Currently, the markets are experiencing a bullish trend. However, the conventional wisdom says that we’re looking at a recession, likely short and shallow, to play out during the second half of this year, with a chance of extending into 1Q24.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking at the situation from RBC Capital, Lori Calvasina writes, “There are two ways it can go from here: Something could go wrong with those winning companies and pull the market down, or the market’s leadership could broaden out. One of those paths isn’t automatically more likely than the other… We recommend a balance: some defensive stocks, some value, and some growth… [We] also like energy stocks. Energy has a high dividend yield relative to other sectors and versus its history, and energy companies have been active in buying back stock.”

RBC’s 5-star analyst Scott Hanold is following Calvasina’s lead, recommending two high-yielding energy dividend stocks, including one that yields around 8%. These strong dividend payers offer the protection of a steady income stream even through a downturn. Let’s take a closer look.

Chesapeake Energy (CHK)

We’ll start with Chesapeake Energy, an oil and gas production firm founded in 1989 and operating today in three high-output shale formations: the Eagle Ford of south Texas, the Haynesville of northwestern Louisiana, and the Marcellus shale of northeastern Pennsylvania. The company specializes in horizontal drilling and hydraulic fracturing, while implementing proven environmental protective measures to protect aquifers and other natural resources.

The Marcellus holding is Chesapeake’s largest, at approximately 465,000 net acres and production of 1.97 billion cubic feet equivalent per day. In the Haynesville formation, the company holds 370,000 net acres and produces 1.55 bcfe/d. The Eagle Ford assets are Chesapeake’s smallest, after the company sold off $2.8 billion worth of land holdings in the first quarter of this year. Chesapeake retains about 50,000 net acres focused in the ‘Rich Gas’ portion of this Texas play.

Altogether, these assets generated a total of 4.1 bcfe/d in 1Q23, and brought the company an adjusted net income of $270 million, or $1.87 per share by non-GAAP measures. This EPS figure beat the forecasts by 18 cents. In addition to its earnings beat, Chesapeake also generated $889 million in net cash from operations, and $241 million in adjusted free cash flow.

These latter two metrics are of particular interest to dividend-minded investors, as cash flow typically supports the dividend payment. Chesapeake’s last payment was sent out on June 6, at $1.18 per common share. The annualized rate of $4.72 gives a yield of 5.75%. Chesapeake’s dividend payment made up a significant portion of the $250 million-plus the company returned to shareholders during the first quarter.

Checking in with RBC’s Scott Hanold, we find that the analyst points to the company’s ability to maintain capital return as a key point for investors. In his comments on the stock, Hanold writes, “There are several potential catalysts over the coming quarters including increased buybacks, improving natural gas prices, and a sale of its remaining Eagle Ford asset. CHK plans to remain flexible with its natural gas directed drilling program that currently contemplates activity reductions over the next few months. There is flexibility to taper more budgeted activity if the natural gas macro remains weak, which we don’t anticipate at this time. The pacing of buybacks appear more ratable and amount to around 8% of the market cap through YE23.”

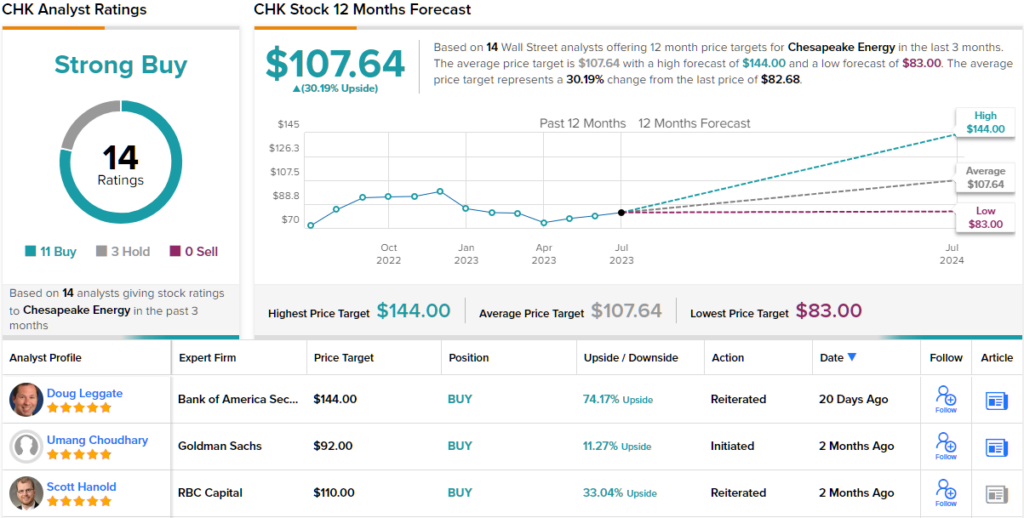

Hanold goes on to rate CHK shares as an Outperform (i.e. Buy), while setting a price target of $110 to indicate his confidence in a 33% upside potential for the coming year. (To watch Hanold’s track record, click here)

