When Roblox (NASDAQ:RBLX) released its December key performance metrics update, its bookings performance of $430 – 439 million significantly exceeded Street expectations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The problem with that display, says Wedbush analyst Nick McKay, is that the drivers of the beat “remain unclear.”

“The debate around January is tied to the mystery around the drivers of the December-to-remember,” expounded the analyst. “We are assuming that the primary catalyst was gifting until we learn otherwise. Also, the company likely benefitted from a cold spell across much of the U.S., as well as the debuts of Contact Importer and Friend Recommendations.”

With Roblox about to report 4Q22 (December quarter) results before the markets open on Wednesday (February 15), McKay might get an answer to his question soon enough.

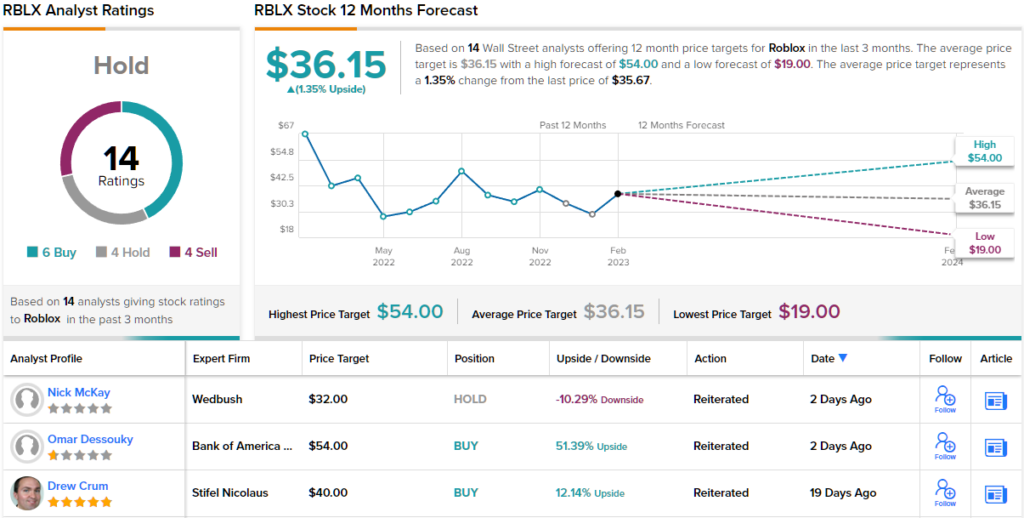

Meanwhile, ahead of the results, McKay is sticking with a Neutral rating and $32 price target, suggesting the shares are currently overvalued by around 7%. (To watch McKay’s track record, click here)

The general problem for Mckay remains Roblox’ valuation and unless the online gaming platform consistently outperforms expectations for monthly key metrics, McKay is skeptical the company can maintain its “best-in-class valuation multiples over the near term.”

Looking further ahead, there are also issues. For the company to preserve its multiples over the longer term, McKay thinks Roblox must eventually “improve its profitability by a significant amount.” Not only that, for investors to stay onside, McKay says the company “must become and remain the de facto metaverse leader.”

As for the numbers, for Q4, McKay is calling for bookings and adjusted EBITDA of $891 million and $88 million, respectively, compared to consensus at $881 million and $104 million.

For 1Q23 (March quarter), based on January bookings of around $250 million, followed by $230 million in both February and March, McKay sees bookings reaching $710 million. That is some distance below The Street’s forecast, which stands at $746 million for Q1.

What does the rest of the Street make of Roblox’ prospects? The reviews are decidedly mixed. With 6 Buys, 4 additional Holds and 4 Sells, the analyst consensus rates the stock a Hold. The average target currently stands at $36.15, suggesting the shares will stay rangebound for the foreseeable future. (See Roblox stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.