Generally, investors with a low-risk appetite buy shares of large-cap companies, defined as stocks with a market cap of more than $10 billion. On the other hand, people with a higher risk profile may invest in small-cap stocks or even penny stocks with an eventual goal of outpacing the broader markets. But investors can also consider mid-cap stocks to benefit from a combination of consistent top-line growth and improving profit margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Typically, stocks with a market cap of between $2 billion and $10 billion are defined as mid-cap stocks. One mid-cap stock that has outpaced the broader markets in the past decade is Rambus (NASDAQ:RMBS). Valued at $6.75 billion by market cap, RMBS stock has surged nearly 700% in the last 10 years and almost doubled in 2023. Despite its outsized gains, I am bullish on Rambus stock due to its reasonable valuation, strong balance sheet, and steady revenue growth.

An Overview of Rambus

Rambus is a semiconductor company that manufactures chips and silicon IP. Its portfolio of products enables performance improvements for data centers and other markets. Basically, Rambus offers solutions to improve data bandwidth, capacity, and security from the cloud to consumers.

Rambus is among the major players in the high-performance memory subsystems vertical, solving for the bottleneck between memory and processing for systems that are data intensive.

Founded in 1990, Rambus went public in 1997 and has since returned 976% to shareholders. In this period, the S&P 500 (SPX) has gained 783% after adjusting for dividends.

How Did Rambus Perform in Q3 2023?

Rambus reported revenue of $105.3 million in Q3, as licensing revenue stood at $57.9 million, followed by product revenue at $52.2 million and contract sales at $24.2 million. It also ended the quarter with an operating cash flow of $51.6 million.

The company’s sales were down around 7% year-over-year as enterprises reigned in spending to tide over a volatile global economy. A decline in revenue, as well as changes in working capital, meant Rambus reported an operating cash flow of $51.6 million, well below the prior-year period of $80 million

With capital expenditures of $11.4 million, Rambus reported free cash flow of $40.2 million in the quarter. Rambus forecasts licensing billings between $56 million and $62 million in Q4, while product sales are estimated between $52 million and $58 million.

In Q4 2022, Rambus reported revenue of $122.4 million. Comparatively, total sales are forecast at $135 million in Q4 of 2023, an increase of 11% year-over-year.

Rambus emphasized that it delivered a strong third quarter, as revenue and earnings were above its midpoint guidance despite an uncertain macro environment.

Its positive cash flows allowed Rambus to recently complete its share buyback program worth $100 million. Further, Rambus closed the sale of its IP business as it focuses on the development of differentiated chips to gain traction in the data center market.

Rambus explained that the sale of its business and consistent cash flows allowed it to increase its cash balance by more than 40% year-over-year in the September quarter.

What’s Next for Rambus Stock?

Rambus is bullish on generative AI (artificial intelligence) and data-intensive workloads, which should drive demand for memory performance and capacity across the data computing landscape.

In the last few months, demand for AI servers with advanced CPUs and DDR5 rams has skyrocketed, as companies are training large language models to expand their AI capabilities. The DDR5 RAM (Double Data Rate 5 Synchronous Dynamic Random-Access Memory) aims to reduce power consumption while doubling bandwidth compared to predecessors such as the DDR4 RAM.

Additionally, high-performance servers powered by DDR5 are seeing higher demand to meet growing computing infrastructure requirements for AI players.

During the company’s earnings call, CEO Luc Seraphin stated, “As the industry builds out the infrastructure for the broadening adoption of AI, we look forward to continued innovation and growth in server CPUs as well as workload optimized accelerators. This trend also creates opportunities for our silicon IP business.”

Is Rambus Stock Undervalued?

Rambus is part of the cyclical semiconductor industry, which suggests its revenue and earnings will fluctuate during periods of sluggish demand. However, the company is forecast to increase sales by 22.4% year-over-year to $557 million in 2023 and by 14.4% to $637 million in 2024. Comparatively, adjusted earnings are forecast to rise from $1.76 per share in 2023 to $2.17 per share in 2024.

So, priced at 31.5x forward earnings and 11.6x forward sales, RMBS stock trades at a premium, making it very difficult for the tech company to replicate its 2023 gains this year. For instance, the median forward price-to-earnings multiple for the sector is much lower at 23.5x, which indicates RMBS stock trades at a premium of 54% right now.

Is RMBS Stock a Buy, According to Analysts?

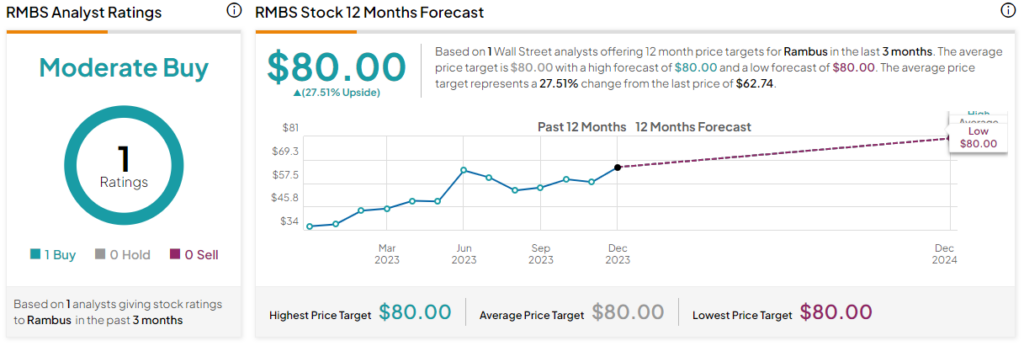

Just one Wall Street analyst covers Rambus stock. With one Buy rating assigned in the past three months, RMBS stock’s price target is $80, indicating upside potential of 27.5% from current levels.

The Takeaway

Rambus generates a majority of its sales from licensing, allowing it to generate cash flows across market cycles. A debt-free company, Rambus ended Q3 with $375.5 million in cash and almost $1.2 billion in total assets.

While its lofty valuation may limit its upside potential in the near term, the company is well-positioned to take advantage of the secular trends surrounding the generative AI vertical in the upcoming decade.