After a dismal year in 2022, shares of semiconductor companies are on the rise. As semiconductor stocks mark a comeback, investors could leverage sector-focused ETFs, or exchange-traded funds, like VanEck Semiconductor ETF (SMH) and Direxion Daily Semiconductor Bull (SOXL) and Bear (SOXS) 3X Shares to capitalize on the recovery and reduce the overall risk. Let’s dig deeper.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Is SMH a Good ETF?

The SMH ETF tracks the MVIS US Listed Semiconductor 25 Index and thus is an attractive investment to capitalize on the recovery in semiconductor stocks. The SMH ETF has delivered an average annualized return of about 23% in the last 10 years (as of January 31, 2023), which is encouraging. Meanwhile, it has a low net expense ratio of 0.35%.

With total net assets of $7.5 billion, SMH’s three top holdings include Taiwan Semiconductor (NYSE:TSM), Nvidia (NASDAQ:NVDA), and Advanced Micro Devices (NASDAQ:AMD) stocks. Together, these three stocks account for 26.47% of the total holdings of SMH.

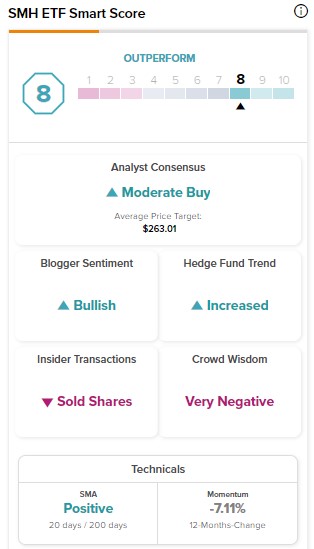

Overall, SMH ETF has an Outperform Smart Score of eight on TipRanks.

What Are SOXL and SOXS?

The SOXL and SOXS are leveraged and inverse ETFs, respectively. Notably, a leveraged ETF seeks to deliver multiples of the index’s performance it tracks. Meanwhile, an inverse ETF aims to deliver the opposite of the benchmark index’s performance.

The SOXL and SOXS ETFs aim for a daily return that is +300% or -300% of the return of the benchmark they track. The ETFs follow the ICE Semiconductor Index (ICESEMIT).

The expense ratio of SOXL remains a bit high at 0.90%. However, this ETF has delivered attractive returns. For instance, as of January 31, SOXL has generated an average annualized return of about 39.6% in the past decade.

The SOXL ETF has an Outperform Smart Score of eight. However, investors should note that leveraged ETFs are riskier, and investors with an appetite for risk should consider investing in them.

Bottom Line

The SMH and SOXL ETFs have an Outperform Smart Score on TipRanks, implying they are more likely to beat the broader markets with their returns. Meanwhile, investors can lower their risk and get exposure to multiple semiconductor stocks with these ETFs.