Although the new normal’s wild housing market boon sent shares of full-service real estate brokerage firm Redfin (RDFN) flying throughout much of 2020 and 2021, the party appears to be over due to a severely challenged economic environment. Therefore, I am bearish on RDFN stock.

Few could have imagined at the very beginning of the COVID-19 crisis that the housing market would represent one of the biggest recipients of capital influxes. At the time, few people wanted to commit themselves to a life-changing acquisition like residential real estate.

Eventually, as the months went on, people with means recognized the once-in-a-blue-moon opportunity that the Federal Reserve was providing with its rock-bottom interest rates. As housing inventory dwindled, many folks naturally panicked, sparking remarkable bidding wars across the country.

Of course, RDFN stock benefitted cynically from the madness. During the spring doldrums of 2020, shares were trading around $12 a pop. At its peak in February 2021, RDFN was tantalizingly close to breaking above the triple-digit mark.

While the equity unit slipped from there, it still commanded a very respectable share price until early November. That’s when circumstances went ugly.

Unfortunately for those that chose to hold RDFN stock, circumstances don’t appear to be improving anytime soon. Real estate experts have now sounded the alarm, noting significant downturns in formerly hot regions like Boise, Austin, Nashville, Phoenix, and Sacramento.

While contrarianism may be exciting, the fundamentals likely do not support a risky gamble on Redfin.

Redfin’s Smart Score Rating

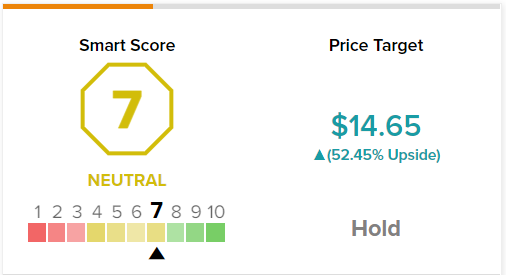

On TipRanks, RDFN has a 7 out of 10 Smart Score rating, giving it a “neutral” rating, indicating that it isn’t very likely to have a stellar performance, going forward.

RDFN Stock and the Housing-to-Income Gap

For anyone who has paid attention to the economic malaise of the post-COVID new normal, inflation has been a vexing headwind for households trying to get ahead.

The issue with an accelerated money supply without a corresponding increase in productivity is the eventual erosion of purchasing power. Essentially, the real earnings of workers suffer from an invisible tax, resulting in a lessened ability to acquire various products and services.

While it’s true that wages have increased nominally during this inflationary period, in real terms, the lift has not kept pace with inflation. Further, the gap between national housing prices (of homes sold) and the U.S. median household income has only widened, exacerbating wealth disparities and the broader viability of the real estate market.

Back in 1984, real median household income stood at $53,337, whereas the median sales price of homes sold was $79,950, or a home-price-to-income ratio of just under 1.5 times. At the peak of the last housing crisis (2006), the ratio hit 3.93, a remarkable statistic at the time.

However, this dubious record would not last long. Between 2017 through 2020, this ratio accelerated to 4.9 times. Even worse, using household income data from December 2021 of $72,933 and a median sales price of $396,800, the home-price-to-income gap soared to 5.44 times.

In other words, it’s not sustainable. Assuming no money down on a $396,800 home with a 6.66% interest rate on a 30-year fixed mortgage, the monthly payments would come out to be $2,550 – about 42% of the monthly gross payout of a $72,933 annual salary.

Under this scenario, RDFN stock arguably has nowhere to go but down.

The Financials Don’t Make Sense Either

Granted, it’s always difficult to predict what will happen in the broader economy. However, a deeper look into the underlying financials for RDFN stock also reveals a problematic profile.

While it’s true that Redfin posted revenue of $1.92 billion in 2021, along with first-quarter sales of $597 million that were up 123% year-over-year, the focus may shift toward the predictability of this growth. With clear evidence that formerly hot real estate markets are eroding in demand, growth is absolutely not assured in future quarters.

Also, investors need to consider the widening net losses. In 2020, Redfin posted $19 million of income in the red. In 2021, this stat widened to a net loss of $110 million. Further, in Q1 2021, net losses registered $91 million, expanding significantly from the year-ago quarter’s result of $36 million in the red.

With many if not most signs pointing to at least a slowdown in real estate valuation growth, the income headwind probably won’t ease up.

As well, Redfin’s free cash flow (FCF) is problematic. In 2020, the company generated free cash flow of $47 million. However, in the following year, this metric staggered to a loss of $329 million. Again, if prospective home buyers get spooked due to challenges such as high inflation and rising borrowing costs, FCF probably won’t improve.

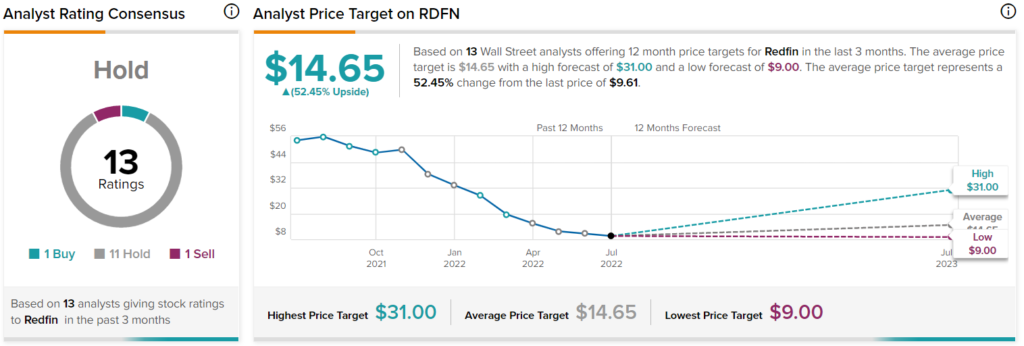

Wall Street’s Take on RDFN Stock

Turning to Wall Street, RDFN stock comes in as a Hold based on one Buy, 12 Holds, and one Sell rating. The average Redfin price target is $14.65, implying 52.5% upside potential.

Conclusion: Logic Suggests Staying Away from RDFN

While it might be enticing to purchase shares of a popular company that has dropped substantially this year, investors need to apply simple logic to RDFN stock.

Basically, evidence indicates that the underlying company’s total addressable market – the real estate sector – is declining. Further, Redfin has failed to deliver the goods on the fiscal front.

In combination, these two qualities make for a poor investment. Unless you have strong data to indicate otherwise, you’re likely better off staying away from RDFN stock.