Casino gaming is often perceived as a no-lose investment situation. After all, the house always wins, and investors can tap into those winnings. But the truth is more complex. The gaming industry depends on consumer spending and on consumers having disposable income. Macro headwinds, such as inflation or the threat of recession, can and do impact the casino industry’s bottom line, as do idiosyncratic issues like governmental regulation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These are just the sort of headwinds that have been hitting the industry recently, putting heavy pressure on casino gaming stocks. But even though shares are down for now, the casino industry as a whole is likely to emerge as a winner in the long term. The companies rest on an eternal truth of consumer spending – that people want to enjoy their leisure spending. Even in a difficult business environment, the casinos have both solid assets and reliable long-term prospects.

For RJ Milligan, 5-star analyst from Raymond James, this points toward buying now as a chance to ‘buy the dip’ in share prices, and he lays out his firm’s view clearly: “We believe disappointing results in 1Q, weaker-than-expected digital/online performance, and macro headwinds (higher rates/concerns about the consumer) have driven the stocks to compelling valuations. While there are headwinds in both Las Vegas and the Regionals, the stocks are pricing in significantly worse fundamentals vs. reality… We expect better results from the land-based casinos as we move through the year, improved profitability in the online/digital segments, and improving balance sheets as we move into 2025.”

Using the TipRanks platform, we’ve looked up the broader take on two of Milligan’s casino picks, finding that both get ‘Buy’ ratings from the Street consensus and offer investors robust upside potential. Here are the details and the Raymond James commentaries.

Caesars Entertainment, Inc. (CZR)

The first stock we’ll look at here, Caesars, is the current iteration of an old casino name. This modern incarnation of Caesars was formed through a 2020 buyout action, when Caesars Entertainment Corporation was acquired by Eldorado Resorts – and formed into the current Caesars Entertainment, Inc. The company now boasts a market cap of $7.7 billion, owns and operates more than 50 destinations, including gaming venues and resorts, and bills itself as the largest gaming company in the US markets.

The company’s entertainment venues, casinos, and hotels operate under several brand names, including Caesars Palace, Eldorado, Harrah’s, Reno, and Circus Circus, among others, and the company has locations in over 20 states as well as internationally. Customers and guests at a Caesars Entertainment venue can find dining, nightlife, great casino gaming, or just simple relaxation. Earlier this month, the company announced the opening of Harrah’s Racing & Casino in Columbus, Nebraska, marking its entry into the Cornhusker State – and the 22nd state overall with a Caesars Entertainment operation.

The impact of the current headwinds can be seen in Caesars’ recent financial results. Quarterly revenue in Q1 was reported as $2.7 billion, down 3.2 percent year-over-year and missing the forecast by $90 million. The company reported a net EPS loss in Q1 of 73 cents per share, a loss that was 10 cents per share deeper than that in 1Q23 – and was 65 cents per share deeper than had been expected. The company finished 1Q24 with $726 million in cash and liquid assets on hand, and management stated plans to use free cash flow to pay down existing debt.

While the company put a positive spin on the quarterly results, but that hasn’t helped investor sentiment. Overall, the shares are dowb by 24% year-to-date.

For RJ analyst Milligan, however, this pullback has simply given the stock a better point of entry. He acknowledges that the earnings release was ‘disappointing,’ but believes that the investor reaction was overdone, and sees the potential here outweighing the negatives. Milligan writes of Caesars Entertainment, “After a disappointing 1Q and subsequent sell-off in the stock, CZR shares are now trading at just 6.5x 2025E EV/EBITDAR, which we view as a very attractive entry point. Outside of the 1Q noise in the land-based operation business (which we view as one-time in nature), there are two major investor hang-ups that have weighed on CZR’s multiple: digital profitability and higher leverage. We see a clear path to resolving both issues, with the digital business beginning to deliver positive EBITDA and a path for CZR to meaningfully de-lever using free cash flow.”

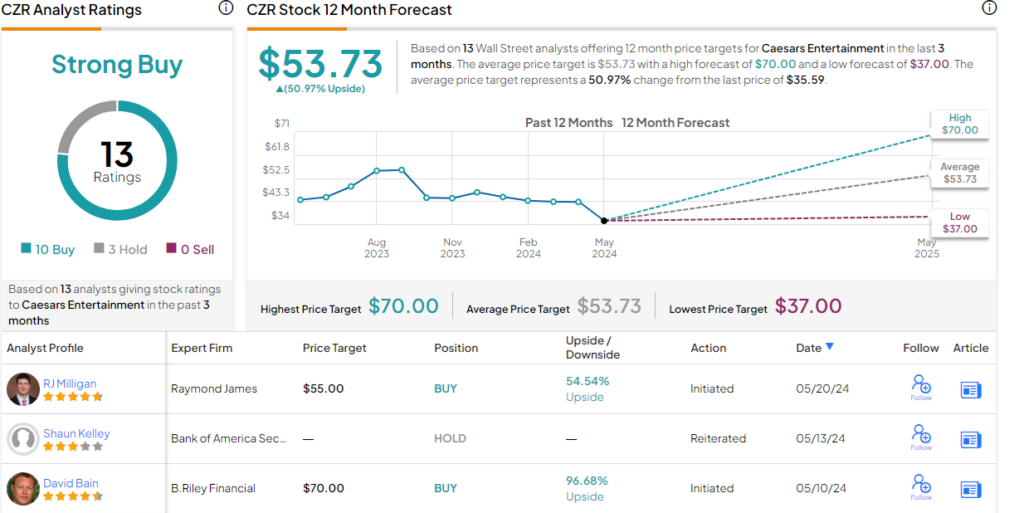

All told, Milligan rates CZR as a Strong Buy and describes it as his ‘top pick’ in the gaming industry. With that rating, he also sets a price target of $55, implying a one-year upside potential of 54.5%. (To watch Milligan’s track record, click here.)

