Coming in the wake of a recent agreement to acquire Spirit Realty Capital in an all-stock transaction worth ~$9.3 billion, Realty Income (NYSE:O) released its Q3 report earlier this week, in what amounted to a solid showing from the blue-chip REIT.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company generated revenue of $1.04 billion in the quarter, amounting to a 24.2% year-over-year increase and beating the Street’s forecast by $84.22 million.

FFO (funds from operations) reached $1.04, thereby outpacing the forecast by $0.02. Moving forward, the company raised the low end of its 2023 normalized FFO guide from the range between $4.07-$4.15 to $4.08-$4.15, with the midpoint now above consensus at $4.11.

In the quarter, acquisitions reached $1.7 billion, generating an initial cash yield of 6.9%. The company noted that the margin on these transactions was 105 basis points, which is a decrease of 30 basis points compared to the previous quarter, and it fell below the typical 150 basis points due to a higher cost of capital.

Looking ahead, Realty Income raised its 2023 acquisition guide from $7+ billion to $9 billion, suggesting Q4 acquisitions will come in higher than $3 billion.

“While this does include the previously announced $950mm Bellagio deal,” notes RBC analyst Brad Heffern, “it is still a higher total than we were expecting given the recent rise in cost of capital.”

The company mentioned that a significant portion of these transactions were agreed upon around 6-9 months ago. Management also highlighted it is currently exercising a high degree of selectivity in new acquisitions to ensure that they align with the current cost of capital.

This is a point picked up by Heffern. “While a continued heavy acquisition pace is expected in 4Q23, O appears set to be more selective in re-establishing higher acquisition spreads given an elevated cost of capital,” Heffern explained. “That said, O noted the potential for 4-5% AFFO/sh growth in 2024 without raising equity, which is slightly better than we expected and gives us more confidence in our 5% 2024 growth (with equity) estimate.”

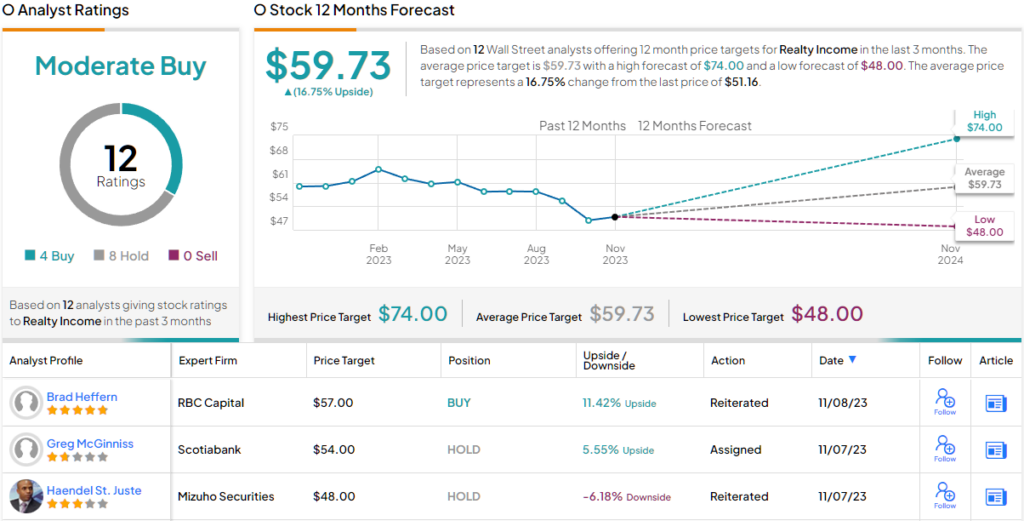

To this end, Heffern rates Realty Income shares an Outperform (i.e., Buy) and nudged his price target up from $56 to $57. (To watch Heffern’s track record, click here)

Overall, the stock claims a Moderate Buy consensus rating, based on a mix of 4 Buys and 8 Holds. The average target is more upbeat than Heffern will allow; at $59.73, the figure represents growth of ~17% in the months ahead. (See Realty Income stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.