Realty Income (NYSE:O) is arguably the most famous monthly dividend stock among income-oriented investors. The retail REIT, having interests in 13,282 retail single-tenant properties, is often praised for its distinctive dividend growth track record. It has paid 639 consecutive monthly dividends and is a Dividend Aristocrat, boasting 29 years of dividend growth. In fact, I believe that the company’s pace of dividend growth could reaccelerate, moving forward. Thus, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Powers Realty Income’s Extensive Dividend Growth History?

Realty Income’s extensive history of consistently increasing dividends stands as a testament to the company’s enduring success. But what is it exactly that sets Realty Income apart when it comes to its ability to consistently increase its dividend compared to its peers? The answer lies in the outstanding expertise of its management and a conservative capital allocation strategy.

Realty Income’s leadership has navigated the company adeptly through various economic climates, emerging stronger even during challenging market conditions, such as the Great Financial Crisis and, most recently, the COVID-19 pandemic.

Do you remember how retail REITs, in particular, were severely affected during 2020 and 2021, as many retailers were forced to pause their operations? Impressively, not only did the company’s rent collections remain robust, but Realty Income even managed to continue to grow its AFFO per share every year despite the underlying challenges flogging the industry. In particular, Realty Income’s FFO/share in 2019, 2020, 2021, and 2022 landed at $3.30, $3.39, $3.59, and $3.90, respectively.

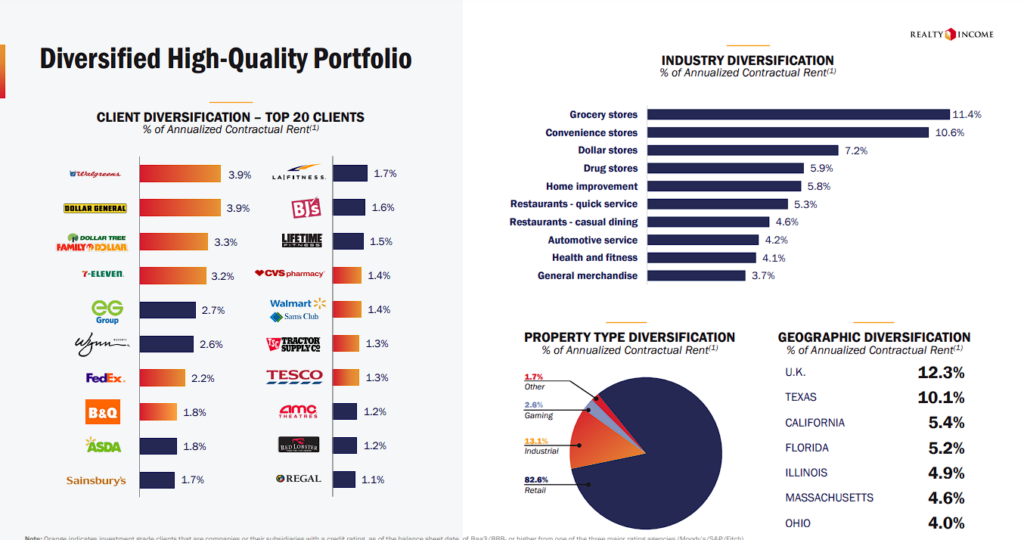

The “secret” to Realty Income’s success is investing in properties utilized by tenants that operate in essential industries. These include grocery (11.4% of annualized contractual rent), convenience (10.6%), drug stores (5.9%), and QSR restaurants (5.3%), among other resilient areas. Thus, most of its tenants are powerhouse, recession-proof firms, exemplified by industry leaders such as Walgreens Boots Alliance (NYSE:WBA), Dollar General (NYSE:DG), 7-Eleven, and Walmart/Sam’s Club (NYSE:WMT), to name a few.

