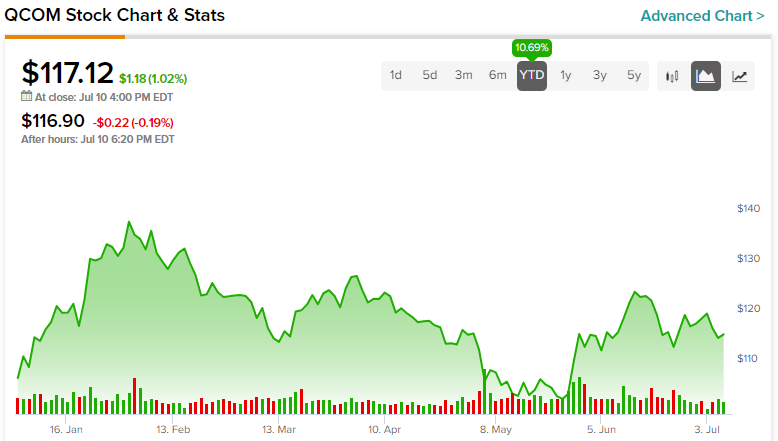

Shares of Qualcomm (NASDAQ:QCOM) have lagged over the past few months, hovering between $100 and $120, despite the overall market gaining notably during the same period. At roughly $117 today, the semiconductor behemoth is still trading considerably lower from its early 2022 highs of $193. While such a decline may suggest that Qualcomm’s future outlook has softened, this is hardly the case. The company, in fact, remains at the forefront of innovation in the semiconductors space.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The share price decline is most likely attributable to the fact that Qulacomm’s sales and profits will take a hit from last year’s record levels, as semiconductor oversupply and industry cyclicalities will leave a temporary mark. That said, the company’s overall growth trajectory, juicy profitability, and strong capital returns comprise a compelling investment case. Accordingly, I am bullish on QCOM stock.

Industry Cyclicalities to Affect Financials, but Not for Long

The semiconductor industry is wildly cyclical due to several reasons, including the pace of technological advancements, seasonality/product cycles, inventory management, as well as the fact it is capital-intensive in nature.

Having concluded Fiscal Year 2022 on a high note, with Qualcomm witnessing an extraordinary increase in revenues and profits by approximately 32% and 43% to amass $44.2 billion and $12.9 billion, respectively, the company also encountered the unavoidable effects of industry cyclicality as it transitioned into Fiscal 2023.

Specifically, in the most recent Q2-2023 results, Qualcomm recorded revenues of $9.3 billion, representing a decline of about 17% compared to the previous year. Although Automotive revenues demonstrated growth of 20% year-over-year, driven by the widespread adoption of its Snapdragon digital chassis, revenues from Handsets and IoT experienced declines of 17% and 24%, respectively.

This downturn primarily resulted from challenging macroeconomic conditions affecting demand and channel inventory reduction. Management anticipates that macroeconomic headwinds, weaker global demand for handset units, and channel inventory drawdown will continue to impact Fiscal Q3. Consequently, they expect revenues to range between $8.1 billion and $8.9 billion. This implies a decline of approximately 22.3% at the midpoint, aligning closely with the performance observed in Fiscal Q2.

It is worth noting that the industry’s outlook hasn’t shown some improvement since the release of Qualcomm’s Fiscal Q2 report. Notably, industry bellwether Samsung Electronics recently stated that it anticipates a 96% decline in its Q2 operating profit due to the ongoing chip oversupply.

However, it is crucial to provide a contextual perspective. The current decline in Qualcomm’s revenues and profits can be attributed to the exuberance experienced last year, which was fueled by exceptionally favorable supply and demand dynamics. Nevertheless, Qualcomm’s success remains evident when we examine the long-term trend.

Take, for example, the $9.3 billion achieved in Fiscal Q2, which indicates a year-over-year decrease of 17%. This figure still surpasses fiscal Qualcomm’s Q2-2021 revenues by 17.8%. Fluctuations of this nature in financials are customary within the industry and should not cause concern for investors, particularly in the case of Qualcomm, due to its market-leading position and established dominance in the field. As inventories normalize and the macro environment improves, positive surges should also make a comeback.

Capital Returns Increasingly Attractive Following Share Price Decline

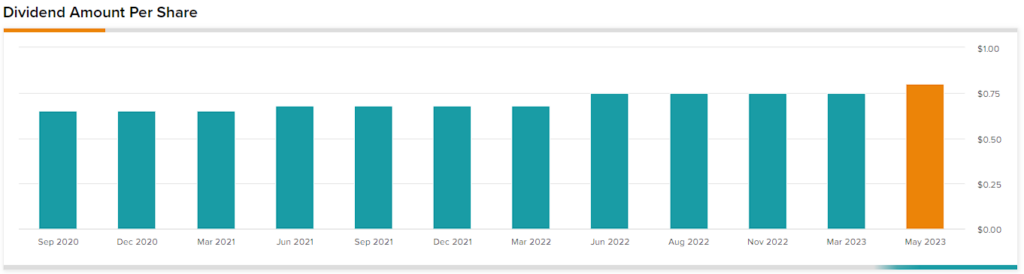

Another reason I like Qualcomm following its share price decline is that its capital returns have become increasingly attractive. Just this past March, Qualcomm increased its dividend by 6.7%, now boasting 20 years of uninterrupted dividend hikes.

Interestingly, the company will soon attain Dividend Aristocrat status if it stays on course, but more importantly, the combination of a dividend increase and the stock price decline has now pushed the yield to a decent 2.7%. This isn’t a massive yield in today’s rising-rates environment but certainly a noteworthy one given Qualcomm’s unwavering commitment to growing its payouts for two decades now.

Further, Qualcomm features a tremendous history of stock buybacks, having repurchased roughly 35% of its outstanding shares since 2013. During Fiscal Q2 alone, Qualcomm repurchased $903 million worth of stock. With shares trading at just 14x and 12x Wall Street’s expected earnings per share for FY2023 and FY2024, Qualcomm’s management should now have to repurchase shares at an even more discounted valuation than a couple of years ago.

Is QCOM Stock a Buy, According to Analysts?

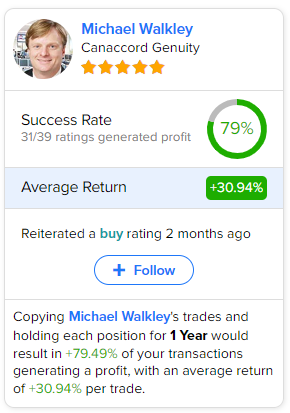

Regarding Wall Street’s sentiment, Qualcomm features a Moderate Buy consensus rating based on 14 Buys and six Holds assigned in the past three months. At $135.26, the average Qualcomm stock price target implies 15.5% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell QCOM stock, the most profitable analyst covering the stock (on a one-year timeframe) is Michael Walkley from Canaccord Genuity, with an average return of 30.94% per rating and a 79% success rate.

The Takeaway

Despite a recent decline in Qualcomm’s share price and the challenges posed by industry cyclicality, the company’s long-term growth trajectory, profitability, and dominant position in the semiconductor market make it an appealing investment. While short-term financial fluctuations are to be expected in this industry, Qualcomm’s solid fundamentals and commitment to capital returns, including dividend hikes and stock buybacks, further enhance its attractiveness.