Electric vehicle technology is nothing new – some of the earliest cars to be invented ran on electric batteries. Developments over the past few decades, in battery, materials, and motor technologies, have improved EV’s performance parameters and made them competitive with combustion engine vehicles. Add to that social pressures to reduce pollutant emissions and government subsidies to boost the EV sector, and you have a recipe for an expanding market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Some recent boons for the EV sector include President Biden’s pledge of $85 billion in EV investments since 2021 and his stated goal to increase EV production to half of all new vehicles by 2030. The Administration has even pledged a massive buildout of charging stations by that year, totaling 500,000 units.

These points have caught the attention of Stifel analyst Stephen Gengaro, who sees them as a collective counterbalance to the obstacles that are facing the industry. Summing up the EV situation in the US, Gengaro writes, “Electric vehicle sales have faced stiff headwinds recently, driven by both macroeconomic factors (high interest rates, inflation, and recessionary worries) as well as EV specific headwinds including range anxiety, vehicle costs, model availability, and charging infrastructure. We believe these EV hurdles will shrink over the next few years, paving the way for sales growth… While the trajectory is unclear, EV sales are gaining momentum and are estimated to reach about 50% of global sales in the early 2030s.”

Gengaro hasn’t just watched the macro scene; he has also narrowed his vision to look at individual EV stocks – and he has interesting things to say about Rivian (NASDAQ:RIVN) and Lucid (NASDAQ:LCID). While one stands out as a compelling buy, the other falls short. Let’s take a closer look.

Rivian Automotive

The first EV stock we’ll look at is Rivian, one of the many companies that has sprung up in the last 10 years to take advantage of the rapid expansion of the EV market. These firms are generally new to manufacturing, which means that they are not tethered to traditional designs and methods. Rivian exemplifies this; the company approaches EV development from the chassis, creating a four-wheeled ‘skateboard’ platform powered by an electric motor on each wheel. The chassis is designed to include pre-installed fittings for a variety of battery systems and can be completed with several different outer bodies to match a wide range of styling and end-use functionality. In short, Rivian is building a fully modular EV, designed from the start to optimize flexibility in the construction.

Earlier this year, Rivian ramped up regular production at its factory in Normal, Illinois, and in 3Q23, the last reported, the company moved 16,304 EVs off the assembly line. This marked the company’s strongest quarterly production number to date and put Rivian on track to build 54,000 vehicles for the full year 2023, an increase of 2,000 over the previous published outlook. Rivian delivered 15,564 vehicles during the same period.

The vehicles in production are variations of Rivian’s R1 model. Two-thirds are the R1S, an all-electric SUV, and most of the remainder are the R1T, the company’s new light pickup truck. Both versions feature a battery range of approximately 400 miles.

In addition to its consumer-oriented vehicles, Rivian also has two delivery van models under development, with deliveries planned to commence in 2024. Rivian has an agreement with Amazon to provide the e-commerce giant with electric delivery vans, and in July of this year announced that Amazon was using more than 300 of Rivian’s vans in Germany. In a related announcement, Rivian last month announced that it is ending its exclusivity agreement with Amazon and will make its electric delivery vans available to other corporate customers. This non-exclusivity does not negate Rivian’s existing deal with Amazon to provide up to 100,000 electric delivery vehicles.

Also in early November, Rivian released its financial results for 3Q23. The company showed a revenue total of $1.34 billion, its highest yet, up 150% year-over-year, and $30 million ahead of the estimates. The strong revenue was derived mainly from the company’s 15,000+ EV deliveries. At the bottom line, Rivian’s non-GAAP earnings per share came to $1.19 net loss – narrower than expected, by some 13 cents per share.

Turning to Stephen Gengaro’s view, we find the Stifel analyst upbeat on Rivian, taking an optimistic view based on vehicle quality and the high future deliveries in the pipeline. He writes, “The key positives to the Rivian story include: 1) High-quality R1S/R1T driving brand awareness; 2) Agreement with Amazon for 100,000 EDVs, and recently opening commercial van for purchase from other fleets; 3) R2 platform addresses largest vehicle segment in the U.S. which is highly concentrated towards toward Tesla; and 4) Several drivers of 2024+ margin expansion including new technology (Enduro motor and LFP battery), better pricing, EDV deliveries, new zonal architecture, rising production, and impact of new supplier agreements.”

Gengaro also acknowledges this company’s idiosyncratic headwinds, and lays them out clearly: “Our main concerns include: 1) Continued high capital spending and cash burn, with additional liquidity likely needed; 2) Current interest rates a headwind for sales and/or pricing; and 3) 2024 production harmed by temporary line shutdowns to introduce new technology.”

