Airfares have spiked in response to the robust demand and higher fuel expenses. A recent report from the Financial Times highlighted that airfares are rising at double the rate of inflation. However, this isn’t stopping travelers from booking a trip, as airline companies expressed optimism regarding travel demand during the most recent quarterly call. Let’s leverage TipRanks’ data to check which airline stocks are more likely to outperform as airlines are set to cash in on robust summer travel demand and higher fares.

Which Airline Stock is a Good Buy?

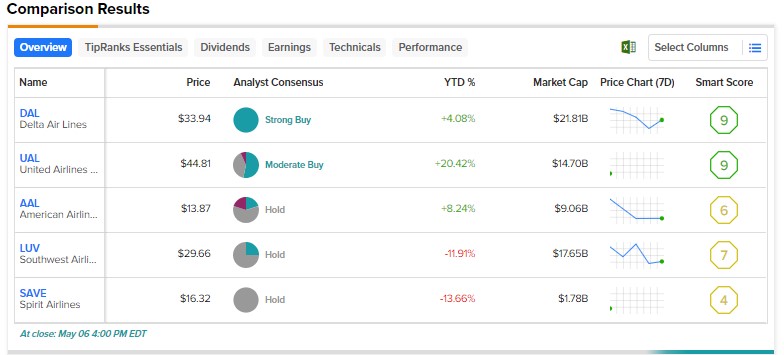

TipRanks’ Stock Comparison tool reveals analysts are bullish about Delta Air Lines (NYSE:DAL) stock. Further, it commands a high Smart Score, implying it is more likely to outperform the broader market averages than its peers.

During the Q1 conference call, DAL’s CEO, Ed Bastian, said that 2023 has started on a solid note with record advance summer bookings.

DAL’s top line increased about 45% year-over-year. At the same time, the company generated close to $2 billion in free cash flow, reflecting solid demand for summer travel.

Bastian added that with “visibility into the strength of summer travel demand, we are confident in our full-year guidance for revenue growth.”

Delta’s revenue is projected to increase by 15-20% in 2023. Management expects to deliver earnings in the range of $5 and $6 per share. The company’s full-year earnings outlook indicates year-over-year growth of 56-88%.

As DAL is befitting from solid demand, analysts are upbeat about its prospects. DAL stock sports a Strong Buy consensus rating based on 10 unanimous Buy recommendations. These analysts’ average price target of $50.40 implies a lucrative upside potential of 48.50%.

In addition, DAL has a positive signal from hedge fund managers, who bought its 3.7M shares last quarter. Overall, DAL stock has an Outperform Smart Score of nine.

Bottom Line

While concerns around pressure on consumer spending are real, the travel demand has been bucking the broader market trend indicating better days ahead for airline companies. As for DAL, sustained demand, focus on driving profitability, a Strong Buy consensus rating, and an Outperform Smart Score suggest it could outperform peers.