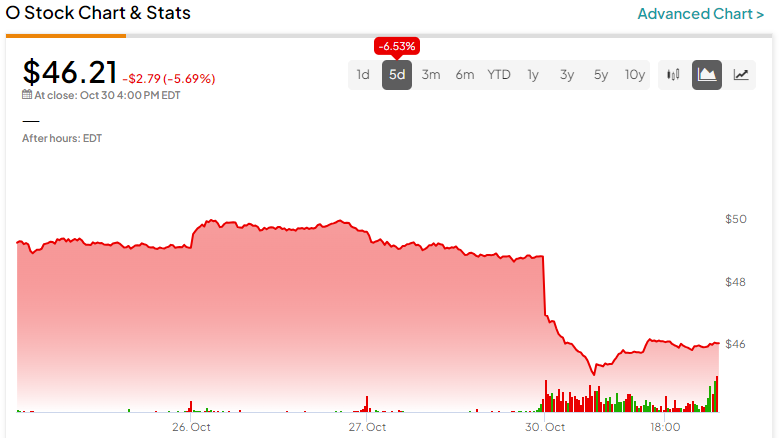

Realty Income Corp. (NYSE:O) stock got dumped today and has been falling all year long. Usually, I would consider buying the dip in a distressed real estate investment trust (REIT) stock that pays a generous dividend. However, I am neutral on O stock, as the near-term future is unclear for Realty Income.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in California, Realty Income Corp. is an American REIT giant that derives revenue from over 13,100 real estate properties. The company literally calls itself “The Monthly Dividend Company.”

I suppose it’s fair to say that Realty Income earned that title. After all, the company has increased its dividend payments 122 times since its public listing back in 1994. I wouldn’t be too hasty in buying O stock, though, as there are current and upcoming events to take into consideration before making any investment decisions.

Realty Income Stock is Under Pressure

Sure, it’s impressive that Realty Income Corp. offers a forward annual dividend yield of around 6.7%. For comparison, the average real estate sector dividend yield is 3.91%.

On the other hand, dividend payments aren’t a great consolation prize if the share price is falling. This year, O stock has dropped from more than $60 to around $46.

Surely, it’s not easy to operate a real estate business during a time of high interest rates. The U.S. commercial real estate market is in rough shape, and residential real estate is under tremendous pressure due to tight housing inventories and 8%-or-higher annual interest rates.

Adding to the sense of anxiety and uncertainty, Realty Income has a quarterly earnings event coming up on November 6. Unfortunately, the company posted an EPS miss for the second quarter, and that EPS result was worse than the result from the year-earlier quarter.

Soon, O stock could fly or fall as investors watch closely for Realty Income’s earnings data. Will the third quarter bring a better result than the previous one? At this point, it’s anyone’s guess.

Realty Income’s Pricy Acquisition

Considering Realty Income Corp.’s challenges amid a high-interest-rate environment, this might not be the ideal time to spend a lot of money on mergers and acquisitions. Nevertheless, Realty Income is boldly moving forward with a big-ticket buyout.

Specifically, Realty Income agreed to acquire Spirit Realty (NYSE:SRC). As you would expect, Realty Income Corp. President and CEO Sumit Roy hyped up the buyout in the official press release. Just to provide a quick recap, Spirit Realty mainly specializes in single-tenant real estate assets and controls a portfolio of around 2,000 retail, industrial, and other properties.

Roy had nothing but positive things to say about this acquisition, of course. It “will create immediate and meaningful earnings accretion, while enhancing the diversification and depth of our high-quality real estate portfolio,” Roy proudly proclaimed.

That’s undeniable, but this acquisition won’t be cheap. As it turns out, the Spirit Realty buyout will be an “all-stock transaction valued at an enterprise value of approximately $9.3 billion.”

In the wake of this announcement, Spirit Realty stock jumped, but Realty Income stock tanked. Evidently, investors are wondering whether Realty Income will actually get a good return on its sizable capital outlay. Maybe they also questioned whether Realty Income will be able to sustain its dividend payments.

Is Realty Income Stock a Buy, According to Analysts?

On TipRanks, O stock comes in as a Moderate Buy based on three Buys and seven Hold ratings assigned by analysts in the past three months. The average Realty Income price target is $62.80, implying 35.9% upside potential.

Conclusion: Should You Consider Realty Income Stock?

As you can see, analysts are only mildly enthused about Realty Income Corp., and investors are generally not hyped up about the company’s future. Moreover, passive income collectors might be wondering whether Realty Income’s dividend is safe and sustainable after the large buyout announcement.

It will take some time for Realty Income Corp. to justify its buyout of Spirit Reality. Also, there’s an earnings event coming up for Realty Income, and the outcome is uncertain. Therefore, I am neutral on O stock, and I feel that investors shouldn’t consider the stock right now.