Republic Services (NYSE:RSG) stock has managed to successfully withstand the market’s turmoil thus far. As you can see below, shares have traded relatively flat over the past year, notably outperforming the S&P 500 (SPX), which has lost roughly 9% during the same period. Republic Services provides non-hazardous solid waste collection, transfer, disposal, recycling, and environmental services in the U.S. Its outperformance can be attributed to three distinct catalysts that provide compelling support for its investment thesis.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

At the same time, however, one particular reason, namely the stock’s hefty valuation, has not allowed the stock to record any notable gains. Overall, while I believe that Republic Services is likely to remain a robust low-volatility dividend-growth pick, its expensive valuation suggests that future returns could be limited. Accordingly, I am neutral on the stock.

The Bullish Case for RSG Stock: Three Key Factors to Keep in Mind

In my view, Republic Services’ bullish case is supported by three compelling factors. Firstly, its cash flows are highly predictable. Secondly, it has robust expansion prospects. Finally, its strong dividend growth is a testament to its financial stability. Let’s explore them!

Factor #1: Predictable Cash Flows

Given the current volatile macroeconomic landscape, investors can be highly appreciative of companies that feature highly-predictable cash flows. Republic Services certainly excels in that regard.

Specifically, Republic Services benefits from reliable cash flows due to the inherent stability of its operations, which primarily consist of waste collection and processing. The waste management industry is an essential service that is necessary irrespective of the economic climate, which translates into a constant demand for the company’s services, independent of any sudden shifts or turbulence in the macro environment. In other words, people will always produce waste, irrespective of whether the economy is in a recession or not.

Furthermore, the company’s cash flows are predictable because it operates in a contractual business model. Republic Services typically enters into long-term agreements with its governmental (municipalities) and corporate customers, which provides high cash-flow visibility into the future. In fact, about 80% of Republic Services’ revenues have an annuity-type profile, while 50% are linked to CPI or similar indices. This ensures a steady flow of growing revenues over the long term, especially during highly-inflationary environments like the current one.

Finally, the industry is highly oligopolistic, with Republic Services, Waste Management (NYSE:WM), and municipality-owned firms overlooking more than 75% of the domestic market share. In addition to being a capital-intensive industry, the market entry barriers are so high that any potential competitors are ultimately deterred, which reinforces the predictability of Republic Services’ cash flow.

Factor #2: Robust Expansion Prospects

The second factor that is currently powering Republic Services’ bullish case is the company’s robust expansion prospects. Due to a growing population and an upward trend in consumption patterns, the overall production of solid waste increases at a steady pace over time. Consequently, Republic Services can secure agreements for processing higher volumes of waste in the future, along with their regular pricing adjustments, contributing to consistent revenue growth over the years.

Over the past 10 years, Republic Services’ revenues have grown at a compound annual growth rate of 6.1%. In Fiscal 2022, revenue skyrocketed to $13.5 billion, a 19.6% increase compared to the previous year. While 9.6% of this growth can be accredited to their acquisition of US Ecology, the remaining 10% represents organic growth, in line with the aforementioned point concerning higher waste processing volumes and pricing adjustments linked to inflation.

Most importantly, the acquisition of US Ecology was accretive to earnings, which, combined with the underlying revenue growth, sustained Republic Services adjusted earnings-per-share growth. Specifically, adjusted EPS grew came in at $4.93 last year, an increase of 18.2% over Fiscal 2021.

Factor #3: Strong Dividend Growth

The third favorable catalyst RSG features is its strong dividend-growth potential. As the company has been able to grow its revenues and earnings fairly predictably over time, management has comfortably grown the dividend over the years. In particular, Republic Services’ dividend has grown for 18 consecutive years, with growth over the past 10 years averaging 7.7%.

Considering that management’s Fiscal 2023 projected earnings per share range of $5.15 to $5.23, after adjustments, suggests a payout ratio of 38% at the midpoint, it is highly probable that the company will sustain its bold dividend hikes. That’s another catalyst that should keep generating investor interest in the stock.

Is RSG Stock a Buy, According to Analysts?

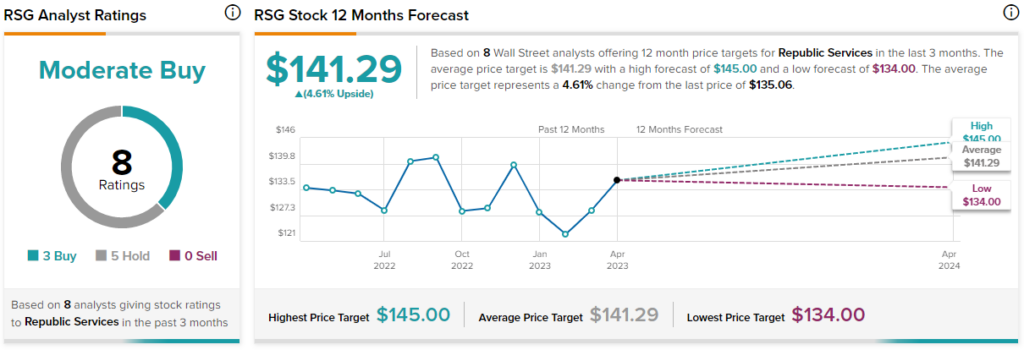

Turning to Wall Street, Republic Services has a Moderate Buy consensus rating based on three Buys and five Holds assigned in the past three months. At $141.29, the average Republic Services stock price target implies 4.6% upside potential.

Takeaway – Hefty Valuation Dilutes RSG’s Bullish Case

Republic Services is likely to remain a low-volatility investment even in a turbulent market environment, as investors are expected to continue gravitating toward the stock for the reasons previously mentioned.

That said, the stock’s hefty valuation — a key reason to avoid the stock — is likely to limit future upside, as it already implies that the company is priced to perfection. At the midpoint of management’s guidance, shares are currently trading at 26.2x earnings. This is a rich multiple in today’s high interest rate environment, even if Republic Services continues to grow in the high single digits. Hence, even though the stock may retain its premium multiple, I wouldn’t expect outperformance over the medium term.