The market for electric vehicles (EVs) is experiencing a boom in the United States with consumers increasingly looking at buying environment-friendly vehicles. This market has got a further boost with a friendly regulatory environment and government initiatives.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earlier this year, U.S. President Joe Biden signed an executive order intending to make 50% of all new vehicles sold in the United States electric by 2030 to reduce greenhouse gas emissions in the U.S.

Let us compare two companies: Rivian Automotive, a new EV player on the block, and Tesla, an established player when it comes to EVs, using the TipRanks Stock Comparison tool, and see how Wall Street analysts feel about these stocks.

Rivian Automotive (RIVN)

In less than a month after its initial public offering (IPO), the electric automotive company, Rivian has taken the market by storm. Shares of Rivian have soared 15.3%. The company designs, develops, and manufactures electric vehicles (EVs).

Rivian’s first R1 platform will support its first-generation consumer vehicle – the R1T, a two-row five-passenger pickup truck. As of October 31, the company had more than 55,000 R1T and R1S pre-orders.

While initiating coverage on the stock earlier this month, Deutsche Bank analyst Emmanuel Rosner pointed out that considering the focus of Rivian on the U.S., Canada, and Western European markets, “the light truck segment will be key to gaining meaningful market share.”

According to the analyst, this is because light trucks make up more than 70% of new vehicle sales annually in the U.S. and Canada. (See Top Smart Score Stocks on TipRanks)

However, Rosner cautioned that Rivian’s models, R1T and R1S, are positioned “at the very high end of the truck market in terms of brand and pricing, representing aspirational lifestyle vehicles rather than work trucks.”

As a result, the company would be under pressure to justify these price points. However, given its “solid” order book and its strategy “to launch multiple vehicles in different segments each year,” it would create “economies of scale without the need to achieve heroic market share in any given segment.”

The company had stated earlier that it plans to start deliveries of the R1S, a three-row seven-passenger sports utility vehicle (SUV), in January. However, this has been moved to between May and July.

By Rosner’s estimate, considering that the company is targeting both consumer and commercial markets, its total serviceable addressable market (SAM) could be well over $1 trillion by 2024, while the total addressable market (TAM) could be around $9 trillion.

Rivian is also targeting the commercial EV segment with its Electric Delivery Van (EDV). Amazon (AMZN) has proved to be Rivian’s first commercial customer with an initial 100,000 orders for RIVN’s Electric Delivery Van (EDV) with an option to expand the agreement.

Rosner mentioned in his research report that this deal gives RIVN an “immediate foothold in the commercial delivery space, giving it guaranteed volume with the largest customer in the space.”

Furthermore, the analyst added that if AMZN decides to expand the agreement with Rivian by 2025, it would “validate the EV maker’s technology offering and help accelerate its commercial scaling efforts.”

As a result, Rosner is bullish with a Buy rating and a price target of $130 (11.9% upside) on Rivian.

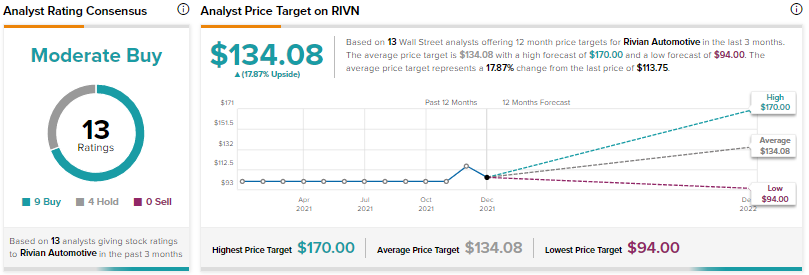

Overall, other analysts on Wall Street are cautiously optimistic about Rivian with a Moderate Buy consensus rating based on nine Buys and four Holds. The average Rivian price target of $134.08 implies 17.8% upside potential to current levels.

Tesla (TSLA)

Tesla has been a frontrunner in the EV race, and it appears that the company is set to deliver more EVs in the coming years.

The EV maker had said in its Q3 press release back in October that it intended to ramp up its manufacturing capacity and expects to increase its vehicle deliveries by an average of 50% annually over multiple years.

RBC Capital analyst Joseph Spak estimates that by 2025, TSLA will be able to “meaningfully expand” its production capacity at its facilities in Shanghai, Texas, and Germany. As a result, the analyst has forecasted that its facilities at Fremont, Texas, and Germany will each produce EVs between 400,000 to 500,000 in 2025, while Shanghai is expected to produce 850,000 units.

Still, will the demand be there for Tesla’s EVs? Yes, demand would be “solid” for its EVs, believes Spak.

As a result, the analyst has considered the demand for TSLA’s “Model 2”, its $25,000 car, in his forecast beginning in 2024 and continuing into 2025. What’s more, Spak expects that Tesla will expand its EV portfolio with “Model S/X, Model 3/Y, Cybertruck, and Model 2 (as well as Semi)” in 2025.

However, the analyst still considers this expanding EV portfolio as a “limited” one “versus other manufacturers’ offerings which could be a risk as historically in auto, the consumer has preferred choice and differentiation.” (See Analysts’ Top Stocks on TipRanks)

However, Spak thinks that the company’s “inexpensive” access to capital could allow Tesla to grow organically or through acquisitions resulting in it coming ahead of its competitors.

With these positives aside, the analyst cautioned that Tesla’s investment in service and quality has not kept pace with its rising demand and could potentially damage the brand. Spak added that “service could be particularly important as Tesla continues to try to expand outside its core market.”

Lastly, while being sidelined on the stock with a Hold rating, the analyst raised the price target from $800 to $950 (8.7% downside) on the stock.

The rest of the analysts on the Street remained cautiously optimistic about Tesla with a Moderate Buy consensus rating based on 13 Buys, six Holds, and six Sells.

The average Tesla price target of $982.96 implies 5.8% downside potential to current levels, suggesting that the stock could have overshot its valuation.

Bottom Line

While analysts are cautiously optimistic about both stocks based on the upside potential over the next 12 months, Rivian seems to be a better Buy.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates. Read full disclaimer >