

Is Roblox Stock a Buy or Sell, According to Analysts?

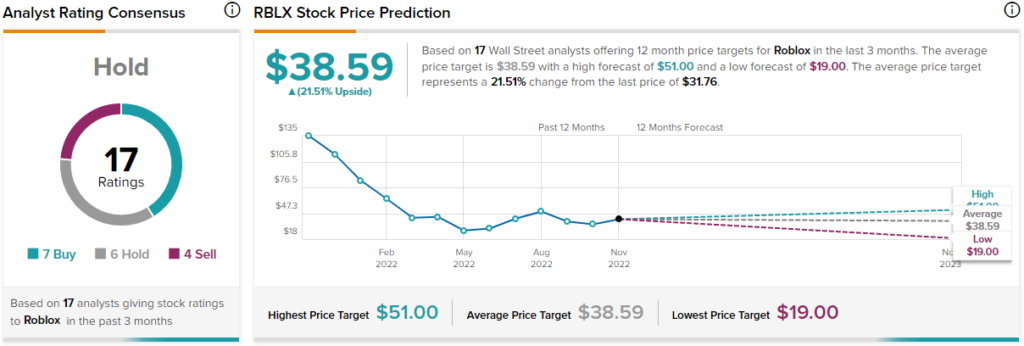

Turning to Wall Street, RBLX stock comes in as a Hold. Out of 17 analyst ratings, there are seven Buys, six Holds, and four Sell recommendations.

The average Roblox price target is $38.59, implying upside potential of 21.5%. Analyst price targets range from a low of $19.00 per share to a high of $51.00 per share.

The Bottom Line on Roblox Stock

Roblox and the rest of the unprofitable innovation basket are under considerable pressure. It’s hard to say when the pain will end. With solid user growth metrics and continuous improvement of the platform, Roblox seems to be one of the hard-hit innovators that are becoming difficult to ignore. The company proves that the metaverse is here. Once recession fears peak, look for Roblox to get off to the races again.