Overall, Caesars holds a Strong Buy consensus rating from the Street, based on 13 recent analyst reviews that include 10 Buys and 3 Holds. The shares are trading for $35.59 and their $53.73 average target price points toward a 51% gain on the one-year horizon. (See Caesars Entertainment’s stock forecast.)

Boyd Gaming (BYD)

With nearly 50 years of experience behind it, Boyd Gaming is a leader in US casino operations. The company operates in 27 top-notch locations, spread out from Las Vegas to the Mississippi River, and features more than 100 attractions – casinos, dining, live entertainment, and fine hotel amenities – in more than 15 cities. Boyd has always been known as a specialist in gaming entertainment, and its venues feature everything that gamers expect from a casino experience: exciting live poker, classic table games like blackjack and roulette, the best new slot machine titles, and even high-payback video poker terminals.

Boyd hasn’t put all of its chips down on the casino number, however. The company has plenty more to attract customers to its venues, including a solid rewards program and sports betting featuring both professional and collegiate leagues, based on current game scores and real-time wagering. The company also features FanDuel Sportsbook at its Boyd Rewards locations, letting fans bet on spreads, single bets, and much more, for all of the major US sports leagues, from pro football, basketball, and baseball, to golf, boxing, motorsports, and even soccer. The widely popular college football and basketball games are also included. Boyd’s customers can even get into online gaming, with the Stardust social casino.

In its last quarterly earnings release, which covered 1Q24, Boyd reported a top line of $960.5 million, relatively flat year-over-year (down by less than half a percentage point) – and nearly $6 million over the pre-release estimates. The bottom line figure, a non-GAAP EPS of $1.51 based on $147.3 in total adjusted earnings, was down more than 11% year-over-year and missed the forecast by 8 cents per share. Shares in Boyd are down 12% this year, with the bulk of that loss coming in the immediate aftermath of the Q1 release.

Even though the company reported mixed earnings results, management has reaffirmed its commitment to supporting the share price and returning capital to stockholders. On May 13, the company announced an addition of $500 million to its share repurchase authorization, and declared a common share dividend of 17 cents per share for payment on June 15. This dividend marks the 10th consecutive quarterly declaration since the company restarted the payment post-COVID.

We’ll check in again with Raymond James’ Milligan, who sees several reasons to buy into Boyd now, particularly given the stock’s current value proposition. He says, “After a whipsawing of short-term outlooks, it appears investors have become motion sick, deciding to get off the rollercoaster and take a wait-and-see approach (prompting a buyer’s strike). While we expect 2Q to be another difficult quarter (partially driven by tough y/y comps), we view the post-1Q selloff as a clearing event, as reset EBITDAR expectations are already more than priced into the stock, and view BYD shares as a longer-term value play.”

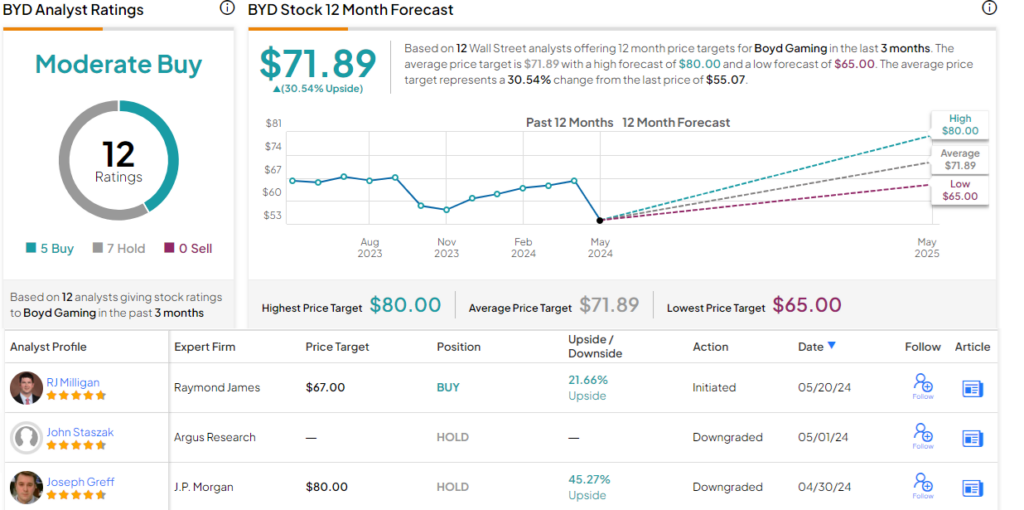

Milligan follows up this stance with an Outperform (Buy) rating on the stock, and a price target of $67 that suggests a one-year gain of 21.5%.

The broader Street view of BYD, based on 5 Buy and 7 Hold ratings, is a Moderate Buy consensus. The shares are trading for $55.07, and their $71.89 average target indicates potential for a 30.5% upside in the next 12 months. (See Boyd Gaming’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.