Realty Income (NYSE:O), a retail real estate investment trust (REIT), has a solid reputation as a dependable option for income-seeking investors. What’s more, the company has been added to the S&P Dividend Aristocrat Index after increasing its dividends for the past 25 years, making analysts optimistic about the stock. Meanwhile, taking the positives into account, I am only cautiously optimistic about the stock due to its aggressive expansion strategy during challenging macroeconomic conditions, which may be risky.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Understanding Realty Income

Realty Income’s strategy is to acquire freestanding, single-tenant properties. These properties are then leased to a diverse range of tenants, spanning various industries such as convenience stores, pharmacies, dollar stores, and even well-known retail chains. The company’s portfolio includes 13,250 properties across 85 industries.

Its portfolio diversity and the quality of its tenants play a significant role in reducing risk. With a wide array of tenants operating in different sectors, the risk associated with a single industry downturn is minimized.

This strategy has enabled it to pay monthly dividends of $0.2565 per share, earning it the title “The Monthly Dividend Company.” Realty Income stock has returned 145% to investors in the last decade.

Improving Fundamentals

Realty Income earns rental income by leasing out properties, which is the source of its revenue. It primarily uses triple-net leases, where besides rent, the tenant also pays for maintenance costs, property taxes, and insurance.

Furthermore, the company’s lease agreements have a weighted average lease term of around 9.7 years, which means the company has recurring revenue.

In the third quarter, Realty Income’s revenue increased by 24.1% year-over-year to $1.04 billion, surpassing analysts’ expectations of $994.87 million. Earnings per share came in at $0.33, higher than the consensus estimate of $0.32 per share.

REITs are required to distribute 90% of their taxable income in the form of dividends to their shareholders. In the case of REITs, AFFO (adjusted funds from operations) measures the cash available to be paid out as dividends, similar to what net income measures for non-REITs. Realty Income’s AFFO increased to $721.4 million in Q3 from $603.6 million in the year-ago quarter.

Looking ahead, management expects AFFO to be in the range of $3.98 to $4.01 per share for the full year, up from $3.92 per share in 2022.

Does a High Dividend Yield Make Realty Income a Good Buy?

Realty Income has an appealing dividend yield of 5.3%. In comparison, the sector average is 3.91%. While the yield may entice investors, dividend payment consistency is important when selecting dividend stocks. The good thing is that Realty Income has proven its worth there as well. The December dividend increase marked its 123rd dividend increase since its public listing in 1994.

Furthermore, with an AFFO payout ratio of 76.3%, Realty Income’s dividends are sustainable, with more room for dividend growth.

However, the company has been on a spending spree recently, which is an added risk if things don’t go according to plan. Recently, Realty Income announced an all-stock agreement to acquire Spirit Realty Capital (NYSE:SRC) for a hefty enterprise value of $9.3 billion. This transaction is expected to “deliver over 2.5% accretion” to Realty’s annualized AFFO per share, according to management.

CEO Sumit Roy noted, “We expect that this transaction will create immediate and meaningful earnings accretion, while enhancing the diversification and depth of our high-quality real estate portfolio.”

Management also highlighted that Realty will not require any additional external capital to fund this agreement. Following regulatory approvals, the company expects to seal the deal in Q1 2024.

This transaction follows its $950 million investment in August to acquire Bellagio Las Vegas. Still, spending heavily on mergers and acquisitions during rising interest rate periods may not be a good idea. In Q3, the company invested $2.0 billion in 289 properties. This could explain Realty’s stock dip of 6.2% year-to-date, compared to the S&P 500’s (SPX) nearly 25% gain.

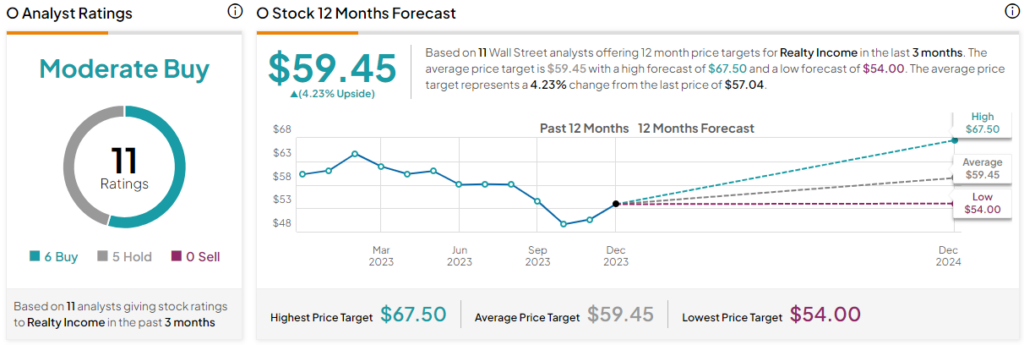

Is Realty Income Stock a Buy, According to Analysts?

Overall, Wall Street remains bullish on Realty Income stock, giving it a Moderate Buy rating. Following its third quarter results, analysts at Wolfe Research, Mizuho Securities, and Exane BNP Paribas upgraded the stock to Buy. Meanwhile, BofA maintained its Hold rating, citing the possibility that it is too early to be overly optimistic about the net lease REIT sub-sector. BofA, however, increased its price target for O stock to $55 from $52.

Out of 11 analysts covering the stock, six rate it a Buy, and five rate it a Hold. None rate it a Sell. The average O stock price target is $59.45, which implies upside potential of 4.2% from current levels.

The Verdict on Realty Income

Realty Income Corporation stands as an attractive option for investors seeking stability and consistent income from their investments. A proven track record of paying out monthly dividends, an attractive dividend yield, and a diverse portfolio make a compelling case for Realty Income.

While Realty Income’s diverse portfolio helps to mitigate some risks, larger economic challenges can still have an impact on its operations. As a result, I am cautiously optimistic that Realty Income will be able to maintain its dividend payouts over the long haul if it is smart with its finances.

Furthermore, TipRanks has also assigned a Perfect 10 Smart Score to Realty Income stock, indicating that the stock has a high probability of outperforming the broader market.