Ever since going public in 2020, GFL Environmental Inc. (NYSE: GFL) (TSX: GFL) has made a mark in the environmental services market of the United States and Canada. Its shares have surged 60.1% over the period. Further, the company’s prospects look bright and increase the investment appeal of its stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The $10.3-billion company has expertise in managing liquid and solid waste. It also provides soil remediation and infrastructure-related services. As of May 1, 2022, the company had at least 18,000 employees, 9,200 trucks, and 450 post-collection facilities.

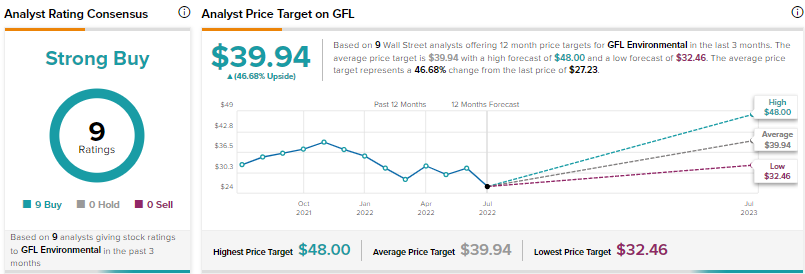

On TipRanks, the company has a Strong Buy consensus rating based on nine Buys. GFL’s average price forecast is $39.94, reflecting an upside potential of 46.68% from current levels.

Going Public Helped GFL Strengthen Its Balance Sheet

In March 2020, GFL Environmental offered to the public 75 million of its subordinate voting shares at the rate of $19 per share. Also, the company offered 15.5 million of 6% tangible equity units for $50 per unit. Shares of GFL started trading on the stock exchange on March 3, 2020.

From its initial public offering (IPO), the company received gross proceeds of $2.2 billion (or net proceeds of $2.09 billion). Part of the proceeds were used for the redemption of senior notes (with maturities in 2022, 2023, 2026, and 2027) and general corporate purposes, including repayments of debts and making acquisitions.

GFL’s Journey Underpins Its Growth Story

Since its listing, GFL Environmental has reported results for nine quarters. It surpassed consensus estimates in eight quarters but lagged in one. In May 2022, the company’s first-quarter 2022 bottom line surpassed expectations by 25%.

Also, in May 2022, the company announced that it had the authorization to purchase up to 16.5 million of its subordinate voting shares. Also, the company boosted its portfolio by acquiring Spring Waste Services in May.

In April 2022, GFL Environmental divested GFL Infrastructure Group Inc. through a spin-off transaction. GFL’s Founder and CEO, Patrick Dovigi, said “The spin-off of GFL Infrastructure is part of our ongoing strategy to rationalize our balance sheet to maximize the value of our asset base.”

“We intend to invest the proceeds received from the transaction in our robust near-term acquisition pipeline,” Dovigi added.

GFL also increased its quarterly cash dividend by 10% to $0.011 per share in April 2022. The company’s current dividend yield is 0.2%.

In December 2021, the company, via its subsidiary, joined forces with OPAL Fuels LLC for two renewable natural gas projects.

In November 2021, GFL conducted a secondary offering of 12.7 million subordinate voting shares.

In October 2020, the company added WCA Waste Corporation to its portfolio and solidified its footprint in the United States.

GFL’s Prospects and Projections Are Encouraging

The company is committed to boosting its organic growth prospects, working on reducing its costs of debts, and expanding footprints in renewable natural gas and CNG fields. Also, synergies from acquired assets are strengthening its position in the North American solid waste market. It is worth noting that the company made 22 buyouts in 2020, 45 in 2021, and 21 until May 1, 2022.

For 2022, the company anticipates revenues to increase 17-19% year-over-year and adjusted earnings before interest, tax, depreciation, and amortization to grow 19-22% from the previous year. Adjusted free cash is forecast to increase 28-34% from 2021.

The company is slated to report its results for the second quarter on July 27, 2022, before the market opens. The consensus estimate for earnings is $0.14 per share.

Hedge Funds, Insiders & Retail Investors Are Buying GFL Stock

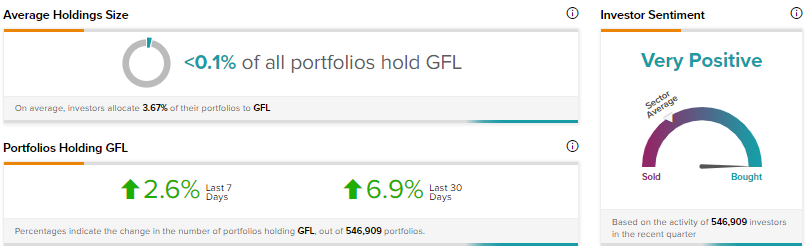

Investors seem to be using current price levels to gain exposure to GFL stock. Year-to-date, shares of GFL have declined 27.9%.

In the last quarter, hedge funds have purchased 110.9 thousand shares of GFL and corporate insiders have bought $997.6 thousand worth of GFL stock.

Also, investor sentiment is Very Positive on GFL, evident from a 6.9% increase in the number of portfolios holding the stock in the last 30 days.

Momentum to Stay Strong Going Forward

GFL Environmental is well-positioned to leverage a large addressable market, expertise in handling waste, solid asset base, and acquisitions made over time. This growing company is also rewarding shareholders well with dividends and share buybacks.

GFL has a ‘Perfect 10’ Smart Score on TipRanks, implying that the stock has the potential to outperform the broader market. Therefore, the stock could be a strategic fit for investors seeking exposure to the environmental services market.

Read full Disclosure