I am bullish on Qualcomm (QCOM). It is the world’s No. 2 supplier of smartphone processors. Selling processors and 5G chipsets is a $16.5-billion annual business for Qualcomm.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This company’s stock is trading at 26.8% discount to its 52-week high of $167.94. (See Analysts’ Top Stocks on TipRanks)

Snapdragon Brand Is Strong

Qualcomm’s market share in smartphone application processors is down to 24%. On the other hand, most high-end and mid-range Android phones and tablets still use Qualcomm’s Snapdragon processors.

Mediatek (MDTKF), the No. 1 company now, sells Dimensity processors, which are usually used inside sub-$300 phones and tablets. Microsoft’s (MSFT) new $700 dual-screen smartphone uses a 5G-enabled Snapdragon 855 System-on-Chip.

Qualcomm’s refusal to challenge Mediatek’s dominance in entry-level smartphone processors is why QCOM has a net income margin of 28.3%. The net income margin of Mediatek is 19.1%.

Higher profitability is preferable over market share numbers. The smartphone application processor industry is expected to become a $38.2-billion business by 2023.

Qualcomm’s foundry partners are TSMC (TSM) and Samsung. There’s no need to worry that Qualcomm might suffer a supply shortage of Snapdragon processors.

Windows 11, Chromebook Tailwinds

The commercial launch of Windows 11 on October 5 is a solid tailwind for Qualcomm’s Snapdragon 7C processors for laptops and desktop computers. The new HP (HPQ) 14 Windows 11 laptop is powered by an 8-core Snapdragon 7C Gen 2 processor.

Qualcomm is now selling TPM 2.0-compliant processors for the $161.9-billion personal computer industry. The Snapdragon 7C processor is also used in some Chromebooks. Sales of Chrome OS laptops are growing at 35% CAGR.

Forty million Chromebooks are expected to be sold this year. Many of those would be powered by Qualcomm’s Snapdragon 7C.

Affordable Valuation Ratios

The 14.1% three-month decline of QCOM has made it more affordable. Its forward P/E is only 13.3x, and its TTM Price/Sales is 4.3x. These ratios are much lower than Nvidia’s (NVDA) 44.2x and 23.5x.

The Piotroski F score of QCOM is 7, indicating that it has a robust financial health, and offers excellent investment value.

Wall Street’s Take

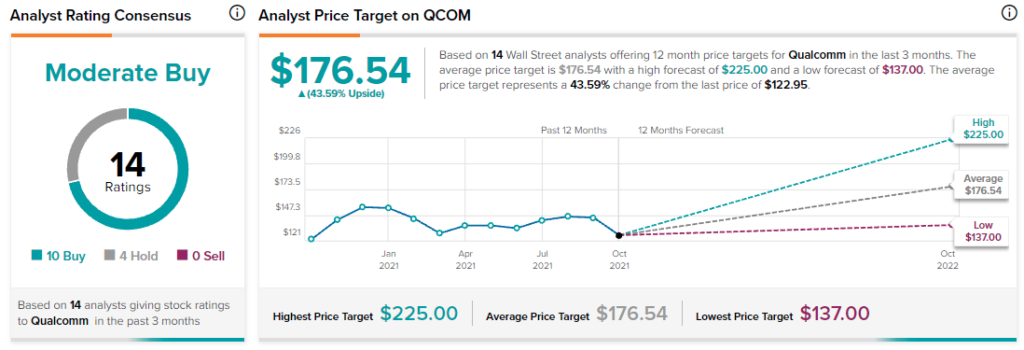

The consensus among Wall Street analysts is that TSM is a Strong Buy, based on 10 Buys and three Holds. The average Qualcomm price target is $176.54, implying 43.6% upside potential.

Conclusion

Qualcomm is a good growth stock. Its processors and 5G chipsets are now being sold to PC and smartphone manufacturers.

Disclosure: At the time of publication, Motek Moyen did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.