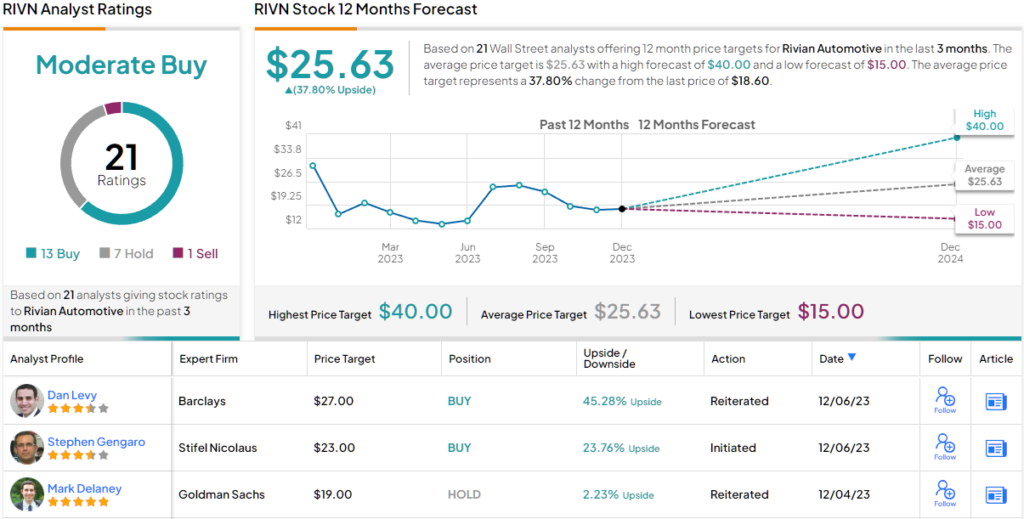

Overall, Gengaro believes that the potential rewards outweigh these concerns. The analyst rates RIVN stock as a Buy, while his $23 price target suggests a 24% share appreciation in the next 12 months. (To watch Gengaro’s track record, click here)

What does the rest of the Street have to say? The stock has a Moderate Buy consensus rating, based on 21 reviews that include 13 Buys, 7 Holds, and 1 Sell. The shares are currently trading for $18.43 and their $25.63 average price target suggests a one-year upside potential of ~38%. (See Rivian stock forecast)

Lucid Group (LCID)

The next stock we’re looking at is Lucid Group, a Silicon Valley-based EV company focused on the luxury market. Lucid is combining the most advanced automotive technologies with the most captivating luxury designs to create a line of EVs geared toward the top end of the market.

Lucid currently has two models available for order: the Air, a high-performance luxury sedan, and the Gravity, a luxury SUV. The Lucid Air has a battery range of up to 512 miles, can accelerate from 0 to 60 in just 1.89 seconds, and can generate up to 1,239 maximum horsepower. The Gravity SUV is rated at 800 max horsepower, has a 440-mile battery range, and can reach 60 mph in less than 3.5 seconds. Both models can be fitted with a variety of trims, both interior and exterior. Both vehicles feature digital ‘glass cockpit’ instrument panels and plenty of legroom for passengers.

The Air line of sedans is currently in production, and the Gravity is scheduled to begin production next year. In Q3 of this year, Lucid delivered 1,457 various versions of the Air and produced 1,550 at its Arizona manufacturing facility. The company’s stock price took a hit in early November when Lucid revised its full-year 2023 production numbers from 10,000 down to the range of 8,000 to 8,500. The production outlook revision was done to keep factory output more in line with actual vehicle deliveries.

The Q3 deliveries generated $137.8 million in total revenue. This figure was down 29.5% year-over-year and missed the forecast by $57.4 million. The company’s earnings results came to a net loss of 28 cents per share, but this was 12 cents per share better than had been anticipated.

Gengaro sees both positives and negatives on Lucid shares, and starts by laying out what’s going right: “The key positives to the Lucid story include: 1) The Lucid Air is an outstanding vehicle, delivering top-tier performance and luxury; 2) the recently unveiled Gravity SUV creates access to the critical SUV segment; 3) Propulsion system provides leading efficiency (miles per KWh), underpinning industry-leading range; 4) Recent licensing agreement with Aston Martin showcases Lucid’s technology – additional deals could follow; and 5) Large ownership by deep-pocketed Saudi PIF fund supports capital needs. Large order from Saudi supports growth.”

Turning to the downside, Gengaro points out several reasons for investors stay cautious, including: “1) Brand awareness and market for Lucid Air sedan still developing; 2) Production is improving but still in the ‘prove-it-to-me’ stage, and margin progression is hard to pinpoint; 3) More affordable vehicles that could drive higher volumes are likely 2-4 years away; and 4) Cash burn remains high, and additional capital likely needed in 2025.”

Considering these factors, Gengaro initiates a Hold rating on Lucid’s stock, suggesting that investors remain on the sidelines, with a price target of $5, implying a potential one-year gain of approximately 12%. (To watch Gengaro’s track record, click here)

Gengaro is not alone in playing it safe on the electric luxury-car maker, as TipRanks analytics exhibit LCID as a Hold. The stock has 9 recent analyst reviews, breaking down to 8 Holds and 1 Sell, and the average price target of $5.21 indicates a potential upside of ~15% over the next 12 months. (See LCID stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.