The list of good stuff on offer in Rivian’s (NASDAQ:RIVN) latest quarterly readout was reassuringly long. There were more deliveries than expected, beats on both the top-and bottom-line, and an increase to its production forecast for the year.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Another highlight, says Barclays analyst Dan Levy, revolved around the progress in cost reduction.

Case in point: In Q3, the EV maker’s cost per unit (ex LCNRV {lower of cost and net realizable value}) stood at ~$122,000, an improvement of almost ~$20,000/unit compared to 3Q23 while in 4Q22, the cost per unit amounted to ~$177,000. The three straight quarters of improvement, says Levy, are testament to “clear progress in reining in cost.”

However, despite these positive developments, RIVN shares tumbled after the Q3 release. The pullback, according to Levy, is down to a “broader EV malaise” that has impacted everyone from new players to legacy OEMs, with undisputed EV leader Tesla not being spared, considering its alarming Q3 report. Additionally, there’s the possibility the results of other new entrants who have been having a hard time have negatively impacted Rivian.

But while Levy also stresses that it is important to be “mindful of demand” for Rivian, and that any indications of demand weakness make its route to improvement more challenging, its strong product + path of cost improvement “reinforces the bull case.”

“We believe the narrative is overall attractive, and we remain positive on the stock,” Levy goes on to say. “Specifically, the 3Q beat (EBITDA -$942 vs consensus -$1.04bn) + ’23 guide raise and reaffirmation of near/long-term targets reinforces the path of improvement ahead for RIVN. RIVN continues to see progress in reducing cost on its path to break even, while reinforcing the moat around its unique offering.”

As such, given it remains one of the few OEMs along with Tesla that has a unique offering and tech edge, Levy believes the current stock price “provides an attractive entry point.”

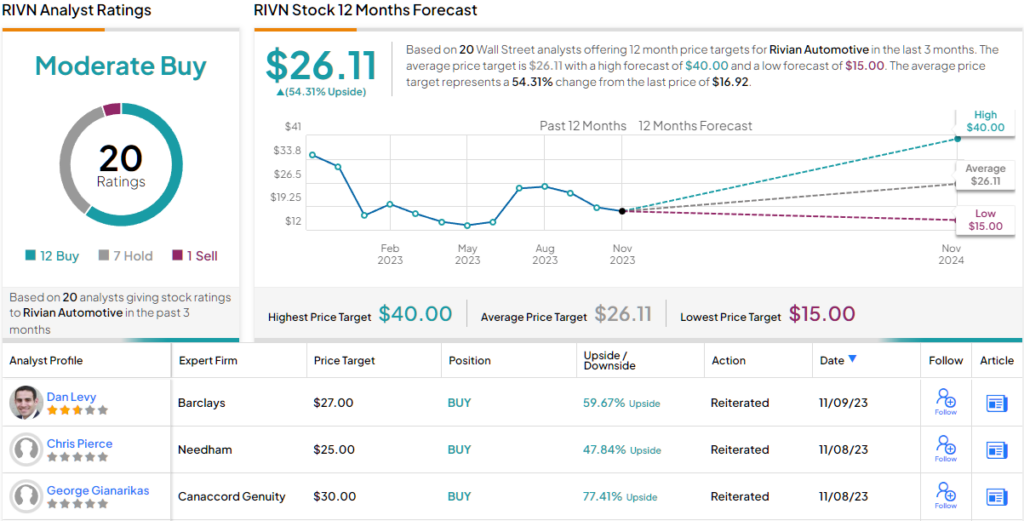

To this end, Levy reiterated an Overweight (i.e., Buy) rating on RIVN shares, along with a $27 price target, suggesting 12-month returns of 59%. (To watch Levy’s track record, click here)

Levy’s price target is a little higher than the Street’s average, which at $26.11, suggests one-year upside of 54%. Overall, the stock claims a Moderate Buy consensus rating, based on a mix of 12 Buys, 7 Holds and 1 Sell. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.