Cryptocurrency is the hottest buzzword right now, as millions of investors around the globe invest in this digital currency. The rise in crypto assets’ availability for trading, and soaring cryptocurrency prices, have only egged on more people to invest in them.

According to a Facts and Factors market research report, the global cryptocurrency market is anticipated to be worth more than $5,190.62 million by 2026. This market was worth $792.53 in 2019, indicating that the cryptocurrency market is expected to grow at a compounded annual growth rate (CAGR) of 30% between 2019 and 2026.

Considering this scenario, let us compare two exchanges that support cryptocurrency trading, Robinhood Markets and Coinbase Global, using the TipRanks Stock Comparison tool, and see how Wall Street analysts feel about these stocks.

Robinhood Markets (HOOD)

Shares of Robinhood have tumbled 10.4% since the company announced its Q3 earnings last week, leaving investors disappointed. Third-quarter loss widened to $2.06 per diluted share from a loss of $0.05 per diluted share in the same period last year.

The financial services company allows for commission-free trading of stocks, cryptocurrencies, and exchange-traded funds.

While net revenues did soar 35% year-over-year to $365 million, they still fell short of the consensus estimate of $431.27 million. Transaction revenues rose 32% year-over-year to $267 million, but sequentially they were down by 40.8%.

Moreover, the company’s outlook for Q4 remained bleak as HOOD expects “seasonal headwinds and lower retail trading activity” to persist from Q3. As a result, the company expects to deliver revenues of $325 million in Q4, and in FY21, it expects revenues to be less than $1.8 billion.

Furthermore, Robinhood also anticipates that newly funded accounts in Q4 “will be roughly in line with the 660,000 opened in the third quarter of 2021.”

Vlad Tenev, CEO and Co-Founder of Robinhood, pointed out at its Q3 earnings call that while Q2 saw a huge interest in cryptocurrencies, in Q3, “crypto activity came off record highs, leading to fewer new funded accounts and lower revenue as expected,” and he expects these patterns to persist in the future.

This is supported by the fact that HOOD reported crypto-based transaction revenues of $51 million in Q3, a huge drop from $233 million in Q2.

Tenev also mentioned on the earnings call that the company was “keeping a close eye on crypto as the regulatory landscape is increasingly uncertain.” (See Analysts’ Top Stocks on TipRanks)

Deutsche Bank analyst Brian Bedell believes that the stock is increasingly going to “become a battleground” between investors who are skeptical whether HOOD will be profitable again anytime soon versus those “that see great long-term potential growth in customer wallet share from a strong pipeline of new product launches.”

The analyst is sidelined with a Hold rating and reduced the price target from $42 to $40 (14.4% upside) on the stock.

While Bedell is of the opinion that HOOD has long-term potential, he said it is also evident from its Q3 results and outlook for Q4 that this “potential may come with growing pains.” The analyst added that the company’s new products like crypto wallets, and a variety of crypto-tradeable assets, may come to fruition only next year.

Furthermore, the analyst commented, “Overall, while we now expect a mild adjusted EBITDA loss this year, we think there is potential for HOOD to become materially profitable next year (in 1Q22) and potentially reach an annualized level of about $1bn in 2024 if these new products & services begin to gain traction next year.”

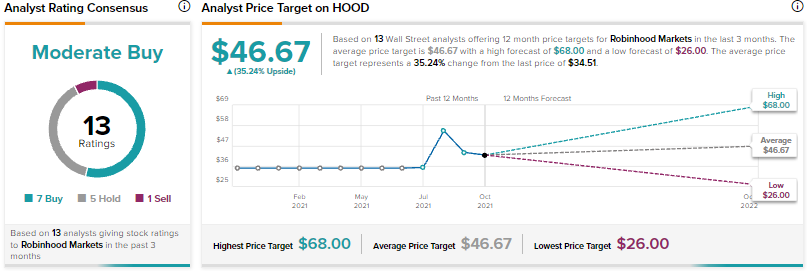

Turning to the rest of the Street, Wall Street analysts are cautiously optimistic about Robinhood, with a Moderate Buy consensus rating based on 7 Buys, 5 Holds, and 1 Sell.

The average Robinhood price target of $47.67 implies 35.2% upside potential from current levels.

Coinbase Global (COIN)

Coinbase is expected to announce its Q3 earnings on November 9. The cryptocurrency exchange platform expects retail Monthly Transacting Users (MTUs) and total trading volume to be lower in the third quarter as compared to Q2.

This trend was evident in August as the company stated in its Q2 shareholder letter that “August month-to-date, retail MTUs and Trading Volume levels have slightly improved compared to July levels but remain lower than earlier in the year.”

Late last month, J.P. Morgan analyst Kenneth Worthington, in his research report, also seemed to echo this view. He pointed out that industry cryptocurrency trading volumes slowed down in Q3, likely declining by around 40% from Q2, “pushed lower by particularly weak trading activity in July.”

However, Worthington pointed out, crypto volume data for COIN suggests that it fell by only 25% in Q3 versus a decline of 38% for the industry. But Worthington cautioned that this rise in volume could be fueled by COIN’s “newer Institutional Prime business or corporate volumes where Coinbase generates less in revenue.”

For 2021, COIN anticipates annual average MTUs to range from 5.5 million at the low end to 8 million at the higher end. When it comes to average net transaction revenue per user, for the past two years, this has ranged between $34 to $45 per month and COIN has projected that is likely to exceed this range in 2021. (See Top Smart Score stocks on TipRanks)

When it comes to app download data for COIN, the analyst cited data from Apptopia. The data suggested that downloads of the Coinbase app had fallen more than 60% from Q2 levels, while the decline in daily average users was much less, at only 30% from Q2.

But October was better, as trading volume and app download data have seen a rebound (up 70% from Q3), supporting analyst Worthington’s view that “Coinbase is the go-to destination for those new to crypto trading.”

A precursor of this trend is also indicated by analyzing the website traffic for COIN, using the TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR). Unique visitors to the site have soared 131.6% year-over-year to 23.3 million in September.

Worthington is bullish on the stock, with a Buy rating, and has modestly increased the price target from $372 to $375 prior to its Q3 earnings. He sees COIN as “both a leading driver and beneficiary of the cryptocurrency economy.”

Wall Street analysts, however, are cautiously optimistic about Coinbase, with a Moderate Buy consensus rating, based on 13 Buys, 3 Holds, and 2 Sells.

The average Coinbase price target of $350.56 implies 5.6% upside potential from current levels.

Bottom Line

While analysts are cautiously optimistic about both stocks, upside potential suggests that HOOD is a better Buy. However, Needham analyst John Todaro seems to differ. In Todaro’s view, the slowdown in crypto-based transaction revenues for HOOD is being blamed “on a drop off in activity in the meme based crypto asset, dogecoin.”

In contrast, the analyst is more bullish on COIN. Todaro thinks that “it is important for exchanges to list as many legal crypto assets as possible,” which COIN is doing. This has resulted in COIN successfully capturing “increased trading activity in other areas of the crypto market which can make up for reduced activity in dogecoin, bitcoin, and ethereum.”

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.