Ripple (XRP-USD) secured a landmark summary judgment in July, giving it a needed win in its lengthy legal battle with the Securities and Exchange Commission (SEC). These results provide fertile ground for “safer” token deployment, but the company isn’t entirely out of the woods yet.

The summary judgment issued by the Southern District of New York carries both positives and negatives. On one end, the court deemed that so-called “programmatic” sales of XRP were not security transactions. By programmatic, the court refers to selling XRP on the open market through exchanges where the counterparty isn’t known.

The argument is that since the buyers did not know those tokens came from Ripple (as opposed to the thousands of other potential holders), they did not enter into a security transaction with the company.

Another relief came from transfers of XRP to Ripple employees, which were also not deemed security transactions.

The logic of this ruling supports the idea that tokens offered in a decentralized manner, via exchange sales, IDOs, and other indirect methods, would probably not be interpreted as securities contracts.

The bad news for Ripple is that the judgment maintained that its earlier sales of XRP to institutions, which were based on direct contracts signed with the company, can be considered as securities offerings. This is not the final say on the matter: the ruling essentially states that the “institutional sales” part of the lawsuit can advance into a full trial, while programmatic sales will be left out of scope.

Big Implications for Altcoins and Other Tokens

Every token launch in the past few years came with a legal Damocles sword hanging on them: if the token was deemed a security, it would likely entail a costly legal battle with few chances of victory. Because of this, many approaches were developed to establish a “reasonable doubt” that the token is a security.

Airdrops, yield farming, and DEX-based sales were a way to quickly bootstrap markets for the token so that any potential sales of it by the team would be done on open and decentralized markets. Legal threats also pushed the industry back to a VC-centric funding model, as initial coin offerings to the public were deemed too risky.

The ruling seems to indicate that the decentralized offerings of tokens can now prosper, as there is more certainty about them being “kosher” for regulators. The institutional part of the funding model is now less safe, although there will likely be ways to circumvent these issues as well (for example, by focusing on providing funding for equity instead of tokens).

The bottom line is: expect more altcoins to be launched with “programmatic” sales, which will be available to regular people to participate in the early days. This would be a renaissance for the sector, likely sparking growth for the entire market.

For XRP and Ripple, Things are Still in Flux

The victory in this judgment is a great sign for XRP. For one, Coinbase (NASDAQ:COIN), Kraken, and other exchanges have already announced plans to relist the token, which should have positive effects on its price.

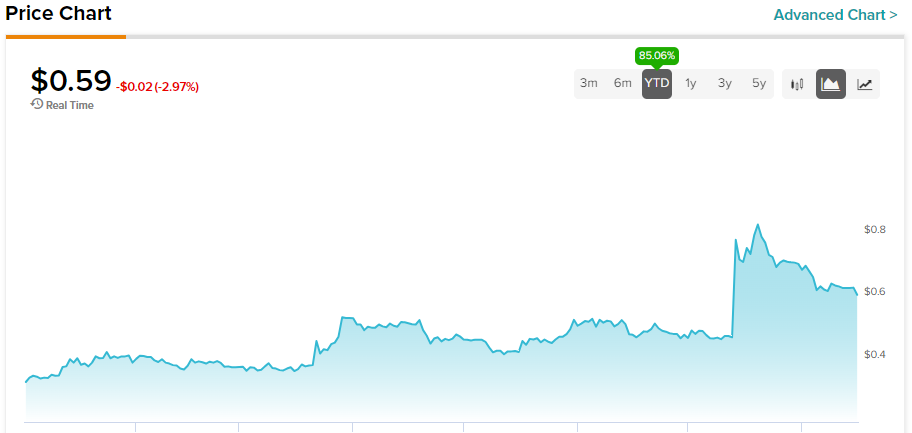

When the decision was announced, XRP had a massive +100% one-day rise. It has retraced since then, now hovering at around $0.59, a good 25% above its pre-ruling price.

However, it’s important to keep in mind that Ripple hasn’t won yet. Of the $1.3 billion in XRP that the SEC alleges that Ripple illegally sold, over $700 million were through institutional sales. This means that if the trial goes awry, at the very least, this money would have to be “disgorged,” or returned, in addition to likely fines.

This is a long-term outlook: it took three years to get to this interim point, so XRP still has plenty of breathing room left. Few would’ve expected even this kind of partial victory, so the prospects are certainly much more hopeful than they were years ago.

The project continues to develop and secure new partnerships, with the most recent one being with the famous motorcycle company Ducati.

Whether XRP will continue to recover here is unknown. The most optimistic path would be if Ripple and the SEC settled, conclusively eliminating the massive legal threat to the project (likely for a generous cash payment). If no settlement is in sight, the prospects for XRP will be situational, depending on crypto market sentiment and potential adoption initiatives.