Palantir (NYSE:PLTR) investors were enjoying proceedings following the markets’ open on Tuesday. Shares blasted higher after the big data specialist’s Q4 results beat expectations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company generated revenue of $508.62 million in the quarter, amounting to a 17.5% year-over-year increase and coming in ahead of the Street’s call by $3.64 million. Segment-wise, government revenue rose by 23% y/y to $293 million while commercial revenue notched an 11% uptick to clock in at $215 million. On the bottom-line, at $0.04, adj. EPS beat the analysts’ $0.03 forecast.

Palantir did disappoint on the sales outlook, however. Revenue for Q1 is anticipated to be in the $503 million to $507 million range, below consensus at $520.3 million. For the full year, revenue is estimated to hit the range between $2.18 billion to $2.23 billion. The Street was calling for $2.29 billion.

Nevertheless, investors were happy to ignore that miss and focus on the company’s improving profitability profile. So does Raymond James analyst Brian Gesuale, who notes that improvement should not be underestimated. With GAAP EPS coming in at $0.01 – reflecting a GAAP profit for the first time in nearly 20 years – and the company anticipating 2023 will be its first profitable year, the “surprise-milestone” along with the topline beat should “put a dent” in the PLTR bear case, says the analyst. Moreover, Gesuale thinks Palantir’s unique attributes make it well-positioned to deal with the macro climate.

“As global geopolitical tensions persists and macro uncertainty remains, we believe companies, like PLTR that are indexed (56% of sales) to non-cyclical government budgets sit on an advantageous perch that drives more stability in its results,” the 5-star analyst explained. “We see past contract performance, technical capabilities, and culture aligned with western governments as uniquely positioned to grow their government business from $1 to $2 B in ~3 years irrespective of macro conditions. This would also fuel positive estimate revisions across the Street which has generally underestimated the government opportunity.”

Further highlighting the company’s positive cash flow, the path to profitability, and expectations that look “reasonable,” Gesuale reiterated a Strong Buy rating and $15 price target on PLTR shares. What’s in it for investors? Upside of 54% from current levels. (To watch Gesuale’s track record, click here)

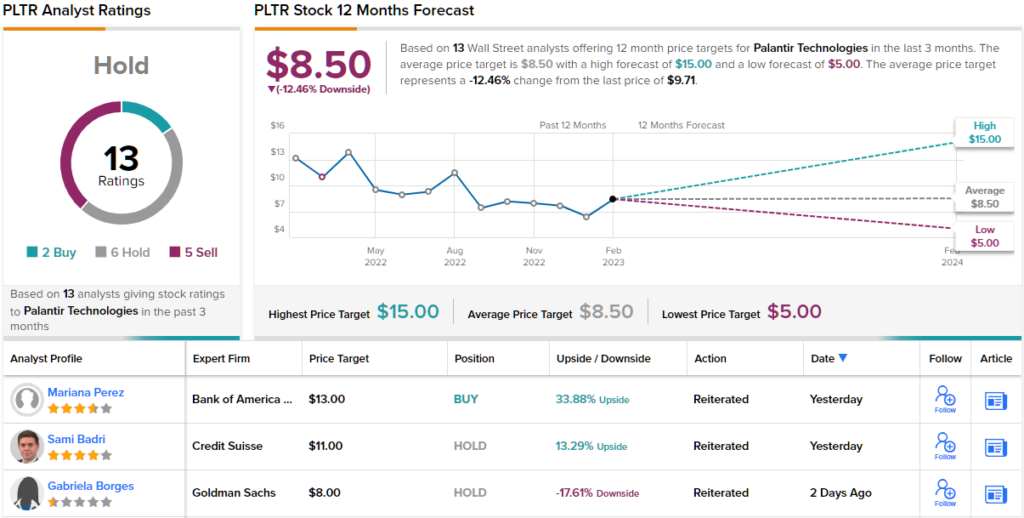

However, Gesuale’s positive take is an anomaly on the Street right now. The ratings breakdown into 1 Buy, 4 Holds and 5 Sells, all culminating in a Moderate Sell consensus rating. Given the $7.56 average target, the stock is projected to lose 12.5% of its value over the coming months. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.