Overall, Chesapeake gets a bullish Strong Buy consensus rating from the Street, based on 14 recent analyst reviews that include 11 to Buy against 3 to Hold. The shares are selling for $82.71 and their average price target of $107.64 implies a 12-month gain of ~30%. (See CHK stock forecast)

Chord Energy (CHRD)

The second energy producer we’ll look at is Chord Energy, an operator in the vast Williston Basin, a major geological formation that spreads across the border regions of Montana-Dakota-Saskatchewan. Chord’s position in the formation is located mainly in North Dakota, although it does extend into Montana. The company is a major hydrocarbon producer, and holds 963,000 net acres in the Williston. In May of this year, Chord entered into an agreement with XTO Energy to acquire additional Williston acreage assets, in an all-cash transaction worth $375 million.

By the numbers, Chord saw total first quarter production volumes of 164.7 MBoepd, a figure that came in above the midpoint of the firm’s guidance. This total included 95.1 MBopd in oil volume. The company’s crude oil production beat the guidance high-end, based on accelerated activity and strong oil well performance.

Beating production guidance led to beating revenue and earnings expectations. In 1Q23, Chord saw $766.2 million in revenues from oil, natural gas, and natural gas liquids. The company’s total quarterly revenue came to $896.5 million, a total that was $219.8 million better than had been forecast. At the bottom line, Chord saw a non-GAAP EPS of $4.49. This was down from $8.32 in the year-ago quarter, but was 20 cents per share ahead of expectations. The company had $468.8 million in net cash from operating activities, and a quarterly adjusted free cash flow of $198.6 million. Chord had $592 million in cash on hand as of March 31 of this year, which it used in the XTO acquisition.

On the dividend, Chord declared its dividend in early May for a May 30 payment. The dividend included a base of $1.25 per common share and a quarterly variable dividend of $1.97, for a total payment of $3.22. Calculating forward, the total dividend annualizes to an impressive $12.88 per share and gives a high yield of 8.3%.

Tuning again to RBC’s Hanold, we find him tapping the free cash flow and acquisition potential as attractive features of this energy firm. Laying out his opinion on Chord, Hanold states, “CHRD’s leading FCF profile and cash position should provide investors and strong return along with the ability to compete for accretive M&A opportunities. Shareholder returns could start to be more balanced with buybacks, but a leading dividend likely remains the case as well. We see a nice path during 2H23 where capital spending tapers as production ramps higher.”

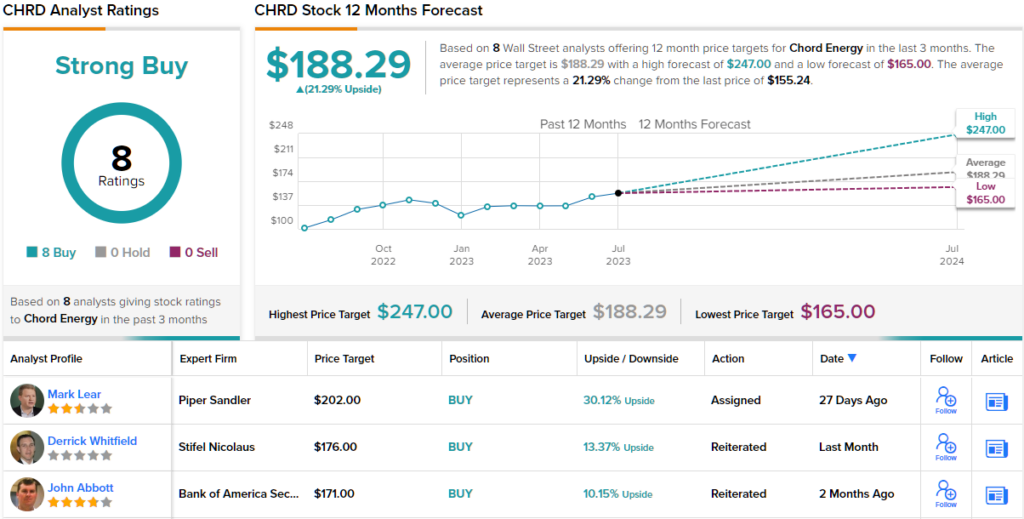

These comments back up Hanold’s Outperform (i.e. Buy) rating on CHRD, and his $185 price target implies a 19% upside going to the one-year horizon.

Zooming out a bit, we find that Chord gets a unanimous Strong Buy consensus rating from the Street’s analysts, based on 8 recent positive reviews. With the stock selling for $155.24 and carrying an average price target of $188.29, the shares have a one-year upside potential of 21%. (See CHRD stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.