These tenants continued to fulfill their rental obligations even during the pandemic, as their operations were hardly disrupted at the time. But beyond highly reliable tenants, Realty Income also enjoys an extended weighted average lease term of about 10 years. This combination translates into very predictable, multi-year cash flows, allowing management to act prudently on future investments without taking on too much risk. In turn, dividend growth hikes have been very consistent and frequent overall.

Dividend Growth Likely to Reaccelerate

As I just mentioned, Realty Income has managed to achieve a tremendous dividend growth track record due to the underlying qualities attached to its properties and their tenant/lease profiles. In line with its management’s prudent style, dividend increases have slowed in recent years. Sure, FFO/share continued to rise, but it makes sense to be more conservative during the pandemic and in the face of a rising-rate environment. That said, with interest rates likely to start coming down this year, this trend could flip.

For context, even though Realty Income has continued to increase its dividend (even multiple times within each year), the company’s LTM (last-12-month) five-year dividend CAGR (compound annual growth rate) stands at just 3.0%. This is down from 7.3% in the equivalent period in 2017.

However, with Realty Income growing its FFO/share at a more significant pace, its payout ratio has been on the decline. It was 89% in 2013, 82% in 2017, and 75% based on this year’s projected FFO/share of $4.11. The below-average payout ratio, combined with the possibility of declining interest rates in the coming quarters, which could further enhance profitability, should allow management to accelerate the pace of its dividend hikes.

Realty Income boasts an impressive A3/A- rating from Moody’s and S&P, affirming its solid standing. Notably, the company maintains a robust balance sheet, characterized by a remarkable 96% of unsecured debt and 93% of debt at fixed rates. This underscores the high level of confidence creditors have in Realty Income’s creditworthiness.

Further reinforcing this confidence is the extended weighted average term to maturity of 6.6 years for its notes and bonds. This lengthy duration positions Realty Income favorably, aligning with the expectation of falling interest rates by the time the company needs to refinance its obligations. This could prove to be a significant tailwind to Realty Income’s FFO/share as the company continues to scale.

Is O Stock a Buy, According to Analysts?

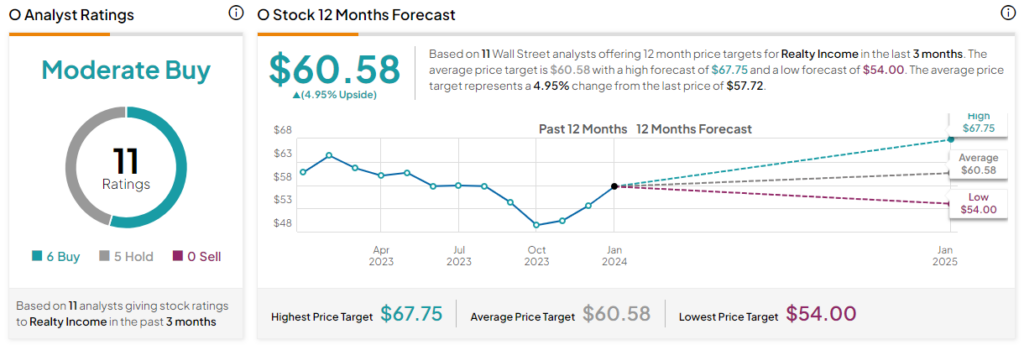

Turning to Wall Street, Realty Income stock features a Moderate Buy rating based on six Buys and five Hold ratings assigned in the past three months. The average Realty Income stock forecast of $60.58 implies 4.95% upside potential.

The Takeaway

Realty Income’s remarkable track record of consistent dividend growth is a testament to its resilient business model and competent management. The company’s focus on essential industries, reliable tenants, and a prudent capital allocation strategy has shielded it from economic downturns.

Despite recent conservative dividend increases, the potential for declining interest rates and a declining payout ratio suggests a future acceleration in dividend growth. Coupled with the fact that shares offer a rather attractive dividend yield of 5.3%, Realty Income remains a compelling choice for income-oriented investors, in my view.