AI is here, whether we’re ready or not. The headlines and buzz around the recent launch of ChatGPT is only the tip of a much larger iceberg. The chatbot uses ‘generative AI’ tech, a machine learning system with the ability to create text, images, videos – and even computer code – that successfully mimics human communications, and it promises to stir up far more than just the tech industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At it base, AI technology involves a computer system that has been fed a huge amount of data, enough that it can be ‘trained’ to recognize patterns and even to make inferences when it encounters novel information – by referring back to what it was originally trained on. It’s data processing – but based on the model of human thought. While new, generative AI is already finding uses in marketing and advertising, digital art and video gaming, even in the writing of legal contracts.

Will it replace the human touch? In the short term, probably not, but farther on – we just don’t know yet. What we do know is that AI systems are turning into an economic engine. By the end of this year, it’s forecast that the total spend on AI systems will hit $97.9 billion, a 161% increase from the $37.5 billion collectively spent in 2019. That’s an impressive spend, and it’s sure to open up opportunities for investors willing to take a closer look.

Using the TipRanks database, we’ve pulled up the latest information on two stocks that are deeply involved in the AI boom. Both have made good use of AI tech in the past, and both are looking for further applications of AI in the future. According to the data, both hold ‘Buy’ ratings from the analyst consensus. Let’s take a closer look.

Shutterstock (SSTK)

We’ll start with Shutterstock, the popular online image library subscription service. The Shutterstock site and platform is particularly well-known – and well-used – by online digital creators, marketers, and graphic designers. The company boasts some 400 million royalty-free images in its library, available to subscribers.

In the last few months, Shutterstock has been unveiling a series of initiatives that will expand the role of generative AI in the company’s product offerings, as well as expand its partnerships with other tech firms to make use of AI capabilities.

In November, the company announced a joint venture with LG AI Research to train the LG AI system using Shutterstock’s vast collection of images and metadata. EXAONE, the ‘super-giant’ AI under development by the partnership, will be able to generate both visual images and captions in a creative way, based on its multi-modal architecture and the library of images and texts behind it.

In January, there were another two important AI-related announcements. In the first, Shutterstock made public its commitment to working with Meta on the latter’s major AI investment. Meta has plans to expand its AI and machine learning capabilities; these plans will be aided dramatically by access to Shutterstock’s libraries of images, music, and videos.

In the second January announcement, in what was perhaps the most important of Shutterstock’s AI-related notices, the company publicized its own AI image generator platform, a feature that is available for all Shutterstock customers, in any location or language served by the site. The platform uses text-to-image technology to convert text prompts into ready-for-license visuals. The AI platform is Shutterstock’s latest addition to its Creative Flow toolkit.

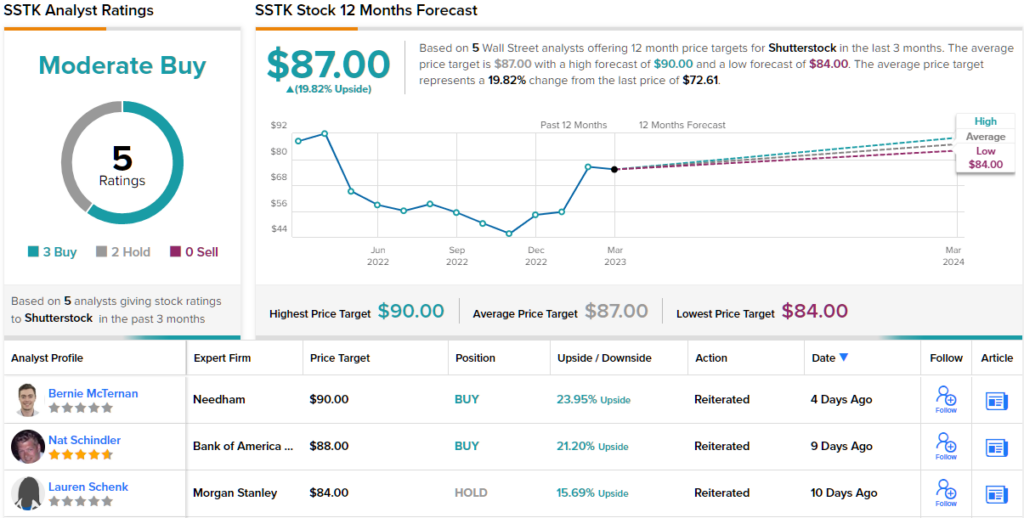

These recent, strong moves into the AI realm have not passed unnoticed by Wall Street. In his recent notes on Shutterstock, Needham analyst Bernie McTernan correctly notes the AI initiatives as Shutterstock’s most important recent moves.

“While currently a small revenue contributor, generative AI continues to gain steam. The most important thing we learned on generative AI is the deals have a recurring revenue stream, giving us confidence SSTK will be able to benefit from this seemingly mega-trend over multiple years… we think SSTK [has the] ability to continue to grow their core content marketplace while creating two additional growth engines which could ultimately be larger than their core content marketplace,” McTernan opined.

