Shares of Rivian Automotive (NASDAQ:RIVN), an EV maker based in California, have risen by 28% this year on the back of a stellar financial performance. This rally, however, has created a valuation quandary with years of future growth already priced into Rivian’s valuation. As 2024 approaches – a year that promises to be packed with exciting electric SUV deliveries from many automakers – Rivian seems only fairly valued in the market despite exceptional growth. Therefore, I am neutral on Rivian.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Improving Numbers

For the third quarter of 2023, Rivian reported revenue of $1.34 billion, a notable year-over-year improvement of 150%. The company delivered 15,564 vehicles during the quarter and produced just over 16,000 vehicles, the highest number of EVs manufactured in any quarter in the company’s history.

After digesting the third-quarter performance, management boosted its production guidance to 54,000 vehicles for 2023, making Rivian one of the few automakers to project a production increase this year when the auto industry is facing many growth challenges.

Rivian’s growth in the last couple of years has been nothing but exceptional. For context, the company reported revenue of just $1 million in the third quarter of 2021 and crossed the $1 billion revenue mark in the second quarter of this year.

Even more encouraging is the notable improvement in profit margins. From -171% in Q3 2022, its gross profit margin improved to -36% in Q3 2023, highlighting the scale advantages being realized by the company.

In Q3, the gross loss per vehicle improved by $2,000 compared to the previous quarter, which is a sign that Rivian is increasingly becoming efficient. To improve margins further, the company is focused on shifting its product mix in favor of electric delivery vehicles, which are higher-margin products.

To reduce production costs further, Rivian is planning major changes for its R1 platform in the second quarter of 2024, including a simplified electronic control unit topology. Manufacturing efficiencies should boost operating margins in the long run, especially when the company grows in scale.

Strategic Decisions to Drive Growth

Rivian ended its exclusive partnership with Amazon (NASDAQ:AMZN) in the third quarter, paving the way for its commercial vans to be sold to other potential customers. This marks a milestone, as Rivian can now focus on becoming the go-to commercial EV fleet solutions provider for companies that are aggressively trying to reduce carbon emissions.

On December 14, Rivian and AT&T (NYSE:T) announced an EV pilot program where AT&T will take delivery of Rivian Commercial Van and R1 vehicles in early 2024 to evaluate how EVs can reduce operating costs while contributing positively to ESG goals. Rivian’s decision to end the exclusive partnership with Amazon seems to be paying dividends already, and this is likely to be the first of many partnerships that the company will form to penetrate the market for electric commercial vehicles.

Rivian has decided to offer an EV leasing program in certain regions in the coming months, which is another strategic move to drive sales by offering consumers alternative ways to transition into an EV.

The ongoing development of the Rivian R2 platform is another strategic area of focus for the company. The R2 midsize electric SUV is set to be unveiled in early 2024, with delivery expected in 2026 at prices ranging from $45,000 to $50,000. The company will build a manufacturing plant in Georgia – construction will begin in early 2024 – to design the R2 platform.

Short-Term Macroeconomic Pains May Affect Demand

The long-term outlook for the EV sector is promising, with the International Energy Agency projecting EVs to account for more than 60% of new vehicles sold by 2030, in line with the Net-Zero Emissions by 2050 scenario. There is still a long way to go to achieve this goal, though, as EV penetration is around 13% in the U.S. today.

Although the long-term outlook is rosy, EV makers will feel the wrath of the new vehicle affordability crisis in 2024. Wells Fargo analyst Colin Langan believes the auto sector will enter a bear market next year, with prices of new vehicles expected to plummet. The analyst has assigned Rivian a price target of $19 in light of these expectations.

Investors will also have to keep an eye on unionization efforts at EV makers. The United Auto Workers union, after winning a historical battle with Detroit automakers, is now targeting other auto manufacturers, including Rivian. The UAW has already set up a new website where workers can get in touch with organizers to explore possibilities of launching new campaigns targeting several automakers.

Is Rivian Stock a Buy, According to Analysts?

On the back of a stellar financial performance, Rivian has attracted some analysts in recent weeks. On December 7, Stifel initiated coverage on Rivian and assigned a price target of $23 per share, highlighting several positive developments, including the decision to end its exclusivity agreement with Amazon. The research firm expects Rivian to benefit from better pricing, a higher percentage of electric vans in its sales mix, and favorable new supplier agreements.

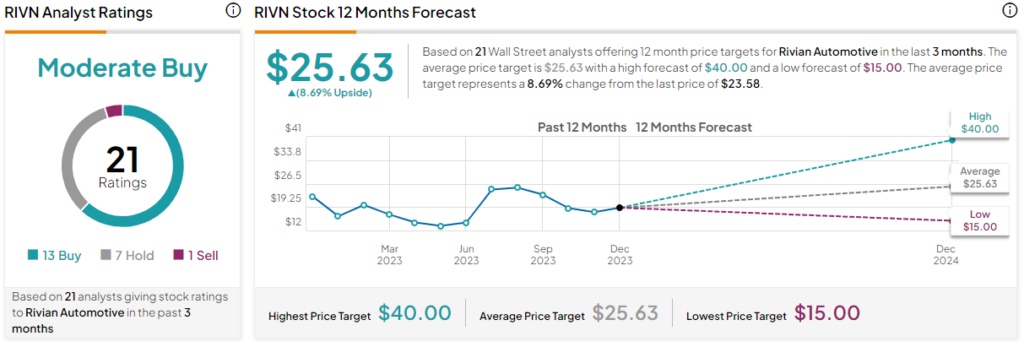

Based on the ratings of 21 Wall Street analysts, RIVN stock comes in as a Moderate Buy on TipRanks. Further, the average Rivian stock price target is $25.63, which implies upside potential of 8.7% from the current market price.

Trading at a forward price-to-sales multiple of 5.3, Rivian seems attractively valued compared to its EV peers Lucid Group (NASDAQ:LCID) and Tesla (NASDAQ:TSLA), which are valued at forward P/S multiples of 17.0 and 8.0, respectively. However, investors need to factor in the expected slowdown in the auto sector next year, which may impact Rivian’s vehicle deliveries and even pricing, making its valuation look fair.

The Takeaway: Rivian’s Growth is Priced in

Rivian is making steady progress toward achieving its long-term financial goals. However, the company seems reasonably valued in the market, which leaves little margin of safety for investors today.