Rivian (NASDAQ:RIVN) will release its third quarter 2023 financial results on November 7. The company’s solid Q3 production and delivery numbers suggest that Rivian is set to deliver strong financial and operational progress. Further, improved cost efficiency augurs well for growth. Let’s delve deeper.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts Show Confidence Ahead of Q3 Print

Displaying faith in the company’s prospects, Cantor Fitzgerald analyst Andres Sheppard upgraded Rivian stock ahead of the Q3 print. In a report dated October 26, Sheppard upgraded RIVN stock to Buy from Hold and maintained the price target of $29. The analyst cited the company’s Q3 production and delivery performance surpassing expectations and expressed confidence in Rivian’s ability to meet and exceed its annual guidance.

Notably, Rivian produced 16,304 vehicles in Q3 and delivered 15,564 vehicles. This reflects year-over-year growth of 121.4% and 136.4%, respectively. Furthermore, Q3 production and deliveries reflect a quarter-over-quarter increase of 16.5% and 23.1%, respectively. In addition, the company remains confident in producing 52,000 vehicles in 2023.

Along with Sheppard, Truist analyst Jordan Levy also remains bullish about Rivian’s prospects and reiterated a Buy rating on the stock on October 19. Levy expects RIVN to benefit from its focus on ramping up production and investments in new technologies. Further, the company’s efforts to reduce costs support the analysts’ optimistic outlook.

With this backdrop, let’s look at the Street’s consensus estimates for Q3.

Analysts’ Q3 Projection

Wall Street expects Rivian to report revenue of $1.32 billion, significantly higher than the prior-year quarter’s sales of $536 million. Further, the analysts’ consensus estimate reflects 17.8% growth in its top line sequentially.

Thanks to the production ramp-up and focus on reducing costs, analysts expect Rivian’s losses to be lower in Q3. Analysts expect Rivian to post a loss per share of $1.34 per share, compared to $1.57 in the prior-year quarter.

Will Rivian Stock Go Up?

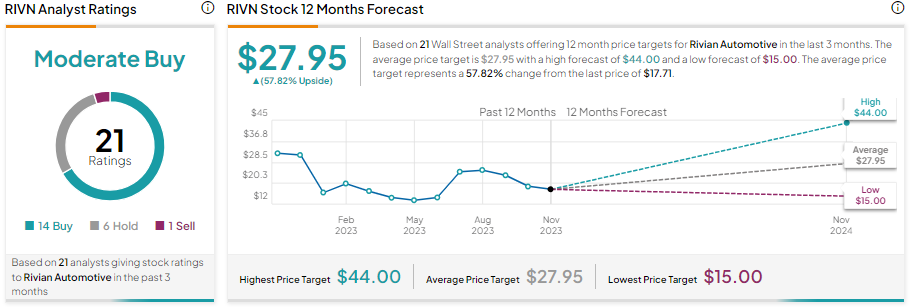

Rivian stock is expected to go up based on analysts’ average price targets. It has received 14 Buy, six Hold, and one Sell recommendations for a Moderate Buy consensus rating. Meanwhile, the average RIVN stock price target of $27.95 implies 57.82% upside potential from current levels.

Insights from Options Trading Activity

Options traders are pricing in a +/- 12.08% move on earnings, greater than the previous quarter’s earnings-related move of -9.88%.

Bottom Line

Rivian is expected to deliver improved financial and operational results in Q3. Higher production and deliveries, cost efficiency, and integration of future platforms and technologies position it well to deliver solid financials, which will likely drive its stock price higher.