Roblox (NYSE: RBLX) recently provided its investors with a glimmer of hope, as the company provided an update with an optimistic stat or two. However, the outlook is murky if Roblox can’t capture the attention and dollars of adult consumers. Therefore, I am neutral on Roblox stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Roblox is a video game company, and its game is purposely populated with blocky graphics. Beyond its function as a game, the Roblox platform is a portal into the metaverse. There, as you might expect, Roblox earns revenue from facilitating the sale of virtual items.

Is this a lucrative business model? That’s the billion-dollar question, and a recently released data set suggests that Roblox is leveling up its digital-goods sales. On the other hand, some financial experts are skeptical that Roblox can successfully court older users while navigating a post-pandemic world.

Roblox Demonstrated Growth According to This Crucial Metric

Roblox doesn’t plan to report its third-quarter 2022 financial results until November 9. However, it has already released an important set of operating results for September. Among the data points were several positive ones, including an indicator of Roblox’s ability to sell virtual products. Indeed, it’s not difficult to figure out why Roblox stock jumped 20% on October 17. The company revealed that its estimated bookings for September grew 11% to 15% year-over-year to between $212 million and $219 million.

The press release didn’t define bookings, but Barron’s explains this metric as “equivalent to the amount of virtual currency purchased during a given period.” Furthermore, Roblox platform users use a virtual currency called Robux to purchase items.

Selling these items is Roblox’s bread and butter, so it’s certainly encouraging that the company’s monthly bookings got a boost. Also in September, Roblox’s daily active users (DAUs) increased 23% year-over-year to 57.8 million, while the hours engaged on the company’s platform grew 16% year-over-year to 4 billion.

Were financial traders overenthusiastic in pushing RBLX stock up 20% in a single day, though? It’s possible that their haste will be punished as Roblox’s future may depend on a user base that skews too young, and too unreliable.

Two Analysts Issued Warnings about Roblox Stock

It’s been a punishing year for RBLX stockholders, even after the aforementioned 20% share-price pump. Moreover, there could be much more pain in store, as a pair of analysts express concerns about Roblox’s youthful user population.

Benchmark analyst Mike Hickey, for example, suggested that the COVID-19 pandemic pulled forward the company’s growth for a while; in other words, people on lockdown spent a whole lot of time playing video games in 2020. Hickey observes a normalization in behavior lately, though, and this may dampen Roblox’s pandemic-catalyzed user engagement growth.

That’s a fancy way of saying Roblox can’t continue to count on COVID-19 to keep people indoors and playing Roblox for hours on end. That’s not the only concern, however. Hickey also observed that many of the platform’s users are children, and kids are more open to switching games since they don’t pay for the game experiences themselves.

It’s typically parents who are giving money to the children to spend on the Roblox game, and these parents have little to no emotional connection to the game. So, they won’t feel bad about dialing back their spending during this time of high inflation.

Additionally, Hickey warns that the Roblox game appeals mainly to young children, who can’t be relied upon as consumers because they’ll age out of the game when they’re teenagers. With all of these factors in mind, Hickey issued a very pessimistic $21 price target and a Sell rating on RBLX stock.

In a similar vein, Cowen Sr. Research Analyst Doug Creutz explained that spending on the Roblox platform is “still very heavily driven by children age, let’s say, 8 to 12,” and that it’s “still largely a youth-driven experience.” Creutz also implied that kids aren’t necessarily big spenders on Roblox, saying, “I don’t know that kids are really that excited about going to a virtual Chipotle or a virtual Walmart. I think they’d rather play games.”

What is Roblox’s Stock Prediction?

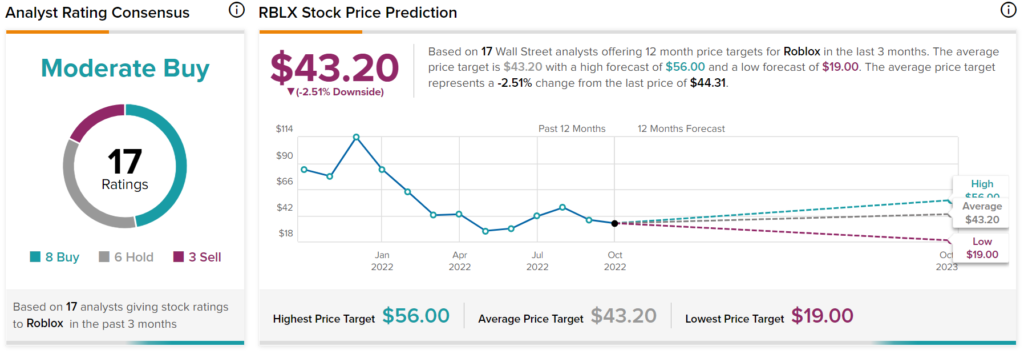

Turning to Wall Street, Roblox stock has a Moderate Buy consensus rating based on eight Buys, six Holds, and three Sells assigned in the past three months. The average Roblox stock price prediction is $43.20, implying 2.51% downside potential.

Conclusion: Should You Consider Roblox Stock?

RBLX stockholders are in a tough spot here. They’re in a losing position year-to-date, but Roblox’s September data release looks highly encouraging. The full story isn’t limited to the raw data, though. Frankly, young children probably can’t be relied upon to stay on the Roblox platform on a long-term basis, or to spend a lot of money there. Hence, as these age dynamics might not play out in Roblox’s favor, it’s wise to steer clear of RBLX stock for now.