“We like the risk reward in shares as we do not believe consensus properly weights the AI bull case with SSTK leveraging their >600M content assets to train high paying third parties and leveraging this technology to increase the value of their subscriptions,” the analyst added.

McTernan goes on to put some numbers behind his stance, giving SSTK shares a $90 price target, implying ~24% one-year upside potential, and backing up his Buy rating. (To watch McTernan’s track record, click here)

Overall, the 5 recent analyst reviews on SSTK break down 3 to 2 in favor of Buys over Holds, for a Moderate Buy consensus rating. The stock is selling for $72.61 and the $87 average price target suggests ~20% upside for the next 12 months. (See SSTK stock forecast)

Adobe, Inc. (ADBE)

The second stock we’ll look at is another familiar name, Adobe. Most of us are familiar with PDF documents; the format was an early product of Adobe’s, and is still appreciated for its value in creating edit-proof documents that anyone can read. Adobe has expanded greatly since its early days, and now offers content creators a solid line-up of development tools, including InDesign, Illustrator, and Photoshop. These, and their sibling programs, are available by subscription to Adobe’s Creative Cloud.

On the AI side, Adobe has developed a platform, Adobe Sensei, to provide AI and machine learning features across the full range of its product line. Sensei is designed to smooth out the difficulties inherent in developing and then delivering the right customer experience for each and every customer. The Sensei platform uses the combination of AI and machine learning to assist content makers in creating perfect products, for informed decisions and better targeted marketing.

The AI features of Sensei represent an important shift in Adobe’s product line, particularly for the Creative Cloud products. The addition of AI into the tools has potential dramatically impact the day-to-day work of content creators, allowing them to produce final products on a faster timeline, with less lost motion and greater efficiency. Perhaps more importantly, however, Sensei can offer new Creative Cloud users a faster entry into using the product suite.

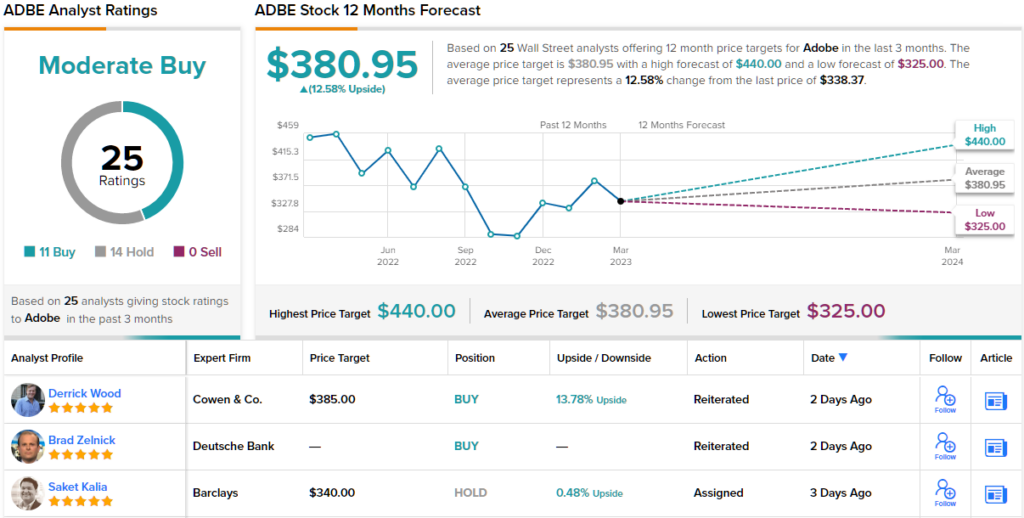

All of this has caught the eye of 5-star analyst Alex Zukin, from Wolfe Research. Zuken has looked ‘under the hood’ of Adobe’s AI development, and he sees it as a strong net positive for the company.

“From a monetization perspective there are a number of opportunities for ADBE. Most importantly, given ADBE ‘s market position, every single Generative AI platform is looking to partner with the company and build plug-ins into Creative Cloud. ADBE will lean into this and enable all the current and future tools to integrate directly so that subscribers can even bring their own models (proprietary or open-sourced). Also, since ADBE has known about Generative AI for years they have been building their own proprietary models and have a much larger cohort of researchers working on the opportunity vs. most of the startups in the category,” Zukin opined.

So, what does this all mean for investors? “We believe ADBE is a must own stock for 2023,” Zukin summed up.

Looking ahead from this position, Zukin cannot help but to give ADBE shares an Outperform (i.e. Buy) rating, and his price target, which he has set at $440, implies a 30% gain for the stock on the one-year horizon. (To watch Zukin’s track record, click here)

Tech stocks tend to attract a lot of attention, and ADBE is no exception – the stock has 25 analyst reviews on record, and they include 11 Buys against 14 Holds to give the company its Moderate Buy consensus recommendation. The shares have an average price target of $380.95, indicating room for ~13% growth from the current price of $338.37. (See ADBE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.